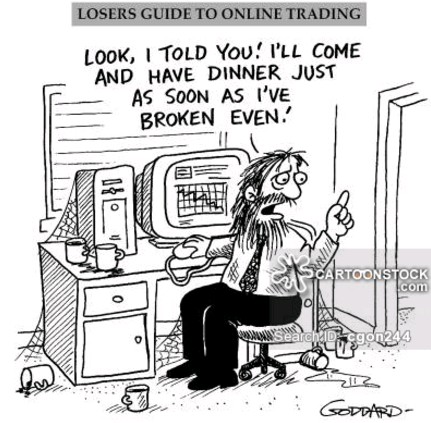

Traditionally it is known that a large percentage of all retail Forex traders don’t make money in the long term. I published a post about this notion in the past and more recent European studies reinforce this notion with measured retail trader failure rates of around 89%. However it is worth asking whether there is any difference between traders who have just started and those who have been trading the markets for a long period of time. Does experience mean anything in Forex trading? Is there any particular correlation between the amount of time people have traded and their profitability and success rates? Are traders who have been around longer more resistant to failure? On today’s post I will comment on some of the more recent publications about Forex retail traders and the way in which retail traders learn.

–

–

Statistical measurements of retail Forex trader performance are no good news. Longer term studies – such as the European study above – point to failure rates around 85-95% and other studies point to profitable outcomes not surpassing those that are expected from random chance alone. The long term profitable outcomes are therefore expected to be dire for most and the results of those who perform profitably in the short or medium term can mostly be explained by modeling using random walks. This already hints that the large majority of Forex retail traders fail to learn since there does not seem to be an accumulation pool of “knowledgeable” traders who are able to consistently extract profits from the currency markets.

Studies about risk taking in retail Forex trading highlight why real edges are so rare. There is a propensity to assign profitable outcomes to skill instead of random chance and an impulse to increase risk whenever this happens while willingness to reduce risk with losses is much less prevalent. Overall traders seem to be commonly fooled by randomness, traders tend to believe that a profitable trade happened because of their “awesome trading skills” and therefore they are willing to greatly increase risk when this happens. I have personally seen this many times with traders – especially more novice ones – when confronted with a profitable week or month many traders decide they have now “made it” and proceed to greatly increase their risk to achieve their desired rag-to-riches dreams. In reality I have very rarely seen traders calculate the probability that a period’s profit was the mere consequence of chance or whether they really have any sort of real trading edge.

–

–

More interestingly a recent study on the learning ability of retail Forex traders directly addresses the matter of whether skill increases with experience. As the paper highlights a rational learning process is expected to lead to better results with time as errors are corrected and observations are made while irrational learning processes are expected to provide no increase in a trader’s edge over time. In the world of retail trading we find that there is no increase in the expected profitability of traders in general as a function of time, pointing out that the entire learning process is not rational and may in general be prone to emotional biases introduced by the way in which people are carrying out the entire trading process. Surprisingly higher experience is even correlated with worse performance, suggesting that cognitive biases get rooted with time as people fail to correct them.

Note that the above observations apply to both discretionary and algorithmic traders because – whether or not you trade via an algorithm – the same emotional and cognitive biases still apply. If a trader uses an automated system to trade he or she can still increase risk greatly after profitable periods, can ignore that profits can be the result of randomness and can stop trading because of a losing period that is within the expected statistical behavior of a strategy. A trader can irrationally assign a randomly profitable period to the skill of the algorithm and the trader can fail to properly evaluate the expected performance metrics for a given system under a given time horizon. Overall the fact that you’re trading in an algorithmic manner does not rid you of the need to learn statistics, evaluate probabilities and establish statistically derived frontier scenarios for your trading.

–

–

All in all the above shows us that there is a predestination to fail when a trader approaches trading without the proper tools. Proper evaluation of mistakes, trading methodology design and estimation of expected performance metrics are all necessary to both achieve profit and be able to improve as a function of time. People who approach trading without adequate knowledge in statistical hypothesis testing and general descriptive statistics are very likely going to fail simply because they lack the tools to avoid being fooled by randomness and to calculate what they should expect from their trading – either algorithmic or discretionary – after different amounts of time. If you would like to learn more about how to approach Forex trading in a systematic manner and how to design and trade your own algorithmic trading systems please consider joining Asirikuy.com, a website filled with educational videos, trading systems, development and a sound, honest and transparent approach towards automated trading in general.