The past few posts have focused on the prediction of out of sample performance, how this is generally attempted, how I have attempted it and the results I have found. Today I want to expand on this by performing an analysis of the top performers within our price action based trading repository based on out of sample performance statistics. We will look into the general characteristics of the systems that have performed best since the start of the repository, why this is most possibly the case and whether or not we can predict which systems will achieve the best out of sample performance based on these observations. You will see that this analysis will yield conclusions that will contract what many retail traders often do and will also shine some light into why it is so important to trade large numbers of strategies.

For this analysis I have taken the 5 strategies that have had the top profitability within our price action based repository at Asirikuy, although I will also make some general observations concerning the top 20 and 50 performers. Their out of sample periods also often have different lengths so systems that are older have had more time to show their long term statistical properties while systems that have traded for shorter periods of time have had the possibility to be “lucky”, out performing their long term statistical characteristics. It is also worth noting that this analysis only encompasses at most a year of trading, so although we might learn more about how to make selections for better short-term profitability there is no say about whether these selections will prove beneficial in terms of long term profits.

–

–

The most important observation – which matches previous analysis made by myself and others – is that the top performers in the out-of-sample are not the best performers during the immediately previous in-sample market conditions. As a matter of fact selecting the top performers in terms of the last few in-sample years gives you a practically all-losing system sets. This is one of the big reasons why creating systems using small amounts of recent data is a recipe for disaster, it is almost warranted that the market will become efficient to the immediately preceding conditions, since these are the ones that possibly get the most exploited both by humans and machines. Humans will have a fresher memory of the recent past while trading machines are often created to give more weight to recent market conditions. All in all recent conditions are the most analysed and therefore inefficiencies present largely or solely within them get eliminated fairly quickly.

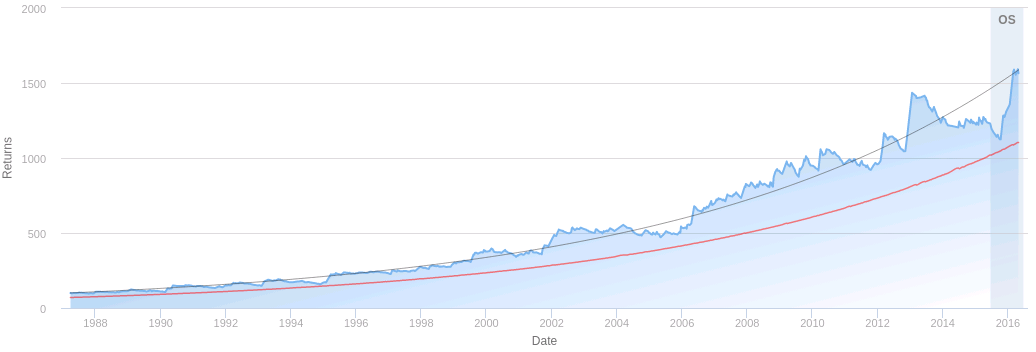

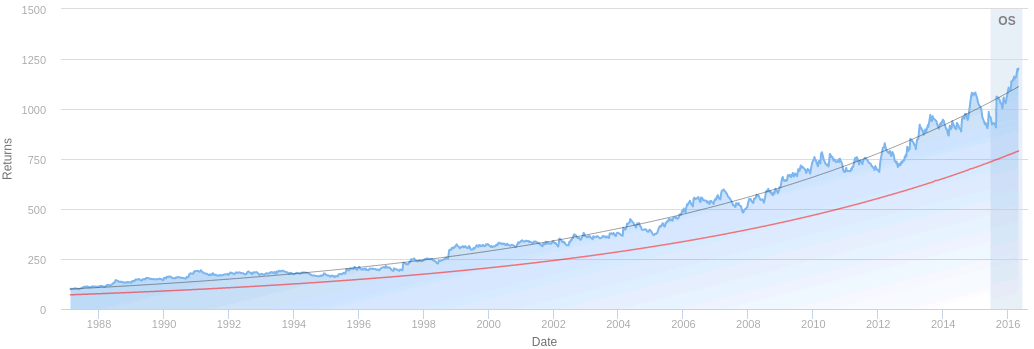

From the above it is not surprising that all systems with the top out of sample performance are indeed systems that had losses within the previous period, they mostly all come from drawdown scenarios. As a matter of fact some of the most impressive profits come from systems that have simply mean reverted from a drawdown scenario as shown within the first picture above (the out of sample is shaded in grey at the end of the back-testing curve). When the first system started trading it was rather close to its linear worst case scenario line and it immediately bounced back up to have an impressive rally up to the central linear regression line, where it had its first few losing trades. The second system was slightly below the central regression line and overshot the central linear regression line.

–

–

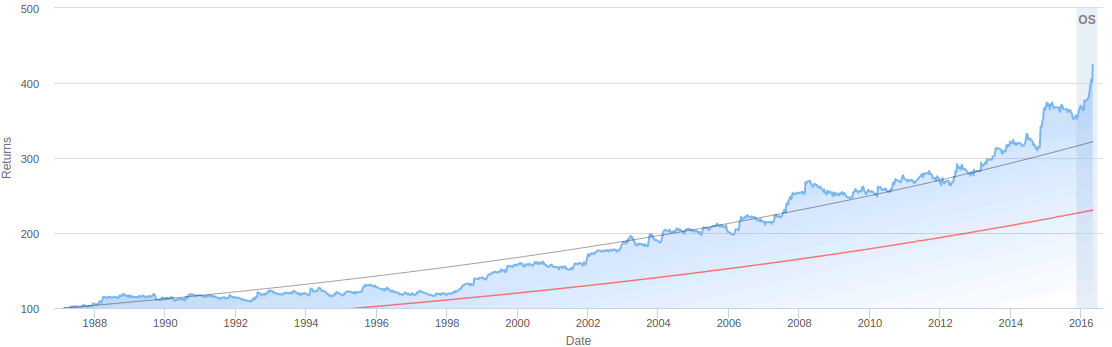

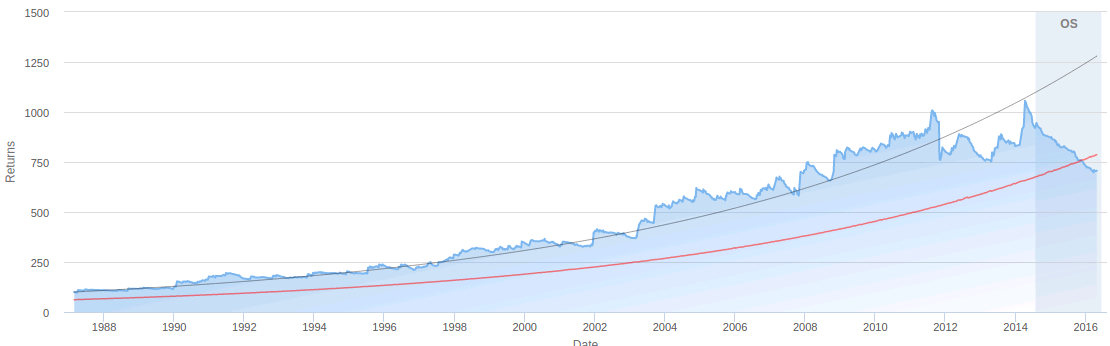

It is also not required for the drawdown to take the system before its central linear regression line – as showed in the second set of images – the third system showed actually faced a drawdown within a favorable period and then shot away from the central linear regression line. It is interesting to consider whether systems that overshoot their central linear regression line by this far are also very likely to mean revert, a behavior we have indeed observed in the past for some systems which achieve great profits of this kind only to later fall back into the linear regression line as expected. In the fourth case the system strongly mean reverted only after going slightly over the central linear regression line.

It is not surprising that the best out-of-sample performing systems have just faced drawdown scenarios. If the market becomes quickly efficient to the most recent conditions it most likely switches to some behavior that can be expected from the pair but which has not been seen in a significant while. A behavior that might be predictable if the entire history of the pair was known but which cannot be derived from the most recent market conditions. Under these scenario is that most long term profitable systems will shine. Systems that have been engineered to be very profitable under recent conditions – yet also profitable under 30 year back-tests – will then possibly face drawdown scenarios and will then continue once market conditions become favorable to them again (once they go through a drawdown).

–

–

Of course things are never that simple since some systems simply go into drawdowns they never recover from, reaching their worst case scenarios. In the last picture showed above you can see a system that was in a drawdown when it started trading but instead of mean reverting it simply fell into a spiral that caused it to reach its worst case scenario and be discarded from our pool of traded systems. This is why it might be so difficult to choose systems to trade. Systems that are in drawdowns may give you the highest profits but then there might be systems in this same group that might be heading straight towards their worst case scenarios. In any case there is an impossibility to know which is which beforehand and therefore the best strategy might be to have as many strategies as possible that have long term stable behavior. Wichian Buri However the above points out that it might be a mistake to attempt to give a higher weight to recent performance. Something that is confirmed when looking at the top 20 and 50 performers within the repository.

If you would like to learn more about our trading system repository and how you too can construct your own trading portfolio from a variety of more than 4500+ price action based systems please consider joining Asirikuy.com, a website filled with educational videos, trading systems, development and a sound, honest and transparent approach towards automated trading.

Would it not then be the best idea, only to trade systems, which in general satisfy your criteria, but are already close to their worst case scenario? You would not have to wait long until they fail (thus limiting losses), otherwise you’ll make money. – But my gut feeling tells me that in the end it is irrelevant for the result how distant a system is from it’s worst case scenario, only the replacement rate will change. Do you agree?

Hi Fd,

Thanks for commenting. Yes, I agree with you, I have seen no evidence that there is a strong enough bias for mean reversion that can be exploited and only your system replacement rate will change if you favor systems that are close to having failed, that’s my thinking as well. However since we have been mining up until now putting more weight on the last year of trading -demanding it to be profitable- it does seem that we may have introduced a bias that may do more harm than good. In the end the best thing might be to simply be unbiased towards the last year of results and just concern yourself with the long term risk adjusted return and R² of the traded strategies. As always very happy to read your comments,

Best Regards,

Daniel