Arbitrage opportunities seek to eliminate market risk by creating trading situations where profit is guaranteed independently of how the market moves. In Forex trading there are several potential arbitrage opportunities that are commonly sought by professional traders – like triangular arbitrage – and other less well-known arbitrage opportunities that are often only available to retail traders, such as the swap arbitrage opportunity we will be discussing in today’s post. Through this article we will be looking into why this opportunity exists, how it is often exploited, why it is difficult to exploit and why the trade-off from eliminating market risk is often an unacceptable increase in other types of risk that can be associated with large amounts of loss.

–

–

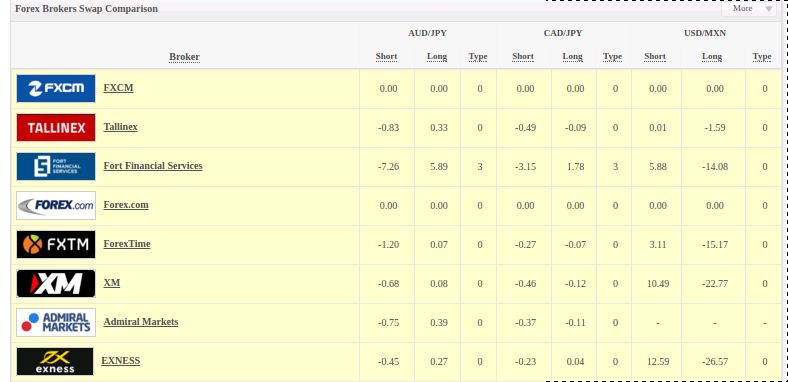

First of all let us start by understanding how swaps work in Forex trading. When you buy or sell a Forex pair you are in practice borrowing a currency in order to lend a different currency and the difference between the interest rates of both currencies often gives you a net negative or positive value. If the value is positive your account is credited each day (you’re borrowing a low interest rate currency and lending a high interest rate currency) while if the value is negative your account is debited each day (you’re borrowing a high interest rate currency and lending a low interest rate currency). For example if you buy AUDJPY you will be credited (you’re lending AUD – high interest – and borrowing JPY – low interest) while the opposite operation will cause your account to be debited. On Wednesdays swaps are usually credited/debited at 3x – to compensate for the weekend – and you will always see that the sum of a pair’s debit and credit will always be negative (so buying and selling AUDJPY would give you a negative swap). If both currencies have similar interest rates the pair’s long and short operations are often both negative in swap terms.

How does this generate an arbitrage opportunity? The opportunity arises because several brokers offer “swap-free” trading accounts (also here) where you can take Forex positions without having to pay swap rates. This means that you can take a positive swap position in a broker that pays swap and the opposite position in a broker that does not credit/debit swap and in the end you will cancel all market risk – because both positions are opposite – while you will gain the swap in your Forex accounts within the swap-paying broker. What usually happens is that your swap-paying account will accumulate a net market loss while your swap-free account will accumulate a net profit. You will often need to transfer money between the accounts to compensate for this and reopen positions which will add to your costs in terms of market spreads and transfer fees.

–

–

Brokers that offer swap-free accounts certainly do not like the above. Generally these brokers do not open positions in the real market – because otherwise they would take losses from the swap – but instead trade them against their internal book (so they are your counter-party) and therefore they will tend to lose money in the long term by the profit you’re making in your account that would otherwise be eaten by swap fees if you were actually executing these positions in the real market. Most brokers will therefore tend to close accounts and negate to give profit to account holders who are identified to be doing this – people who only open and long-term hold what would usually be swap negative positions – this is even more the case if these positions use a high amount of margin. Brokers who offer these accounts are generally also under shady or no regulatory environment and are therefore expected to be problematic if you ever have a legal problem with them.

Imagine a scenario where you’re trading USD/MXN in order to take advantage of this swap arbitrage. Under most brokers this would give you around 5.6 USD per week for each 0.1 lots traded at a movement value currently at around 0.04 USD per pip. With a montly ATR currently around 13000 pips this means that you would probably face movements in the order of 520 USD each month for each 20 USD you want to make during this same period. If you wanted to never lose more than 30% of your account per month and be making at least a 1000 USD profit per week this means you would need to be trading at least 0.5 lots with a value of around 26,000 USD at risk each month which means you would require to have at least 60,000 USD within your account. This of course would need to be offset with a value of the exact same magnitude in your other account as to compensate for this variability. If you want to balance things more frequently you can potentially do just 30,000 USD in each account but then you might have to face weekly transactions to offset market movements. At this level you would be making around 1.6% per month minus spread and transaction costs. Deposit less and you will spend more money in withdrawal, deposit and spread costs that will eat further into your profits and increase your execution risk as you might easily get into margin calls within your accounts and be unable to offset gains/losses.

–

–

http://debashishbanerji.com/category/creativewriting/page/3/ In the end what you’re doing is exchanging market risk for a few kinds of more unpredictable risks. You’re now getting in business with brokers that are in dubious regulatory territory and which have a vested interested in avoiding traders that take advantage of swap-free accounts in this manner. Back in 2004-2008 I did know a few traders who did the above – some even with deposits in the 100-200K USD region – and were able to profit from it very significantly but with the advent of much better detection software by brokers and retail traders attempting this becoming more common this is no longer possible. The last person I know who attempted to carry out this arbitrage in 2014 faced frozen accounts from brokers and then huge problems in trying to withdraw his money from the swap-free brokerage account (they finally agreed to allow him to withdraw his initial capital but they negated all profits which of course meant that losses in the swap paying account couldn’t be compensated). cytotec fedex Make no mistake, these schemes are now obvious to brokers who offer swap-free accounts. This apparently risk-free enterprise therefore has – at least in the present time – much more risk and unknown risks than regular trading with reputable brokers. If you would like to learn more about automated trading and how you too can learn to build and trade your own systems please consider joining Asirikuy.com, a website filled with educational videos, trading systems, development and a sound, honest and transparent approach towards automated trading.strategies.