As I said on the last post, the Watukushay No.2 expert advisor is completely based on price action. I have just finished all the preliminary coding and evaluation and I have to say that this EA far surpassed my expectations. It took me a few weeks to find a way to build a profitable logic solely based on price action as candlestick patterns depend greatly on the context in which they occur and entering or exiting trades based on a single pattern proved to be a totally unreliable and unprofitable strategy. I tried at least 15 different candlestick pattern with non of them by themselves generating a reliable system.

Finally I realized that the problem was that my approach was too simplistics. I decided to apply the sound, logical trading advice we hear from our start in trading. I decided to only enter trades on a very popular candlestick continuation pattern (the three soldiers) and to exit a trade based on either an ATR adjusted TP or a series of candlestick reversal patterns, such as a hammer, morning star or engulfing candlesticks. As you would expect from such a sound trading approach, the results were overall profitable although there was still a lot of room for improvement.

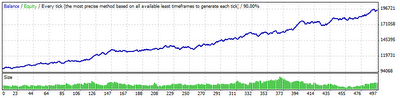

This is when it came to my mind that I was defining candlestick pattern rigidly when in the market a hammer or a 3 soldier pattern was different in 2000, 2004, 2009, etc. Of course, the easiest solution was to adapt these patterns also towards market volatility. So what do you get ? You get a trading system that is absolutely adapted to the market, more than any other system I have ever coded. The EA adjusts the size of the candlestick patterns as well as the SL and TP based on market volatility and the EA is able to profit seaminglessly from Jan 2000 to Nov 2009. This EA has given one of the most beautiful equity curves I have seen. The EA uses a very wide TP (80% of the ATR) and a wide SL (100% of the ATR) and every identification of a candlestick pattern is done based on previous bar closes so it is safe to say that backtesting is reliable (although live testing will definitely confirm this) since there are no one minute interpolation errors and no hindsight whatsoever.

You can see on the backtest shown below the equity curve given by this EA. It is very smooth with every year reaching new equity highs. The EA has a very good risk projection with the maximum draw down being just 6% for each 10% average yearly profit one wishes to obtain. However this is in fact improved by the ATR lot size money management which when risk is increased achieves an incredible 100% average yearly profit with a maximum draw down of under 40%. The EA should also be pretty much broker independent as a few pip variations will not affect the overall candlestick patterns, however, brokers that have Sunday candles vs those that don’t can show different results as the overall patterns may change. Up until now this have proven to be the best results for the EUR/USD, I run several tests on other currencies but it seems that the ATR values of the patterns change a lot depending on the instrument traded and therefore all the optimization needs to be redone for every currency pair traded.

– –

–

I am very pleased with this EA, this is the first EA I ever code that used absolutely no indicators (besides the ATR) that is actually more profitable and smooth in backtesting than the god’s gift ATR. Of course, this EA would be tested live on my weekly newsletter and all its programming and evolution will be a new chapter on my ebook. This chapter will treat how candlestick patterns can be defined in code and how I came up with each pattern as I progressed through the programming of the EA. I am currently writing this chapter which should be out in mid December and should be around 30-60 pages long. If you are interested in the Watukushay No.2 EA please consider buying my ebook on automated trading or subscribing to my weekly newsletter to receive updates and check the live and demo accounts I am running with several expert advisors. I hope you enjoyed the article !

Really looking forward for your demo result for this new Watukushay2 EA. Well done.

Hello Winter,

Thank you for your encouragement ! This EA will go into demo testing for about a month to check the programming and after that it will go straight to live :). Thanks again for your comment and your visits !

Best Regards,

Daniel

congratulations mate! all the best for the LIVE test!

CK

your friend from sunny Singapore :O)

That’s a very nice equity curve. Just curious, what timeframe does the EA trade on? Daily? H1? Thanks.

Hello Wynne,

Thank you for your comment :o) This EA trades on the 1H time frame,

Best Regards,

Daniel

Dear Daniel:

I would like to look at the logic/code of WA2. Where do I subscribe to you newsletter or buy your e/book?

Regards,

Pablo

Hi Pablo,

Thanks for writing. Code for these systems can be obtained by joining our community at asirikuy.com. Let me know if you have any other questions,

Best Regards,

Daniel