A few days ago I came across a thread in forex factory (

here) which discussed the trading of “gaps” in the forex market which occur every Sunday because of the inherent movements that are present on the weekends but unwatched by the majority of forex brokers (forex is truly a 24/7 market). Unlike in the stock market, these gaps appear only once each week, when the market opens for most people on Sunday afternoon (EST). Trading gap closes (aiming for price to “close the gap”) is actually a commonly suggested trading tactic in stocks so I started to wonder if there was a market inefficiency that could be exploited in forex trading in relationship with the Sunday gaps.

–

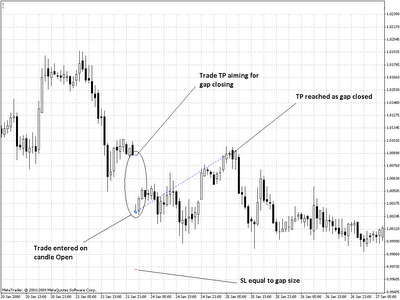

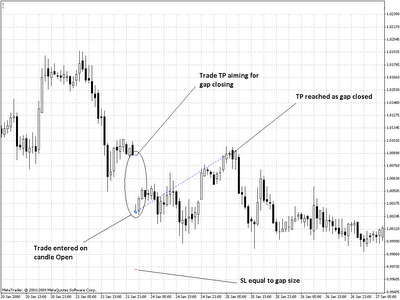

For me the approach the people at forex factory were taking to tackle the problem is wrong in some aspects. First of all, you cannot use a fixed SL since the value of the gap is very variable and changes with market conditions. Using a fixed amount of pips is simply wrong and will inevitably lead to loses once market conditions start to change and the gap sizes become much wider/shorter. The actual trading solution seems simple, aim for the close of the gap as your take profit value, use a multiple of the gap as your SL and use the gap to calculate lot sizes so that the amount you risk becomes fairly constant (risk less with higher gaps, risk more with shorter gaps).For practical purposes, you will also need to have a SL and TP of minimum 15 pips since this number is the actual minimal limit for SL and TP placement on many brokers.

–

–

I decided to give it a shot and code a simple EA to trade this technique. As you see on the next image, the EA enters trades in the direction to close the gap and assigns the TP and SL both as the gap size. Lot size is also adjusted against the gap size so that the amount of money risked per trade becomes independent of the gap size of any specific trade.

–

–

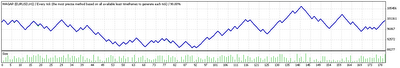

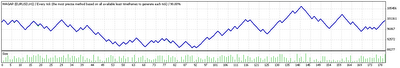

The image above shows the backtesting of this strategy from Jan 01 2000 to Nov 01 2009 (EUR/USD). As you can see, the strategy is break even in the long term with many profitable and unprofitable periods. Also note that profitability may be in fact overestimated due to one minute interpolation errors on some trades (due to some trades having a TP and SL of 15-20 pips). There are only 178 trades in 9 years, something that indicates that only 38% of the Sunday gaps are larger than 15 pips while the majority are smaller than this (therefore if all gaps were traded SL and TP orders ccouldn’t be placed on many brokers, also accurate simulation would become problematic). Gap sizes also vary greatly and are independent of general market volatility with large gap sizes happening on both highly volatile and low volatility markets. However the largest gap sizes did happen during the market crisis in 2008 when volatility was extremely high.

So does an inefficiency exist ? It is hard to say. The tests reveal that only on 51% of the time the gap is closed before advancing at least one gap size away from the entry price (hiting the SL), this means that statistically it is almost identical to entering a trade on a coin toss at Sunday open and using the gap size as a mean to exit and manage the trade. However most of you may now be thinking, can the odds be improved ? Can we modify the SL, TP, etc to afford a more profitable strategy ? Well, the answer is that yes, you can actually play a little bit with the settings and increase the odds. A full optimization of the EA reveals that you can hardly get results higher than a 0.5% average yearly profit for each 10% draw down. Taking into account the probable interpolation errors, I would have to say that there is simply no inefficiency related to gap trading. There seems to be no statistically favored outcome when the market faces a gap, it may close it before reaching the SL (up to 6 times the gap), or it may not. Running a statistical ANOVA analysis you will find that there is no correlation between gaps and movements that end in closing. The system is as good as picking a constant bar each Monday and entering a trade on the next bar assuming that price will return to the open of the previous bar.

–

So is the strategy profitable ? Well, you might get lucky and catch a period in which loses rarely occur like late 2009 or late 2007 however you will eventually give back almost all your profits and come back to where you started. It seems that if you a use gap adjusted technique you may just be break even in the long run. If you run this strategy without adjusting lost sizes, SL and TP to the gap size you will wipe your account (in the long term) due to the higher loses under varied market conditions. In conclusion, price does not react to gaps in a statistically signficant manner, either in one way or another. Gap closing is not an inherent characteristic of the market.

If you would like to learn more about profitable system design and how you too can start your journey to achieve long term stable profits in the forex market using automated trading solutions please consider buying my

ebook on automated trading or subscribing to

my weekly newsletter to receive updates and check the live and demo accounts I am running with several expert advisors. I hope you enjoyed the article !

[…] found that “gap closing” does not lead to any tradable inefficiency. You can check out this article where I talk about such a trading technique and what I found out when I did this […]

Hi Daniel,

Can you please share the expert you have used for this test in asirikuy?

Thanks!

Hello,

Thank you for your comment :o) Certainly, I planned to share the development process of this strategy – within a video – as well as the actual code I used within the Asirikuy Community System Development forum this week. The video and code should be uploaded before the market opens tomorrow. Thanks again for your comment :o)

Best Regards,

Daniel