If you look into most technical analysis books and most forex trading forums you will find that there are always a few or at least one topic devoted to gap trading. These trading technique which assumes that markets tend to behave in a certain way around gaps in price – like what happens in forex when the market closes in Friday and opens in Sunday – is often touted as a highly efficient tactic that will guarantee long term profits. However in my past experience attempting to design systems to trade gaps I have always found that “gap closing” does not lead to any tradable inefficiency. You can check out this article where I talk about such a trading technique and what I found out when I did this analysis.

After doing this analysis it was absolutely clear to me that the “closing of the gap” did not lead to any system that could be traded favorably in the long term and that the changes needed to make such a system long term profitable were not acceptable (like making the risk to reward ratio exceedingly high). However I started to ask myself a different set of questions. Can gaps be used to trade without taking into account the “closing of the gap” ? Do gaps signal any specific market behavior ?

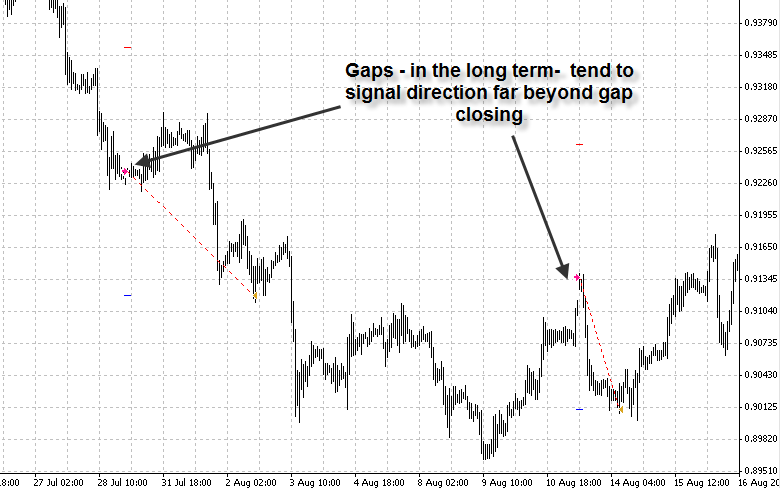

Certainly after doing a mathematical expectancy analysis about entries over gaps it was quickly clear that gaps do signal market direction, even if the actual closing of the gap is irrelevant. So the fact is that if you trade gaps which are larger than a certain percentage of the ATR and open up trades in a direction opposite to the gap with a 1:1 risk to reward ratio you can obtain long term profitable results because price tends to go against the gap significantly. The key here is to totally ignore the gap close and aim for a take profit and a stop loss of about 100-200% of the ATR. Even if a gap is very small – but above the threshold – it will signal a large move against the gap with a higher statistical probability with this move being often many times the actual size of the gap.

–

Since when you aim for the “gap close” you waste all this forecasting power, the actual key to the design of a long term profitable gap trading system with sound risk to reward ratios is to actually ignore if the gap closes or remains open and just focus on the magnitude of the movements that the gaps signal. To my surprise the magnitude of this movement seemed to be independent of the gap size as adjusting its values as a multiple of the gap made the results become worse. So gaps signal market behavior, regardless of the actual gap size if it is above a certain threshold measured as a percentage of the daily ATR.

What are the results of this strategy ? My first initial tests on the EUR/USD and the USD/CHF reveal pretty good results with 1:1 and 1:3 average compounded yearly profit to maximum draw down ratios respectively. The strategy achieves profitable results during most years over the 10.5 year period and the actual results show us that market direction is indeed determined with a high statistical probability by this trading technique. The tests were done from Jan 2000 to June 2010.

–

The success of this inefficiency seems to be based in the simple fact that most people aim for gap closes – something that has no positive mathematical expectancy – but the large majority of people are not aware of the fact that a gap signals the medium term price direction with a good probability. The key – as with the development of most long term profitable strategies – is to find a behavioral aspect of the market which is related to something everybody knows but which is ignored by almost everybody. Every time there is something that appears to be a predictable phenomena – like gap closing – the actual exploitation of this behavior is often not successful but several other effects are seen which can be traded successfully. You need to look beyond what most people assume and fully analyze all the effects of these events.

If you would like to learn more about the development of automated trading systems and how you can develop your own expert advisor based on sound trading tactics please consider joining Asirikuy.com, a website filled with educational videos, trading systems, development and a sound, honest and transparent approach automated trading in general . I hope you enjoyed this article ! :o)

Daniel-

Great post, thanks.

The article (and embedded sub-article) probably saved me 20-hours in EA research and coding since I was under the impression that positions which profit on closing of the gap are the way to go.

Its also good to see you are looking at systems that profit when prices return to recent and prior levels. I think these systems will profit more often (80% of the time?) verus breakout or trend-following systems which are profitable less often but make more profit per trade. Its sort of the antithesis of most of your systems which I beleive favor trending markets.

If any of your existing systems take advantage of “Market Reversion Theory” (from your e-book) than i’m missing it an please let me know. I think these type of systems can be the “break and butter” of daily forex trading profits in combination with trend following systems of course.

Thanks again and keep it coming,

Chris

Hi Chris,

Thank you very much for your comment :o) Definitely – as I say on the article – we tend to believe that “filling the gap” is the way to go since this is what most literature and online resources tell us. However in reality – when analyzing the price action of the different instruments – we actually find that there are “gap related” inefficiencies but they are almost independent of the actual closing of gaps.

As you say, this type of system is different from what I usually do since in essence this system is “trend indepenent” as it doesn’t trade against or in favor of the longer term trend but merely in the direction opposite to that of formed gaps. My efforts are right now focused in systems similar to this in order to provide much more effective diversification to all the trend following systems I have developed. I have in fact published several posts on counter-trending or trend-independent systems such as the ADX based system – which I commented on earlier this year – and the Asian session system I published on the August issue of Currency Trader.

However you also need to consider that most of my systems – although trend following in nature – do so in very different ways. Systems like Ayotl – the turtle trading system – are essentially very long term trend followers while Teyacanani and Watukushay No.2 are essentially shorter term trend followers that are quicker to react to changes in price action. Watukusahy FE and No.2 also have fixed %ATR profit and stop loss values reason why they will not follow the usually expected “fewer profitable and many losing” trade model assumed for more classic and longer term trend following systems.

Of course, during the next few months you will probably see Watukushay No.6 and No.7 come out and I hope to make these systems counter-trending or trend-independent in nature so that they provide a large degree of diversification over current Asirikuy systems. However developing these systems is much harder since the inefficiencies are “far less obvious” in my opinion at least :o)

Thank you very much again for your comment !

Best Regards,

Daniel