Many people – me included – will think here that the best and easiest solution would be simply to decrease the values of the filters on the EA to compensate for a “lower overall” ATR value. However the main issue here is that no accurate 10 year backtesting data with Sunday candles is available to test the strategy and this therefore makes any modification done impossible to evaluate with metatrader 4. Possibly diminishing the value of all filters might work, but there is also a very important possibility that this will simply not work as – when low ATR periods are used – you might get days where the ATR is calculated without the Sunday candle. For example, a 4 period daily ATR on Friday only counts Friday, Thursday, Wednesday and Tuesday, leaving outside Monday and Sunday. Introducing a modification that decreases all overall ATR related variables will probably have an adverse effect on these days.

What is the solution then ? The easiest thing to do here was to find a way of removing the Sunday candles from the chart, merging Monday and Sunday candles to get a “clean feed” that simulates that of a broker without Sunday candles. Using an EA called “without Sunday”, available from the mql4 code database, we were able to eliminate the problem for most brokers. However, due to limiations inherent to some other brokers – particularly Forex.com – this solution wasn’t able to work correctly in some cases.

My solution for this case was to find another adaptive criteria that could avoid the usage of the daily ATR indicator. I thought that if you could simply take a lower time frame and “extrapolate” you could maybe obtain the same results as you would with the regular daily-ATR solution. So my implementation was therefore really simple. Take a given hourly-ATR period indicator and then multiply it by X so that you reach a magnitude similar to that of the daily ATR indicator. You would still get evolving adaptability as market conditions change but of course, the speed and character of the adaptation would change.

–

–

–

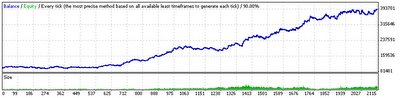

In the end I found the results showed above for the EUR/USD and GBP/USD currency pairs using Teyacanani (Jan-2000, Jan-2010). The trading results – after following the same optimization procedure as with the original Teyacanani version – were very similar to those obtained with the daily-ATR solution, showing that a given hourly-ATR could in fact extrapolate to a daily-ATR without great changes in the effectiveness of the adaptation against volatility. However it is clearly notable here that this approach does not tend to work for all currency pairs. Some instruments like the NZD/USD and AUD/USD tend to have larger and more changing hourly volatilities that do not provide an adequate reflection when extrapolated towards daily volatility. The results obtained for these currency pairs are therefore poorer than when using the regular Teyacanani EA.

In the end, what this exercise has taught me – and I hope I have transmitted to you within this article – is that volatility adaptation can be carried out successfuly through many levels and that alternatives to daily-ATR based adaptation are clearly possible but may prove to be different for instruments with different characteristics. Right now this new version of Teyancanani – now available within Asirikuy – provides users of brokers that could not implement the WithoutSunday solution with a version of Teyacanani that can run on the EUR/USD and GBP/USD with similar profit and draw down targets. Volatility adaptation has always been one of my great areas of interest in automated trading and hopefully within the next few months and years I will be able to develop some robust and creative adaptive criteria :o).

If you would like to learn more about automated trading system development and how you too can develop systems that adapt to changes in market conditions please consider buying my ebook on automated trading or joining Asirikuy to receive all ebook purchase benefits, weekly updates, check the live accounts I am running with several expert advisors and get in the road towards long term success in the forex market using automated trading systems. I hope you enjoyed the article !

Hi Daniel!

There's another broker dependency problem with the short period ATR, but probably not as significant as the Sunday bar issue. When a new day begins, the volatity of that day is almost zero, and therefore the short period ATR drops sometimes the half of the previous value. The problem comes from the fact that brokers close their daily candles in different times and that difference can be 4 hours or more so the timing of the sudden drop of the ATR will depend on your broker which will influence entry and exit as well.

Hi Gabor,

Thank you for your comment :o) Indeed, you are right about that. Having different times of daily closing would also cause differences in trades since the contribution of the newly formed daily candle would be larger or smaller. The overall different open/close values of daily candles would also cause ATR differences (independently of the period) since the ATR uses the close of candles to calculate its value.

The modification presented in this article does address both of these problems, effectively eliminating them from the picture. In the future implementations like this may be more practical than daily chart-based implementations since they provide a much more broker-independent approach.

Thank you very much again for your comment Gabor :o)

Best Regards,

Daniel