I guess anyone who has been in forex more than 5 minute has learned that “90% of all forex traders fail”. If most traders in the market fail, then taking decisions against most traders should provide an edge, since the large portion of retail traders tends to always be wrong, trading against them may seem to warrant some profitability. However the issue is not so simple as designing an actual mechanical strategy based on this behavior is a very difficult task, particularly because knowing the “real-time positioning” of a large amount of retail traders is hard. On today’s post I will talk about a possible solution to this problem as well as a strategy I designed based on this solution. It will certainly not work in the short term time frames but it may provide a statistical edge in the following of long term trends if in fact most traders tend to be on the “wrong side” of trades.

The first thing we need to understand if we want to take positions against the masses is how contrarian trading works and how currency pair rates change. Whenever a person takes a long or a short position it is done so with the expectancy that more traders in the future will do the same thing at worse prices. If for example you go long EUR/USD at 1.5040 it means that you are expecting other traders to go long at levels above this, to drive prices to even higher values. Retail traders tend to get into positions at prices that are not attractive for major players which are effectively the main drivers of market price changes. When a majority of retail traders are positioned in short or long positions the market will turn against them to favor the least possible amount of traders (the 10% or less profitable).

It would therefore be possible to develop a system to profit from this behavior if we could have access to real-time positioning of retail traders. When 90% of retail traders hold a certain type of position then the market is bound to move the other way until at least equilibrium between positioning is reached (50-50) or until a new extreme is reached towards the opposite direction. So if 90% of retail traders are long GBP/USD then the market will turn against them until at least 50% are long and 50% are short, then it may take it to an opposite extreme (10% long, 90% short) or return it to the original one for a second “swing”.

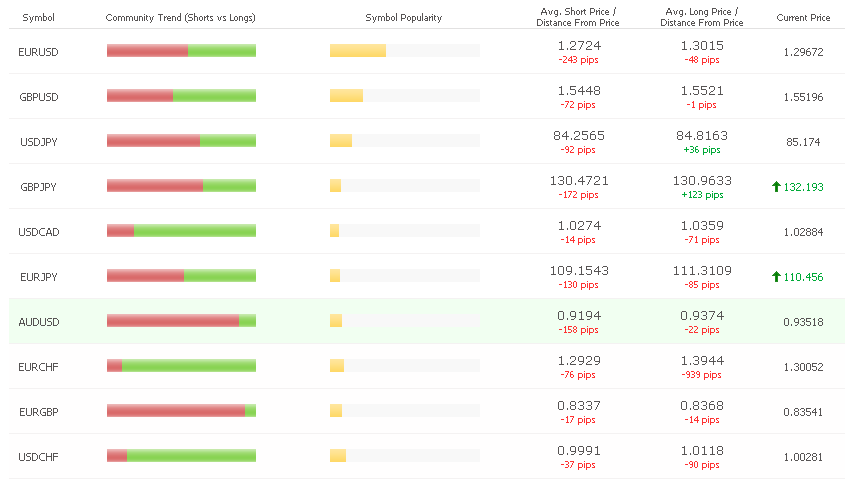

Until recently we had no tool that could estimate the positioning of a “decent amount” of retail traders but now – with the help of MyFxBook – there is a tool available to solve this problem. This website has released a new feature – called Outlook – which shows community positioning, representing the positions of more than 20 thousand live retail trading accounts. During the past few days I have experimented with this feature a little bit and I have already achieved several profitable positions on major currency pairs. For example this tool achieved an extreme on the EUR/USD towards the short-side this Monday, time in which I went long on the currency achieving an almost 300 pip profitable swing. Since then positioning has been shifting towards the long side and it is now close to a 50-50% positioning, meaning that it is now time to exit the position.

–

Of course, such a system is bound to be difficult to evaluate since their is no previous historical data for this “outlook” tool and therefore future performance is by all means unknown and obviously due to this reason its trading should be evaluated on a demo or very small live account for at least a couple of years so that some idea of profit and draw down targets can be drawn. However the possibilities are very interesting, showing us that the fact that most retail traders fail may in itself be exploited as a market inefficiency. This strategy is based on a whole new set of information which is not available from traditional technical analysis, the net positioning of retail traders.

Another great advantage of using this tool against other traditional contrarian indicators as the COT is that this information is available in real time and not just released weekly like these other options. However this information also has the disadvantage of containing only data about a reduced group of retail traders and none about major player positioning which is available through other positioning indicators. As a matter of fact it might be interesting to analyze mechanical strategies developed against the COT to judge their long term performance based on the available weekly historical data of this fundamental indicator.

In the end this new “outlook” tool provides an interesting source of information which could be used – or at least tested – for the development of contrarian trading strategies. If you would like to learn more about my work and how you too can develop your own long term profitable systems please consider joining Asirikuy.com, a website filled with educational videos, trading systems, development and a sound, honest and transparent approach automated trading in general . I hope you enjoyed this article ! :o)

hi Daniel,

that’s is very interesting article.

But i think that if 90% of all forex traders fail, it isn’t because they are wrong about the entry, but because they trade unless a trade plan, they cut profits and let loss run, and so on.

thanks again for your articles.

Andrea

Hi Andrea,

Thank you very much for your comment :o) This is a good point indeed. I think that – independent of any other factors – retail traders lose because they over-trade , lack proper money management and enter but especially exit the market at the wrong times. So the idea of the above tactic is to get into trades when most retail traders are positioned to “take loses” and to exit the trade when the positioning becomes even. Of course – as I say on the post – whether or not this will work in the long term is extremely debatable and for now just an interesting idea :o). Thank you very much again for your comment !

Best Regards,

Daniel

zRx4AO Good point. I hadn’t tohuhgt about it quite that way. :)

Hi Daniel, what do you think is the main reason that Oanda traders has the best performance among the us brokers. Very big diference I think. Maybe just because of no manipulations and low trading costs.And they are the biggest account number having broker, so statisticaly it is clear they have something good. Would realy love to hear your opinion… if you ever get to read this comment:)

Hi Rimas,

Thank you for your email :o) I get an email for every comment posted so I always read all of them despite the post where you place them. Regarding Oanda, it is very difficult to say the reason why the statistics are different because you need to look at the bigger picture. Perhaps the main reasons why Oanda traders lose less overall is because they can trade less and therefore have much better control over their risk (Oanda allows trading from lot sizes as low as you want, even fractions of a cent per pip are achievable) or because they have bigger accounts (larger traders tend to lose less money because they are often more careful with risk). Also it could mean that they have a large percentage of older accounts which sustain their profit ratings. As brokers reveal too little information it is really impossible to say why this is the case but there are many reasons which are much more likely than simply that they offer “better execution”. In my view lot sizing abilities, account age and average account size most likely play the most important role (sadly their lot sizing doesn’t work the same way in MT4 as in their regular platform). I hope this answers your question,

Best Regards,

Daniel

Hi Daniel,

Would you know of any other sources of this type of information? I’ve been trying to find others but haven’t been able to find any that have similar features.

Thanks for many help