When new Asirikuy members go into our tests section to search for 10 year reliable one minute data to run their backtests they are often surprised by the fact that no data for EUR/GBP or EUR/CHF is available. Since the trading of these pairs dates at least back to the trading of the EUR/USD it certainly doesn’t make sense to most people that our data in Asirikuy lacks these two very important EUR crosses. However there are several reasons why data for these pairs isn’t included related to the fact that long term simulations (10 years) for these pairs using one minute data are not at all possible. Through the following paragraphs I will describe the problems of the EUR/CHF and EUR/GBP data sets as well as why the limitation imposed by the MT4 platform do not allow these simulations to be run in an accurate way when using one minute data.

When the EUR started trading in 1999, several different dual currency services – also known as pairs – were generated in order to trade this new major world currency. Certainly the most important of these pairs was – and continues to be – the EUR/USD but many other pairs involving pairing of the EUR with the GBP and the CHF were also created simultaneously for intra-European trading. The EUR/CHF and EUR/GBP pairs therefore have a trading history in line with that of the EUR/USD with short term data going back to at least the beginning of 2000.

–

So what is the difference between the EUR/USD and these other pairs? There are actually several different factors which make these crosses very different from the EUR/USD. Although exact global liquidity figures are not available – due to the nature of the market – it can be said that the EUR/USD liquidity is at least five times if not much larger than the liquidity of these instruments and it was definitely much bigger within the “birth and infant age” of the EUR. This causes the EUR/CHF and EUR/GBP to show different behavior when going back to 2000.

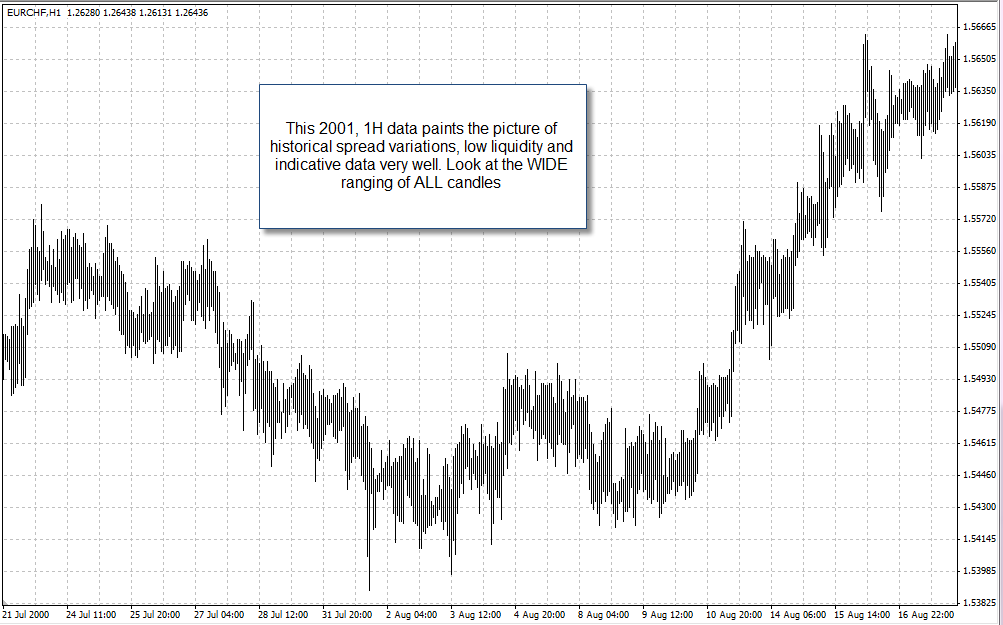

Perhaps the most important thing here – liquidity and its consequences – is what mainly affects our ability to simulate performance on these pairs accurately in the early EUR years. One of the big problems is that the 1M data we have access to is market indicative data (as there were almost no retail forex brokers at the time logging data) and the lack of liquidity means that differences between liquidity providers on the quotes for these instruments were larger and therefore historical spread variations were also enormous as well.

When you look at the early short time frame 2000-2003 data for the EUR/CHF and EUR/GBP you will find an utter and complete mess. The data is most of the time a medley of the input of several different liquidity providers and the spread at the time was likely different between them and much larger than what it is today. This was taken advantage of by several EA creators who “cleverly” used this to exploit their customers. You can in fact simply write a program which buys when the pair moves 30 pips to the downside and sell when it moves 30 pips to the upside and get a system that turns a few dollars into trillions in a few years. This is obviously caused by the fact that you are working on the assumption that the EUR/CHF and EUR/GBP had the same spreads they had today (big problem) and that the feed you would have seen on your screen would have been similar to that indicative data (very unlikely due to the low liquidity of these pairs, even lower at that time).

When you look at post 2003 data things start to get a little bit better but historical spread variations still become important. These currency pairs can have very important Asian session related spread-widening and other such shifts through the years which make the creation of any system within them problematic when devised on the 4H or 1H time frames. It also becomes problematic to evaluate whether or not you could have actually got filled at the levels you wanted since 2nd level market depth data for these pairs (and in general in forex) is simply not there to be used.

In the end it is quite easy to assure that simulations of systems on the 1H and 4H time frames on these pairs using 1M data have many problems and perhaps only adequate estimations of profitability could be achieved with appropriate tick data with Bid/Ask feed separation. It is therefore safe to assume that simulations of systems on these pairs are not worth running on MT4 on time frames lower than the daily and definitely only the development of strategies using ONLY daily EOD data would be somewhat reliable.

So as you see, there are very important reasons why we do not make EUR/CHF and EUR/GBP data available in Asirikuy, mainly because the very nature of this data and these currency pairs does not allow for adequate simulations in MT4/5 and developing systems on these pairs on the 4H and 1H time frames (and obviously lower) is a dangerous exercise that most of the time leads to unrealistic systems based on the above mentioned problems (like so many commercial EUR/CHF/|EUR/GBP scalpers showing “holy grail” backtests). However – as I mentioned – systems based on EOD data can be more reliably developed, certainly something Coatl can help us do :o)

If you would like to learn more about my work in automated trading and how you too can learn to develop and design your own systems based on sound trading tactics please consider joining Asirikuy.com, a website filled with educational videos, trading systems, development and a sound, honest and transparent approach towards automated trading in general . I hope you enjoyed this article ! :o)