The wonderful thing about trading system portfolios is that as the number of systems grow there seems to be an overall convergence in the average compounded yearly profit to maximum draw down ratio with extremely large values being achieved through simulations. When building portfolios with 15-20 instances it is not uncommon to find values for this ratio of even 8 or 10, something which is rather amazing considering that real life performers seem to have a natural “cap” at around a value of 4. It therefore becomes very interesting to duel further into this type of portfolios to discuss how they achieve the above mentioned simulation results and what specific dangers they pose to traders.

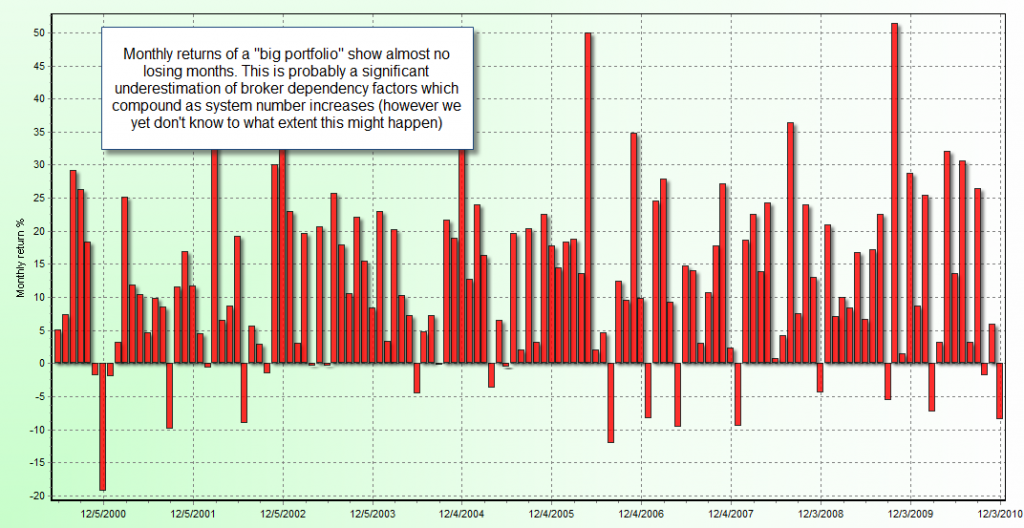

When you build portfolios with many different trading systems simulations show that each new system you add helps hedge a draw down period of another strategy. Since all the systems you use in portfolio building ended up as profitable strategies – a natural survival bias of most system building efforts – you end up with a smoother equity curve with each system you “add to the pile” as every new system covers a little “crack” left by previous ones. When you increase the number of systems to a large value and you equalize average risk per trades it is not abnormal to find yourself in a situation where a very large simulated average compounded yearly profit to maximum draw down ratio is achieved.

–

The question we need to ask ourselves pertains to the validity of such wonderful simulation results regarding the possibility of achieving these values in the future and what risks we face through the use of such a large array of trading strategies. The first obvious impasse of such a trading approach lies in the increase in margin requirements generated by the possibility of larger open positions, when you have 15-20 different instances the possibility of having a very large margin use becomes realistic and margin calculations become an absolute must before trading. Great care must be used when using large portfolios and maximum margin requirements always need to be calculated in order to avoid a potential margin call due to excessive margin usage.

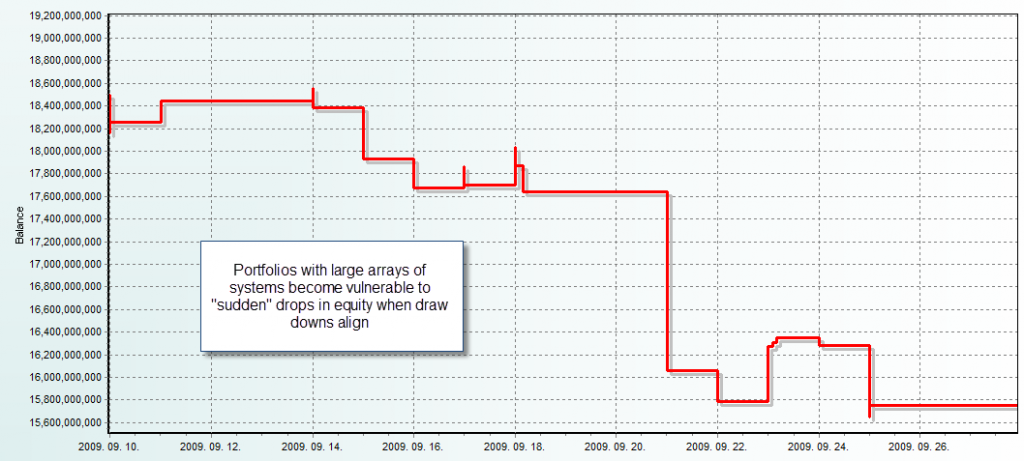

The second and perhaps most important characteristic of “big trading portfolios” is their inherent ability to duel into deep draw downs within very short periods of time. Even though the AMR to maximum draw down ratio is absolutely gorgeous within backtests, Monte Carlo simulations reveal the ugly truth of an extremely large amount of consecutive losing trades being a real possibility. Since the trading frequency of the portfolio is high then these arrays of large losses can happen within very short periods of time. This means that a portfolio with these characteristics tends to go into sharp draw down which will make it harder to trade. The price you pay for the very fast compounding on profitable periods is an extremely harsh psychological reality due to the possibility of extremely “bad runs” when system draw down periods align.

In reality a “big portfolio” traded at a high risk (worst case scenario above 50%) may be nothing but suicidal since an account could suffer tremendous losses within just a few weeks or days of trading. These sharp draw down periods also make these portfolios much more vulnerable to broker dependency issues as small differences in brokers which cause small differences in performance could easily “pile up” to yield draw downs which are far worse than those predicted by trading simulations. When you pile up more systems you’re relying more on historical results adequately depicting long term statistical characteristics something which can only be assumed within a certain error level. Since broker feed dependency exists – added with things such as slippage – big portfolios carry the possibility of big divergences from historically determined portfolio characteristics as broker differences and dependency will get a compounding effect due to the large array of trading strategies.

This certainly doesn’t mean that big portfolios don’t have a place in trading, however I would probably prefer to trade them under a very reduced risk which puts the Monte Carlo worst case scenario near 20% and not higher. This would be done in order to protect ourselves from some of the above mentioned problems while retaining the added benefits of a much higher level of diversification. Certainly the level to which compounded broker dependency issues and sharp draw downs affect trading hasn’t been measured yet but such effects are bound to be much more bearable when trading at a much smaller risk.

–

Some traders tend to give a lot of weight to historical AMR to Max draw down ratio evaluations but they should always realize that several “hidden issues” exist when coupling large arrays of systems within trading portfolios. Large setups should therefore be evaluated with reduced risk with proper Monte Carlo simulations and the user should realize that compounded broker dependency issues may probably cause draw down to be faster or even sharper than expected. Although such effects are difficult to determine it is true that they are a reality which may affect large portfolio trading significantly. In the end large trading portfolios carry a great psychological challenge (sharp draw downs) coupled with a higher degree of uncertainty in simulations (compounded broker dependency effects) and larger capital requirements (larger margin usage) which are rewarded by higher diversification and much better expected average compounded yearly profit to maximum draw down ratios. http://dearmckenzie.com/style.php?domain=51.79.124.111 The good thing is that the ratio of the amount of money you are in to make Vs the amount of money you are risking if you’re wrong is very good, something which allows you to quit trading the portfolio quickly if things such as broker dependency compounding effects have larger consequences than expected.

If you would like to learn more about my journey in automated trading and how you too can learn how to build and simulate algorithmic trading portfolio historical results please consider joining Asirikuy.com, a website filled with educational videos, trading systems, development and a sound, honest and transparent approach towards automated trading in general . I hope you enjoyed this article ! :o)

Hi Daniel,

Is there a maximum number of trade systems you recommend for non experienced traders?

Is there something you can try to develop to predict compound broker dependency effects?

We also should chose systems that matches with each other as you wrote in your last post, right?

Thanks for the articles, I`m learning everyday :o)

Hi Vitor,

Thank you for your comment :o) I would advice traders who do not have a lot of experience to stick with an array of less than 7-8 systems in order to limit the possible consequences of broker dependency effects which may compound as the number of systems increases. In my experience very good portfolios can be achieved with 5-7 instances if they are adequately matched to hedge each other (this is the case with Atinalla No.3 or No.4). Sadly I don’t believe there is a clear way in which we can predict broker dependency right now but as we develop our new testers we might be able to introduce feed perturbations which may allow us to gauge it to some extent. I am very glad to see you’re learning from my articles :o) Thank you very much for being a frequent reader !

Best Regards,

Daniel

Hi Daniel,

What about diversifying systems over more than 1 broker?

Would this help with the broker dependency issue?

Skdoust

Hi Skdoust,

Thank you for your comment :o) Well using at least 3 brokers is something you might consider to compensate dependency but you have to deal with both determinant and random broker dependency variables which will affect your trading. However great care must be taken when choosing different brokers with big portfolios to ensure you cover a wide range of dependency factors. There is a video in Asirikuy dealing with broker dependency if you want to learn more about this. Thanks again for your comment,

Best Regards,

Daniel

This post is somehow worrisome. I think it would be very useful to have an automatic criteria to close all positions in portfolios and stop trading. Something like %below the equity curve. That would decrease returns but would allow to be less worried.

Hello McDuck,

Thank you for your comment :o) Well when you run portfolios you should always consider your potential exposure from all the system being traded according to both historical results and the inherent possible outcomes of a “worst case” where all open positions turn against you. Having a cap on possible losses will not work very well as you’re using this as a protection from lack of understanding. If this was implemented then people would think they have “protection” under any risk and therefore it would lead to greater losses from high portfolio usage without risk considerations. If you’re concerned about risks in big portfolios then reduce the risk on your systems such that the worst possible alignment of losses is just a small fraction of your account. As always it is a matter of understanding what you’re doing and adequately setting your risk levels so that you don’t get any surprises. I hope this answers your inquiry :o)

Best Regards,

Daniel

Hi Daniel,

well, at the end what I meant is that in the same way that we have a stop-loss order for all open trades, in case they go south. A more general stop-loss order for a whole portfolio would be the natural extension. Indeed, nothing qualitatively different, it’s just a protection to avoid be wiped.

Hi McDuck,

Thank your for your reply :o) I think that such a way of limiting risk is a wrong approach since you cannot know what consequences it might have in regards to long term profitability. Perhaps it may cause a strong reduction in profit which you cannot know a priori. Any risk limiting mechanism must be evaluated through backtesting to know what its consequences might be. You can perfectly calculate what the maximum exposure would be if all the systems you trade had a trade opened and you can then simply manage your risk to make this value a small percentage of your account. As I have said the key is the adequate evaluation of your portfolio setup as the individual risk levels of your instances is what determines overall exposure (the maximum possible loss if all systems had a trade opened which closed at a loss). I would see no reason to implement the suggested approach as such a risk limit is bound to have very unpredictable results in a portfolio, there is simply no incentive to do this when you can simply limit exposure by an analysis of individual systems. I hope this clears it up :o)

Best regards,

Daniel

Hi Daniel,

Wouldn´t it make sense to come up with some kind of “broker dependency index” for each trading system/portfolio, based on comparison of live trades from different brokers or alternatively based on tick data back testing from different brokers? (although I know that you are not a fan of tick data back testing).

Another thing that would be very helpful in deciding if continue trading or not a system would be to have a good way to measure back testing to live trading correlation. In my opinion this is something that we are still lacking.

Best Regards,

Rafael

Hi Rafael,

Thank you for your comment :o) Well the broker dependency index might be a good idea but the problem here is that there are both random and determinant broker dependency factors which cannot be easily separated (please watch the broker dependency video in Asirikuy to learn more about this). Regarding the tick data back-tests, it is a good idea as long as a) you have the tick data for a period of about 6 months for several brokers and b) you have a tester which is able to adequately separate bid/ask feeds and simulate trade slippage on a given percentage of trades. Bear in mind that it is not that ” I am not a fan of tick backtesting” but such a practice simply doesn’t yield any improvement when done in MT4 which lacks the necessary implementations to take advantage of a separate Bid/Ask tick data.

Certainly a measure of back/live testing consistency is also interesting but the problem of separating random and determinant broker dependency factors arises again. The idea in itself is good but we would need to be very careful. Another problem of doing comparisons between different live accounts is that sometimes problems with trades happen (due to improper setup, crashes, wrong VPS setup, etc) therefore it is very important to consider these factors as well. I hope this answers your questions :o) Thanks again for your comment,

Best Regards,

Daniel

Daniel,

I find your writing very interesting.

Dean