If you have been trading the Forex market or reading my blog for a while you may already know that one of the most important issues we have on this market is the issue of broker dependency. Since there is a general lack of a central exchange in Forex each broker provides their own custom feed based on the inputs they get from different liquidity providers (or what they “make up”) and therefore it becomes impossible to design a strategy with certainty since the data used is not the “only data” after all. One of the most important questions we need to answer to get to the bottom of the broker dependency problem is how different are brokers and how can we “ease out” these differences to make them less influential when building trading systems.

When we want to compare different brokers there are many things we could do which range from comparing bar open/high/low/close values to comparisons based on indicators, the spread, slippage or other similar execution characteristics derived from these. However the problem of comparing simply price values, indicators or spread variations is that they only give us a limited perception of how the feeds differ and in general they give us no idea about the quality of the provided data and liquidity. What other variables can we compare that give us a better idea of how different two brokers are and what makes one better/worse than the other?

–

Tick volume seems to be the answer to this problem. All Metatrader 4 Forex brokers offer tick volume information which is simply the amount of ticks or “price updates” which the broker issues within a given span of time. By comparing the values of volume and how volume patterns differ between brokers we can get an idea of how different broker feeds differ and we can also get an idea over the amount of liquidity available within a given broker or if any specific manipulation is in fact taking place. For this first part dealing with tick volume I have taken 4 different brokers which I have explored in order to compare their Forex feeds.

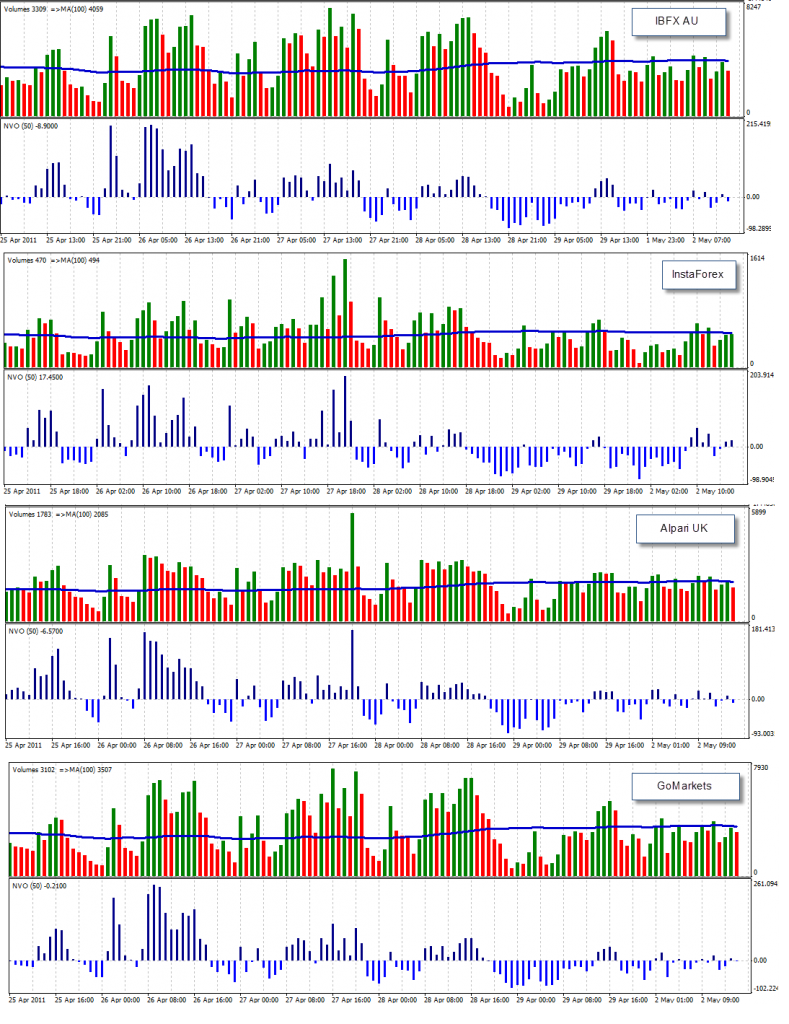

For this first test I decided to compare IBFX AU, InstaForex, Alpari UK and GoMarkets. In order for this comparison to have more meaning I am only comparing values from the LIVE trading servers and NOT from their demo servers (which are bound to have different volume information). Since the LIVE server feed is the one we would use for trading it only makes sense to make comparisons between live feeds without any considerations of how demos behave (as it is not relevant to live trading). I chose these brokers randomly from a list of about 15 brokers in which I have live server access in order to see how different randomly chosen brokers are. On a later part of this series I will talk about differences between broker types (ECN and market makers) and other relevant aspects of volume.

Now it is very interesting to not only compare volume purely but to also compare different aspects of volume values. It is interesting to see how volume patterns differ between brokers (using a normalized volume oscillator or NVO) and how the absolute average number of ticks is different between brokers (using a long term moving average of the volume value). If most brokers share liquidity providers we would expect their patterns to be similar even if their absolute values are different, we would also expect the brokers with the highest volume to be better as they offer more opportunities for adequate trade entry/exit as their overall liquidity is assumed to be higher (tick volume has been shown to be a good proxy for market liquidity).

What we see when comparing volume values has both expected and surprising aspects. First of all we see that volumes are overall different in magnitude between brokers and this difference can sometimes be extremely high, for example average 100 period hourly volume on InstaForex is 493 while the same value on IBFX is 4052 and 2081 on Alpari UK. From this first comparison we could conclude that the best broker regarding liquidity is IBFX AU (amongst this four) as it gives the largest liquidity while InstaForex is the poorest as its volume is almost 10 times lower than on IBFX AU. When we look at volume patterns we find the unexpected consequence of having a large amount of differences telling us that the overall volume distribution between brokers is very different. GoMarkets and IBFX AU tend to match the closest while Alpari UK shows substantial differences as well as InstaForex. Perhaps the most important differences are seen on a small number of hours where Alpari UK simply has “volume spikes” not present on the other brokers. It is obvious that brokers here are divided amongst two groups as GoMarkets and IBFX match closely and Alpari UK and InstaForex also fit better. There seems to be two groups of liquidity providers which cause significant differences in the final feed. Alpari UK and InstaForex share providers which are different – at least in part – from those of GoMarkets and IBFX AU. This information can help us select brokers which are more likely to yield “similar” results as we can deduce whether or not they share liquidity providers by the overall match of their volume structure.

These observations show us that the distribution of liquidity providers amongst this small broker sample is not only different but different enough as to cause large variations in the overall volume patterns seen. We can also judge that the normalization of volume values to highest or lowest values is probably not a good idea since brokers are bound to have “spikes” that cause overall distortions in subsequent NVO measurements as the maximum volume of the past 50 periods (as used here) is distorted significantly due to the “abnormal” movements. It is also obvious from this analysis that different brokers have VERY different feeds which implies a significant difference in either liquidity providers or in the way in which data is processed to feed the MT4 platform. It will certianly be interesting to compare ECN Vs market maker volume feeds and see whether or not there is a substantially larger “coherence” amongst brokers which trade in a supposedly more “direct” way.

If you would like to learn more about my work in automated trading and how you too can learn to design your own trading strategies based on sound tactics please consider joining Asirikuy.com, a website filled with educational videos, trading systems, development and a sound, honest and transparent approach towards automated trading in general . I hope you enjoyed this article ! :o)

Hola Daniel, como andas?

I saw a post called “The Impact of your Broker Choice on your Trading Results” that can maybe be of interest to you:

http://tulipfx.com/2011/04/17/the-impact-of-your-broker-choice-on-your-trading-results/

Saludos,

emc

Daniel,

as for Alpari.uk, the backtest data used in asirikuy come from standard accounts?. I mean, datafeed for microaccounts do not reflect equally well the historic data we have?.

Thanks.

Hi McDuck,

Thank you for your post :o) I am not aware of what specific Alpari server the data comes from (my source doesn’t give me this information) so we would have to search to see which particular live feed it matches. However please discuss issues dealing with Asirikuy on the website’s forum. Thanks again for your post,

Best Regards,

Daniel

ok, thanks and sorry for not constraining to the forum.

Hi,

so tick volume is the number of ticks per minute?

Daffi

It’s the number of ticks per bar on a chart (if you are on a 1m chart then it is the volume of ticks per each 1m bar). I hope this helps :o)

Daniel