On April 15th I wrote a post about simulating the effects of broker dependency using Monte Carlo simulations, introducing distortions against any system’s regular distribution of returns in order to find out what the potential effect of doing this might be on a portfolio or single strategy. Through the past few months I have been doing more in-depth research about the use of these distortions in the evaluation of trading portfolios and I have finally found a way in which they may present very useful information for the comparison and quality evaluation of different portfolios. On today’s post I want to talk a little bit about my findings and about how this way of using distortions allows us to compare robustness using alternations of a trading strategy compared to alterations of another one.

To start we should remember what the whole idea of using distortions in Monte Carlo simulations is about. As it says on my previous post the idea is to introduce a series of random changes within the distribution of returns of the original strategy in such a way that the outcome of strategies is altered significantly from what we would expect without this modifications. For example if we introduce a 5% outcome inversion distortion coupled with a -0.2% distortion on 50% of the trades what we will get is a result where the results of 5% of the trades are entirely opposite and from the total number of trades, half have been altered to show an additional 0.2% loss. This simulates broker dependency in the sense that it duplicates the effect one might expect if a given number of positions fail the TP/SL targets by a few pips (outcome inversions) and if random slippage and re-quotes happen which cause losses in profitability (0.2% loss although this obviously changes depending on the strategy or portfolio being evaluated).

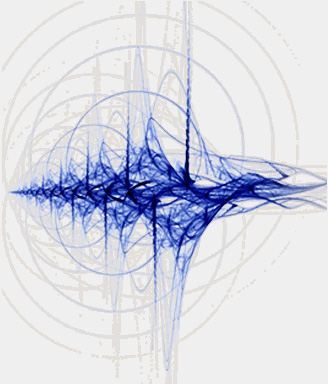

–

–

When I first created the above it was quite clear that we had some way to simulate how a system would react to broker dependency (a crude approximation of course) but it wasn’t straightforward to see how this information could be used in a meaningful way. For example what does it mean if a 5% inversion generates a drop in the average compounded yearly profit to worst case scenario of 20% ? Does this level is acceptable or do we have to discard this strategy as being excessively sensitive to dependency issues? The answer to these questions comes in the form of a comparative method which uses information gained from Monte Carlo distortions in order to compare two different trading strategies and their inherent changes when confronted with this type of modifications.

The key here is not to evaluate things in an absolute way but to draw a comparative model between a system or portfolio for which we “know” or have estimated broker dependency to a good extent and compare it with the portfolio we want to test which should trade at the exact same average risk per trade. What we do in the end is a Monte Carlo distortion across the SAME number of trades for both portfolios and compare the overall changes in the profit to worst case scenario ratios so that we can see how both portfolios compare whenever they are faced with random distortions. This way we are able to easily see if a portfolio is exceedingly vulnerable to possible changes introduced by broker dependency and this will give us a clearer answer regarding which portfolio might be better to trade overall.

What this technique offers is certainly not the “all-in-one” solution to the question of broker dependency and how to determine the vulnerability of a portfolio against this but it does give us our first tool in the quest towards understanding what factors might increase or decrease the problems associated with these issues, at least from a purely statistical perspective based on the changes that dependency causes in the distribution of returns of a portfolio. Of course, there are still tons of ways in which we can implement the distortion engine within our Monte Carlo simulations in order to make this technique much more powerful but right now we can already draw some very interesting comparisons. For example you could already know if a large portfolio introduces a larger degree of broker dependency or which systems suffer the most when facing distortions. Certainly hard work will continue on this road and hopefully we will start to have even more powerful tools for the study of broker dependency.

If you want to learn more about Monte Carlo simulations and how you too can learn how to evaluate your own systems using this powerful statistical technique please consider joining Asirikuy.com, a website filled with educational videos, trading systems, development and a sound, honest and transparent approach towards automated trading in general . I hope you enjoyed this article ! :o)