This year I have spent a large amount of time thinking about the idea of robustness and how to build strategies that can yield the highest possible degree of success under the most varied types of market conditions. After coding several strategies to achieve this objective (all of which you can find inside Asirikuy), I have started to develop a “road-map” to serve as a development guide towards the development of this type of systems. On today’s post I am going to talk about my experience with the building of robust strategies and how I believe you should approach the building of highly robust trading strategies if your objective is to build systems that have an incredibly large probability of achieving profitable results going forward. I will first talk about some of the assumptions I had – which have been proven wrong – and what I have discovered to be the “truth” behind this type of systems.

Let us first begin by describing what a “robust” trading strategy is. A robust trading strategy is a system which can survive to long term periods of out-of-sample testing on many different instruments with the exact same choice of trading parameters. Notice that the longer the out-of-sample period is the more robust a strategy will be so today I am going to talk about strategies which can survive to 10 year periods of backtesting which are achieved either through direct testing without optimization or through 10 year optimizations (1990-2000) followed by 10 years of out of sample testing (2000-2010). Notice however that optimizations are carried out across the whole basket meaning that in the end all systems have the exact same parameter sets.

–

–

When I first began my journey into the development of robust strategies it was seemingly evident that this would only be achievable through the use of very inefficient trend following strategies. If you look at the strategies which have been known to give positive results with the same parameter choice across huge portfolios and very long periods of time it soon becomes evident that strategies like simple long term MA crosses and donchian channel breakouts are the most popular choice. However the problem with these strategies is that results are generally very variable between different strategies and very poor on pairs which are “bad” at forming trends. It is easy to understand how these strategies can be widely successful in commodities (which tend to have long directional trends — look at gold futures for an incredible example) but in currencies the large majority of pairs – which are not very liquid – tend to trade in ways which do not favor trend following strategies.

I quickly found out that I could create – overall – very successful baskets of trend following strategies through long periods of out-of-sample testing if I limited my testing to pairs which had liquid behavior (mainly those called “majors”). The main achievements from this development period were Quimichi and Comitl, with Comitl being a very powerful strategy which achieves success across a 20 year out-of-sample period across many different currency pairs (the “pinnacle” of robustness). Both Comitl and Quimichi are trend following strategies which attempt to tackle different inefficiencies based on how price reaches higher highs and lower lows. Quimichi relies primarily on donchian channel type trading behavior while Comitl uses a large degree of volatility breakout based directional trading to take positions in favor of long term trends.

However there was something which I didn’t like about these strategies, the first thing is their inherent variability due to the pronounced length of draw down periods, their limited statistical significance due to the reduced number of trades, their vulnerability to missing trades (its really not good if you miss a trade which should have generated a 40% profit) and finally their inevitably large degree of correlation as relying on trends implies that things don’t workout when there is no directionality something which tends to materialize on all pairs at once due to the heavy implicit correlations with the USD on liquid currency pairs (most liquid forex pairs contain the USD).

Ideally we would want to have strategies that would achieve higher degrees of success across a wide range of pairs with a logic that is not so inevitably correlated as simple long term trend following. It becomes necessary to search for strategies that are profitable across pairs which do not have so much liquidity which simply do not have the necessary character to generate profits under long term trend following strategies. This is certainly a difficult task as it requires us to search for strategies which can be both reliably simulated and long term tested across many pairs which do not follow the basic principle of “following the trend”, something which seems to be absolutely necessary to find more satisfying solutions to the high robustness problem within the Forex trading market.

After searching for a while my first encounter with such a strategy happened a small while ago when an Asirikuy member (Fd) sent me an email with a strategy containing a very interesting counter-trending technique which seemed to perform this “miracle”; a strategy which was based on a very simple principle based on what seems to be a simple statistical deduction from wide observations of price behavior on the daily candles which works magically across a large amount of Forex pairs. This strategy did something which I hadn’t been able to achieve which is to get profitable results on all available Forex pairs (we have EOD data for at least 20) even if this requires the optimization of one or two parameters. Novohrad-Volyns’kyy Please note that this strategy was created and contributed entirely by Fd, another wonderful contribution of an Asirikuy member to our community.

–

–

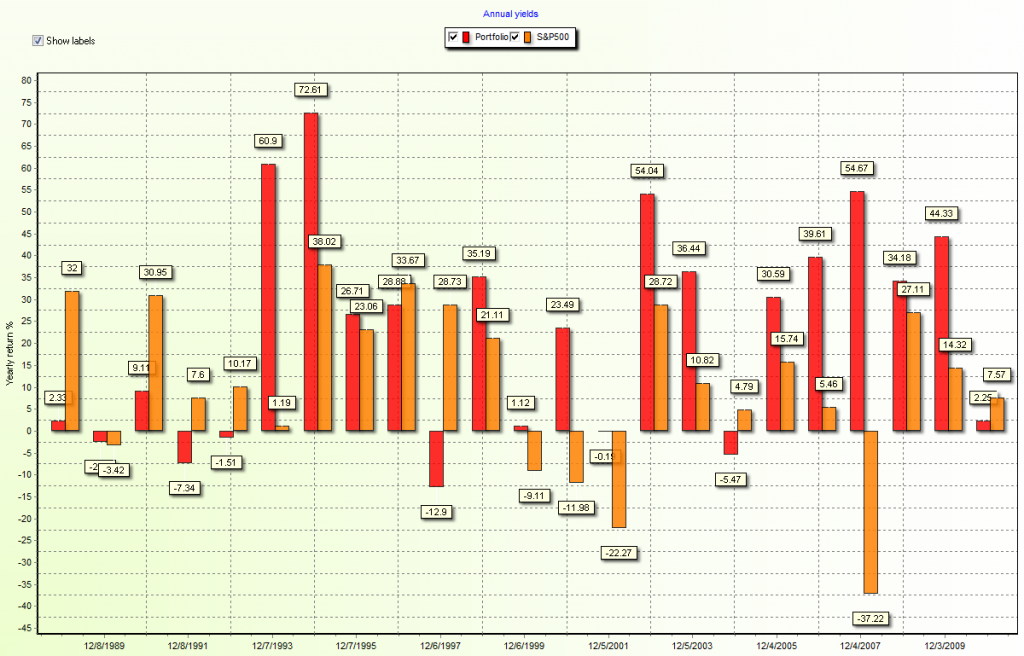

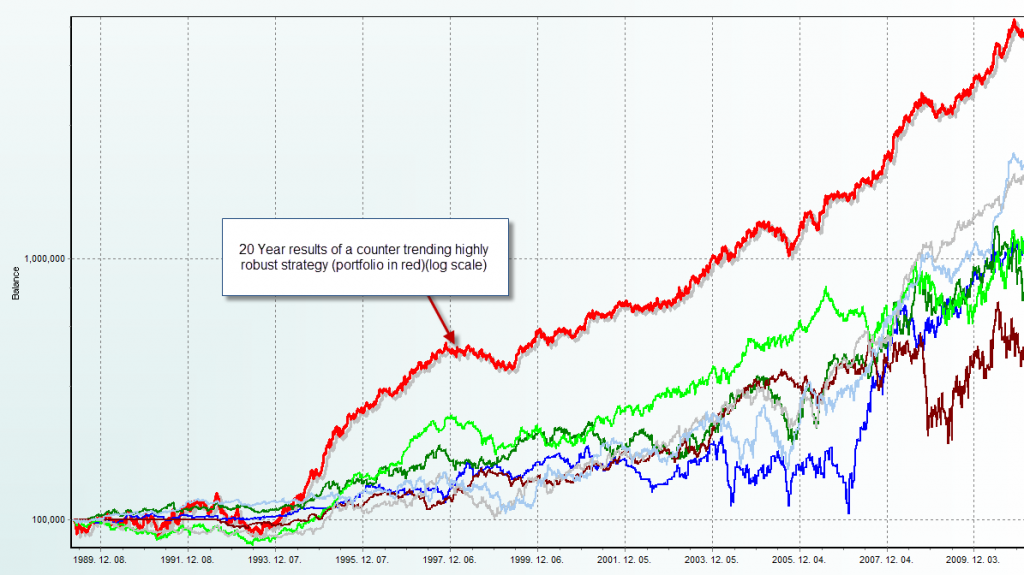

Now the great thing about this proposed strategy is not only that it can achieve these results but also that it gets 20 year profitable results with 10 years of out-of-sample testing on 7 pair baskets of currency pairs with the exact same settings. This means that we can get profitable results for a 20 year period which makes the robustness of this system come very close to that of Comitl. Definitely the strategy can currently be improved even further but it proves the point that trend following is not the only way to achieve long term profitable results to build highly robust strategies but that elegant and simple counter-trending techniques can also lead to the development of highly effective trading techniques for long periods of time.

It therefore seems that in Forex trading statistical analysis of candle formations across large groups of pairs can also lead to the development of successful and highly robust strategies which have nothing to do with long term trend following. The advantages of using non-long term trend following tactics are also evident as we can definitely reach higher levels of profitability with much lower Ulcer Index values mainly due to the fact that correlation plays a much more complimentary role when we do not rely on such a fundamental degree of long term directionality. The results of a counter-trending strategy when used profitably across a wide array of Forex pairs gives a much smoother result when compared with a long term trend following strategy like Comitl.

Of course this doesn’t mean that we should forget about trend following but it perhaps hints at the fact that we should look for shorter term trend following opportunities on the daily time frames which may arise from inefficiencies related with candle progressions. Perhaps we could find much more successful trend following tactics to achieve high levels of robustness if we do not tackle the long term trend but perform wide analysis over the statistical significance of certain candle formations and patterns within the daily charts. The idea here is mainly to find short term patterns that are highly reliable and yet simple and therefore elegant. The advantages of systems developed over these type of tactics are many (as explained above) and therefore approaching the problem from this angle seems to be fundamental.

As suggested by Fd the strategies might also be improved through the use of Neural Networks although the degree of success to which this can be done is still to be tested as we haven’t implemented a neural network yet to attempt to improve any of the above mentioned strategies. Definitely this new proposed system will – probably within the next few months – become a part of our arsenal of Asirikuy systems after further testing and its complete implementation over the Asirikuy F3 or F4 frameworks. If you would like to learn more about our journey in automated trading and how you too can learn to develop systems based on knowledge and understanding please consider joining Asirikuy.com, a website filled with educational videos, trading systems, development and a sound, honest and transparent approach towards automated trading in general . I hope you enjoyed this article ! :o)

Daniel,

You made me (and I assume the community) very happy with another highly robust system. Although you have always tried to ensure “secondary” robustness by testing, I prefer “primary” robustness by design, i.e., min number of parameters and max number of instruments in the longest possible out of test period and seems to me you found another good one. Can’t wait to see/try it when it is finished.

And the log chart looks great. When will we have it in the tester in the configuration agreed (with optional linear regression lines and SD bandS around them)?

Anyway, thanks for the 4th of July gift at least for us here in the good old USA.

Mihaly

Hi Mihaly,

Thank you for your comment :o) well this contribution was done entirely by Fd (so he deserves your congrats here) and as you say, it is a very robust systems that addresses this in a primarily fashion. Without a doubt this will become a very powerful part of our Asirikuy trading arsenal going forward. Regarding the tester configuration, we will be working towards it but as you know there are tons of other features being implemented so it will certainly take us at least a couple of months to reach most of them. Thanks again for posting Mihaly ! (and remember this system was contributed by Fd!)

Best Regards,

daniel

And yet another profitable path to long term, uh, well, profits…… 8^)

It is so cool that as we search, (as a community) we keep finding so many different paths to profit…… Makes me happy to be with such a group……

Daniel I can’t put it into words how blessed we are to be a part of what you have called your “brain child”.

Very blessed and happy in Kentucky……..

8^)

Congratulations Fd and Daniel, looking forward to further development and the final release

Thanks, Franco, for your recognition!