The past few months have been quite hectic at Asirikuy as many changes have been implemented across our website and trading systems. These changes were sparked by our trading experience within the past two years, calling for some significant redesigning of our trading strategies to address problems related with feed dependency, trade chain dependency, etc. Besides these issues we also wanted to perform a significant change towards a much more universal and flexible trading framework, pulling away from the MT4 base that kept us from running tests on other platforms or using more advanced algorithmic trading and testing solutions. Today I can say that the initial phase of this migration is over and – with it – the start of a new day for the Asirikuy trading community. Through the rest of this post I will talk a little bit about the changes that have been implemented, some of their reasons and consequence and how this will most definitely change the experience within the community (hopefully for the much, much better). You will get a glimpse of where Asirikuy was, where it is and where I want it to go.

Certainly one of our main goals in Asirikuy is to explore new trading tactics and evaluate ideas that seem to be statistically and technically sound. From 2011 this led us to venture into unknown territory, including the exploration of genetic programming, neural networks, seasonality filters, etc. All of the ideas we have tried have been sound at the moment of their conception – with whatever information we’ve had at the time – but it is often the case that live trading shows us some aspect of our trading that we hadn’t considered before. This was the case for several of our trading ideas during these past two years, with many of these experiments turning into losing propositions. Although other ideas have been successful, those that didn’t have taught us a lot about how to build better and more reliable trading strategies. For example from genetics we learned about result symmetry and curve fitting of historical system correlations while from other systems – such as Sumaq and Amachay – we learned about trade chain dependency and the big difference this can cause between two brokers.

–

–

All in all, the Asirikuy experience took us through an experimentation ride that had some clear results; we managed to figure out many of the problems with some of our initial propositions and it was now time to polish our systems and bring them up to new trading standards. Timing for this was perfect as we were also starting to build the F4 framework – our ANSI C trading framework – that needed us to port all of our trading strategies to use TA-lib indicators and trade completely outside of the MT4 platform (only using this platform as one of its possible front-ends). While building the new framework we implemented all of these enhancements and we also took the opportunity to elevate our system trading standards to use 26 years of historical data (with more than half used as out of sample) and rank analysis type optimizations. The framework also includes many of our most desired trading features, such as the ability to perform internal back-tests (using the strategy tester module), allowing us to do walk forward analysis (WFA), game theory based management, etc. Last week-end we released a very solid version of the F4 framework that will hopefully serve as a base for Asirikuy during a long time. The division between stable and unstable development branches also allows us to safely experiment on new features without compromising the stable version used for live trading.

Besides changing our trading systems and our trading framework Asirikuy was also in need for some new learning material to put new members up to speed. After more than 3 years of recording videos it seemed obvious that many were outdated and no longer relevant for our trading platforms (so were some of the pdf documents developed for F3) and therefore new members were often lost as they tried to venture into the Asirikuy “knowledge maze”. Through the past few weeks I made some new pdf content to focus on our new trading standards and the F4 framework, ensuring that new members will have a coherent knowledge proposal when they reach the website. In addition to this I also updated many of our analysis tools and created an updated ADA Database to include new 26 year back-tests for the latest F4 stable branch.

Another important addition is the inclusion of new e-learning content within Asirikuy. This content – created using Articulate’s storyline – allows members to go through interactive presentations that teach them about the Asirikuy tools and trading systems. In order to make things easier for new members I created two full new e-learning courses containing information about our analysis tools and a large majority of our trading systems (all but Ayotl which is based on the turtle system) ensuring that information about our trading systems will be easily accessible for new members. The new e-learning content features pictures showing trade examples, descriptions of system strengths and weaknesses as well as detailed descriptions of the trading logic of each strategy. In addition the material also features relevant links to website videos and pdf documents were additional details for the strategies are given. This e-learning content is highly interactive, easy to update and maintain and gives people a better understanding of what Asirikuy systems are about.

–

–

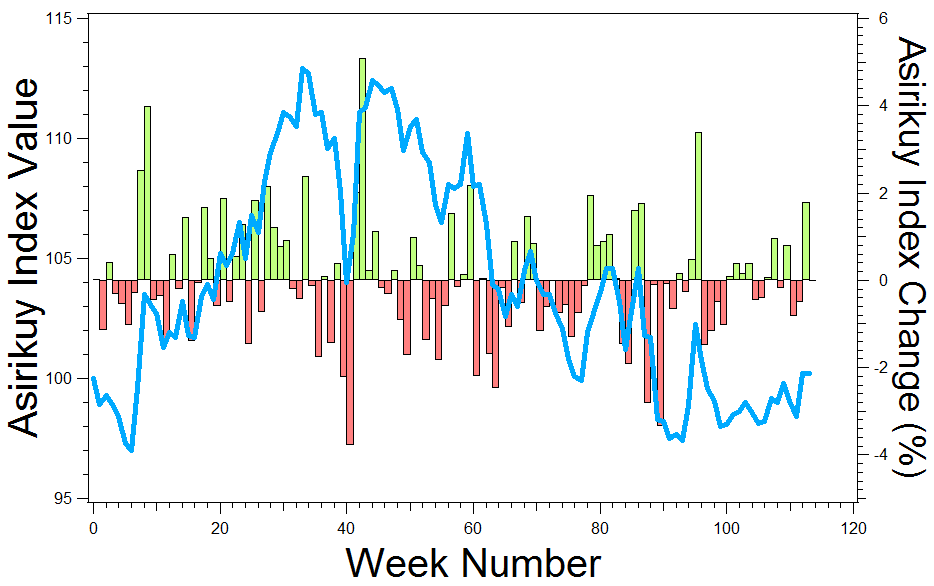

Finally I want to discuss my decision to remove the essay requirement from the Asirikuy website. I have talked to several new members and some members who cancelled their membership early on and it turns out that several people were joining Asirikuy in order to get access to trading systems they thought were “extremely good”. The problem is that many of them got refereed to the website by people who are inside and consider the systems “very good” for some particular reasons (soundness, robustness, development quality, etc) but the other people thought that by “very good” people meant: “insanely profitable”. People then sent me essays portraying something they were not – saying they wanted to just achieve knowledge and understanding just to tell me what I wanted to read – and when they joined the got massively disappointed because we have no holy grails (sigh). If this people had been honest with be I would have stopped them from joining but then they would have thought that I was just protecting some “holy grail” I wanted to hide. I then decided that the best deterrent for this people would be to know that we have no holy grails in advance and for this reason I have made the Asirikuy Index and account distribution charts public. I will not make individual accounts public – because many belong to challengers plus you need to have knowledge of what they are running to understand them as well – but the index and account distribution give you an idea of where our accounts are and – surprise – we have no holy grails. I also placed the myfxbook links to Atinalla FE – and the link to this blog – in Asirikuy, in case people want to get more familiarized with our system development process.

So my hope is that by removing the essay requirement we will get in some people who were in the right mindset but too hassled to write an essay while we will avoid holy grail seekers because, yet again, we have no holy grails (which should be clear by the index and account distribution charts). Of course, I have made all the above changes and – as I do every year – I have increased the Asirikuy initial membership fee by a small amount. This year it has gone from 241 to 292 USD, owing to all the developments and new material now available on the website. If you want to learn more about our journey to achieve long term profitability in Forex trading please consider joining Asirikuy.com, a website filled with educational videos, trading systems, development and a sound, honest and transparent approach towards automated trading in general . I hope you enjoyed this article ! :o)

PS: I have a big surprise coming up (since I owe the world of Forex traders Christmas presents for 2011 and 2012) ! :o)