When deciding to trade a given financial instrument one of the main things to consider is how hard it will be to actually get a positive long term result, regardless of whether or not you have a trading edge (an ability to obtain positive results beyond random chance). So you can get positive results without an edge? Yes, on some instruments there is a natural fundamental bias that skews random chance results into positive territory so even having no edge still yields a positive outcome. This is incredibly important as it means that your investment is bound to appreciate, regardless of how you structure your bets — provided risk remains under control. In fact, one of the main differences between investments and speculative trading is that speculation carries a net risk of loss in case there is no edge while an investment carries within itself a positive skewness towards profit, regardless of any additional edge (or lack of one) obtained through management.

–

–

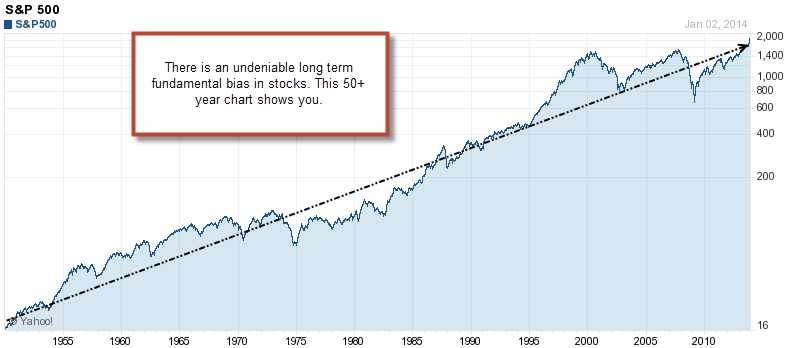

What is the cause of this fundamental bias? In general this fundamental bias in some financial instruments is attributed to the creation of value. The stock market in particular has a natural tendency to go up in the longer term because there is a net creation of wealth behind the companies represented within the stock exchange’s shares. Demographic expansion on its own is enough to ensure that the stock market expands exponentially as a function of time, as long as the population expands on an exponential manner so will the monetary base and so will the companies that build up the economy. As there are places were demographics expand exponentially, there will be stock markets that expand in the same manner. As new people come into play and start working, they generate new value that is reflected within the real economy, represented in companies along the stock exchanges.

The stock exchange is a positive sum game, because value is created within it as a function of time. If you bought the S&P 500 today, you have a very good chance to come out positive in the longer term. It is also true that if you buy the S&P 500 randomly, you will be able to have a good chance for a net positive outcome, regardless of whether you timed the market right or wrong. Obviously whether you “beat the market” (earn more than a buy-and-hold strategy) depends on whether you really have an edge and whether this edge beats the added trading costs (commissions, slippage, spreads, etc). However, you have the confidence that – even if you’re wrong on your assumptions – you will be making some money.

–

–

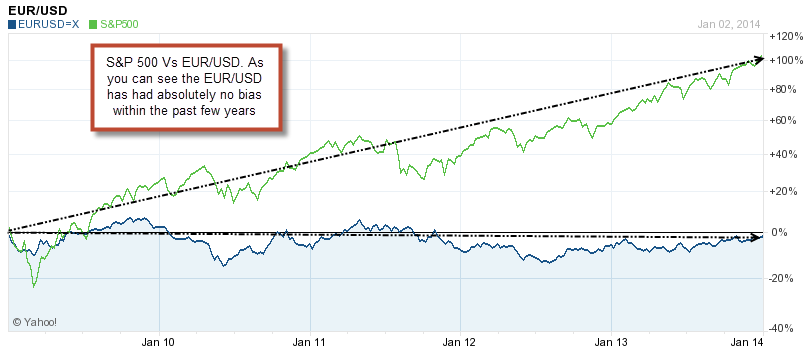

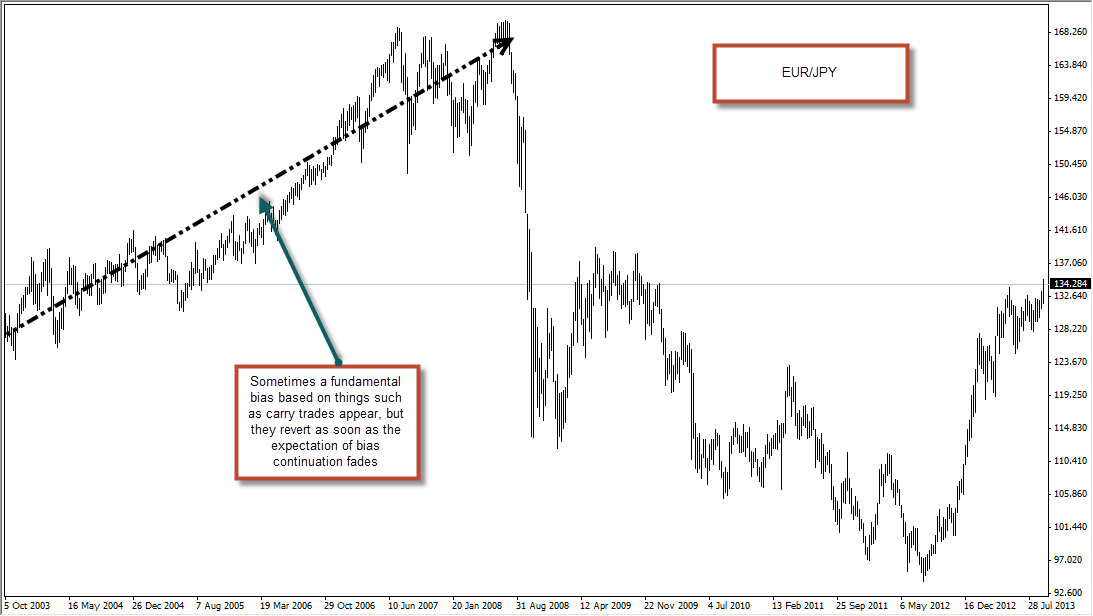

Forex is an entirely different game because it doesn’t measure the absolute value of something, but it measures the value of things relative to others. When you think about the value of the EUR against the USD there is no fundamental reason why the EUR should appreciate over the USD or vice versa indefinitely. Whether one thing or the other happens depends mainly on fundamental economical factors that may change through time. The Forex market does exhibit some fundamental long term bias phenomena, mainly carry trades, which are the consequence of interest rate differentials. However carry trades can “unwind” when the underlying cause of the bias – the interest rates – change. Even worse, the carry trade unwinds when there is an expectation of a change in the bias, even if the interest rates haven’t changed yet. This happened in the 2008 financial crisis as the USD appreciated against other currencies (as interest rate differentials were expected to contract heavily) with investors fleeing towards US treasuries (as a safe haven).

This lack of a fundamental bias makes Forex and commodities speculative in nature, meaning that there is no guarantee of a long term positive result if there is no trading edge. Moreover, a trading edge that is above trading costs is necessary to actually come out positively in the long term (because it’s a negative sum game in nature), meaning that the probability to come out as a loser is fundamentally high. This is the reason why Forex and commodity investments are so much more strictly regulated than stock investments. Financial regulators are not too concerned about people being advised to trade a given stock system or to make certain picks, because they know that – regardless of the strategies, provided they go long – they will have a good chance of making money in the long term. People will not miss their entire investment and will likely make some money. On Forex or commodity trading there is a chance of complete and total money loss and there is only a limited chance for potential profits.

–

–

With this in mind it becomes natural to ask the question: Why trade the Forex market? There are several reasons why one might want to do this but they usually come down to three. The first is that Forex trading requires less capital, so while you will need 10,000 USD to trade US stocks or 25,000 USD to day trade them you will only need 1 USD to open up a Forex trading account. To trade within reasonable risk measures you will want to trade at least a 100 USD cent account or an account with almost limitless fractional lot sizing (as Oanda regular accounts). Forex is extremely interesting for most retail speculators because it allows trading from very low amounts. The second reason, is that Forex allows for high leverage that allows for much higher risk and therefore faster compounding. You will want to trade Forex if you want to have the possibility to make money in a faster manner. Note that this doesn’t mean that it will be easier, in fact the probability of complete loss of capital increases as you increase risk.

The reason why non-retail traders get into Forex trading is outside the two reasons above and relates mainly to the ability of Forex strategies to be uncorrelated with stock trading strategies. The hope of trading Forex/commodities is to reduce portfolio beta in order to have a smoother equity curve. In this case currency pairs are traded in a relatively unleveraged manner, with risks per trade in the 0.2-0.5% fashion. Many of such strategies attempt to tackle some temporary long term fundamental bias present in the market – such as a carry trade – but there are many that also attempt to profit from day trading.

From the above it should become clear that Forex is no place for the long term investor. It’s no place to put your life savings and it is no place to expect to get money for retirement. Aside from professional traders, retail traders have a very high chance to lose their money. It only makes sense to trade this market up to the point where actual investments with long term positive bias become available. There are security ETF and stock strategies that offer 20-30% compounding yearly returns (which we also explore at Asirikuy), with the implicit “guarantee” that the lack of an edge will probably not mean loss of capital but a less-than-expected profit in the long term (due to the long term edge). There is obviously a place for FX strategies within a percentage of a person’s overall portfolio, but it should never constitute a large part of any investor’s portfolio.

Due to all the above FX is probably the most challenging and hardest trading market – from an edge seeking perspective – and therefore it offers the largest intellectual challenge. For some of us this is a big part of the reason why we dedicate so much time and part of our portfolios to FX trading. It also offers a significant potential reward although clearly with all the risks associated with a negative sum game market (no profit in the long term without a substantial statistical edge).

If you would like to know more about my systematic approach to FX trading and how we create systems to attempt to generate long term edges please consider joining Asirikuy.com, a website filled with educational videos, trading systems, development and a sound, honest and transparent approach towards automated trading in general . I hope you enjoyed this article ! :o)

Hello Daniel and congratulations for your efforts .

What you say is basically true , being a zero-sum game we have to maintain an edge in the long term if we want a positive outcome.

In your previous article you said that every system tends to be guaranteed in lose its edge over the time, and on this i’m not entirely agree with you.

In Asirikuy you have devoted some attention on systems thought only in terms of robustness based on Daily charts and this is the way to go to get an edge ” almost guaranteed” in the long term in my opinion.

The real holy grail of forex are daily charts and systems based on simple strategies such as Donchian (4 week rule) that are guaranteed to get a trend rider.

The only way to not lose our edge is to choose strategies based on the fundamental concepts of the market, in fact, “the market does not change NEVER as it changes EVER” what I mean is that there will ALWAYS be the trend in this market (its a natural tendency) we must take advantage of this tendency (the concept of the Donchian system)

I think some of your systems have this orientation as Quimichi and Comitl , so you have to try harder in this direction and leave more out systems based on labile and temporary inefficiencies or anomalies and lower time frame (unpredictability of edge outcome due to the volatility and noise)

I think I will join myself with Asirikuy if you will take that direction .. Happy trading :o)

Hi Carmine,

Thanks for posting :o) The issue with daily systems based on Donchian channels is that their profit to drawdown characteristics are far worse than those of simple buy-and-hold stock investment strategies or even simpler daily trading strategies. Trend following – through donchian channels – is something that worked very well in the 70s and 80s but it doesn’t work well now (particularly in currencies). If you want to trade something like this you must be ready to endure drawdown periods lasting ages (1000-2000 days) even when using techniques such as pyramiding. You can look into some articles I’ve published on Currency Trader magazine about systems like this.

It is also wrong to believe that daily systems cannot fail. They can in fact fail, just as quickly as any other system based on another time frame. When you systematically study daily systems you see that this can happen as well. Although your point of view is quite intuitive – something I also believed when I started and then for some time – systematic studies reveal that this simply isn’t true. Daily systems based on donchian-type trend following do not work very well and any daily system can also fail. That said, we are still live testing Comitl and Quimichi on Asirikuy and the F4 framework is also very well suited to build and test this type of systems as well. If you join you can explore this venture, run your own experiments and come to your own conclusions on the matter.

Thanks a lot for posting :o)

Best Regards,

Daniel

PS: There are never guarantees. Donchian systems are not “guaranteed” to get a trend rider. When you run simulations you see that they can go without a trend rider for a long and then when they do get one it barely compensates for the long and sometimes deep drawdown period. Thing are always far more complicated than then seem ;o)

Hi Mr. Fernandez,

a question about this post. I’ve read in the past articles from You that talk about asimmetric systems argumenting that they are doomed to fail, given the fundamental symmetry in the market. How do U reconcile the asimmetric systems argument vs the fundamental bias argument? Further, if U think that an index like sp500 has (rightly) a fundamental (long) bias, which trading strategy (in theory) would be better:

1 simply buy and hold sp500?

2 an only long ts on sp500?

3 a symmetric ts (long and short) on eurusd?

do U have any statistics in regard?

tnx

Hi Eugenionca,

Thanks for commenting :o) It is difficult to say what would be “better”, because that depends on the systems to be traded. However these setups have some fundamental characteristics:

1. buy and hold S&P 500 : Guarantee of long term profit as long as there is economic expansion. Largest certainty of long term profit but limited to fundamental bias positive edge.

2. an only long ts on S&P 500 : Large probability of long term profit. Possibility of larger than buy-and-hold profit if an additional edge is present. Still significant probability of coming out positive in the long term due to the bias but significant probability to under-perform the index if an edge is lacking.

3. a symmetric ts on EURUSD: Possibility to perform better than the two systems above, however risk of total loss of capital if an edge is not present. Since there is no fundamental bias a lack of a long term edge implies an inevitable loss of capital.

The third system has the highest profit potential if you have a significant edge while the other two have lower expected profits but have a higher guarantee of profit because they are at least in part investments (based on a long term fundamental bias). Whether you choose the first, the second or the last depends on how confident you are in the fact that you have an edge. No doubt, the third is the riskiest and the most speculative (where the possibility of loss is largest). If loss of capital is the most important aspect, then system 1 would be the best choice, then system 2 and ultimately system 3 if the most important thing is the potential for profit accumulation, if the possibility of partial/total loss isn’t as important.

Clearly the lack of a long term edge makes FX trading the most speculative. I hope this answers your question :o)

Best Regards,

Daniel

PS: Bear in mind that the above only applies to the S&P500 regular instrument (something like the SPY ETF), not the CFD. I will write a post soon about why the CFDs eliminate all the fundamental bias advantage.