I have always been interested in the topic of long term results and what has been achieved under real, live trading conditions by audited, real, market performers. Normally such information would be quite difficult to obtain, as retail accounts are private and brokers have no obligation to reveal details that are concise enough for the drawing of any conclusions. Thankfully we have services like myFXbook, which has now been monitoring accounts that started as far back as 2009 (when myfxbook became popular). MyFXbook also verifies trading account access/trading privileges and allows you to see information such as trade history, broker, account number, etc. Through the following post we will be looking at myFXbook trading champions, we’ll analyze their results and see what retail trading champions have been able to achieve across a long trading timeframe (between 3 and 5 years).

–

–

First of all, we have to be clear in that myFXbook results can also be fake (despite verification). If a party is interested enough in cheating you – show you altered yet apparently audited long term results – they can buy metatrader server software to create a server that they can disguise as a recognized broker and then simply hide their account number and other information such that it appears that they are trading on a real account, while they fake their entire history by server side modifications. Such techniques are also used sometimes by shadowy unregulated brokers to show highly profitable fake accounts with extremely low slippage values that may encourage new traders to join.

A party can also hide equity loses – have huge floating loses that don’t show in the statistics – by making their trading history and open trades hidden and trade grid-like trading tactics. Because of all the above I have only considered accounts that have an open trading history, trade on recognized brokers (this means large brokers with significant market capitalization), are verified (access/trading privileges) and have the account number open, allowing me to verify the account’s existence with the broker they belong to. Moreover I only considered accounts with trading records of more than 3 years.

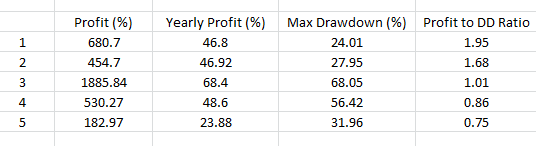

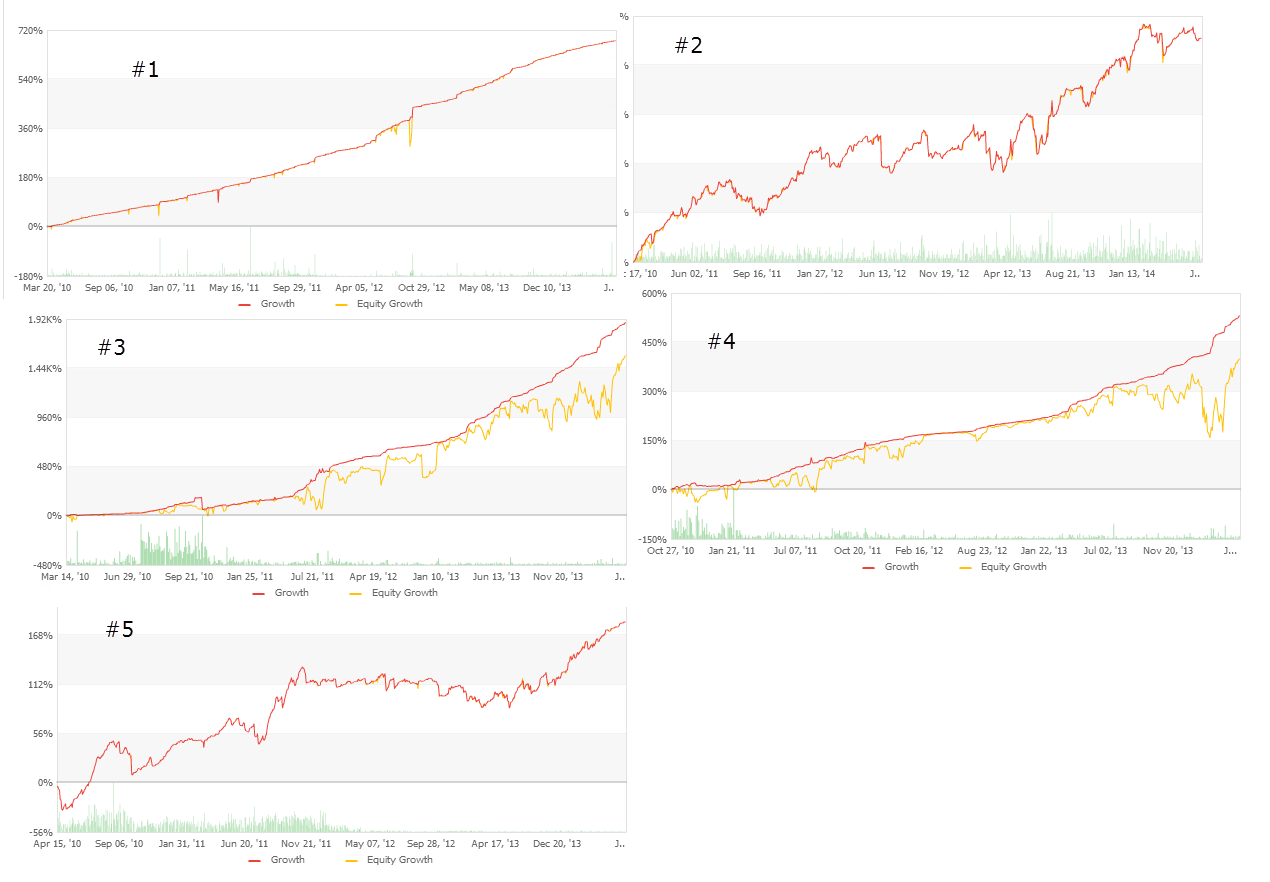

When we look at the long term trading record it becomes apparent that few accounts can fulfill the above criteria, despite the fact that myFXbook has had thousands of accounts being monitored since 2009 only 5 accounts make it through the above mentioned filters. From these accounts we can immediately see that low risk is not something common for retail traders – which is expected since retail traders are usually looking for fast compounding – with the maximum drawdown values going from 24.01 to as high as 68.05%. It is also clear that having a larger drawdown not always equates to having a better overall performance, as the average yearly profit is nearly the same for the accounts with the highest and lowest drawdown levels.

–

–

It is also interesting to look at average trade lengths, none of these accounts are fast market scalpers as the lowest average trade duration is 5 hours. Yet we also see that accounts like #1 have an average profit of just 10 pips, which we would consider to be a sort of almost-scalper strategy. Such a strategy probably opens trades during low volatility periods and therefore takes a long time to close trades at a profit or loss. Some accounts do the complete opposite, for example account #3 has an average trade duration of 6 days and has an average win of more than 30 pips. An interesting aspect is that none of these accounts trade at a favorable risk to reward ratio, as a matter of fact all of the accounts have an unfavorable risk to reward ratio, which in average approximates a 1:2 reward to risk. Although these trading methods require traders to win 2 trades for each trade they lose, they are still able to compensate with winning rates that are often above 75%.

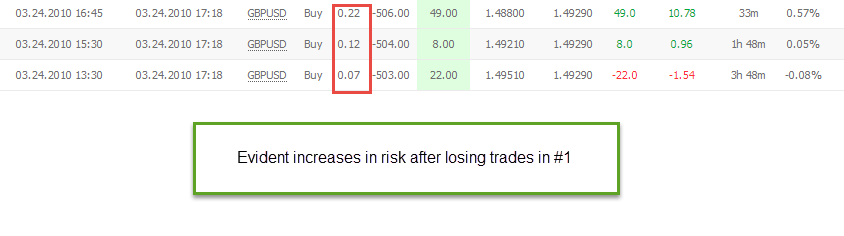

There are also some interesting aspects that might distort the reality behind these accounts. For example account #1 is an instaForex swap-free account, therefore it does not suffer from the negative effect from swaps that all other accounts had to endure. The average trade duration of 15 hours implies that swap charging would have been made to a large majority of trades taken, with more than 9000 trades the effect in diminished compounding would have been important. It is no coincidence that the day of highest profit for this system is Wednesday, where it avoid the charging of triple swap — an artificially created market edge. This negative swap bias becomes even more obvious when you look at all other accounts, where the swap always had a net negative effect in the long term. It is obvious that InstaForex loses money by not charging swaps to this account. It is also clear that this account uses a trading technique that increases exposure as a measure of loses, reason why equity dips are infrequent yet very pronounced when they happen.

–

–

Regarding FX brokers we can also see that account #1 uses Instaforex, #2 uses Alpari NZ, #3 and #4 use LiteForex and #5 uses MB Trading. From these accounts only #2 and #5 would be considered regulated brokers while LiteForex and InstaForex are unregulated brokers with Russian/Asian origins that often have conflicts with user withdrawals (you can simply browse these broker names to see a huge list of user complaints). Brokers are a very important element for consideration as they may affect the ability to scale the trading techniques used. Less regulated brokers may have important issues when attempting to execute the same trading tactic across larger volumes as a large enough trader may in fact affect the ability of such a broker to hedge internal trades. Such brokers may then take action using MT4 server side tools to significantly slip trades or hunt stops, which may dramatically reduce profit margins, especially for strategies that take very low profits per trade.

Perhaps the most interesting from all the above is the Yearly profit to drawdown ratio. It is obvious from the above that the best long term retail performers never achieve a profit to drawdown ratio above 2 (even in swap-free accounts). As a matter of fact, most of these traders have profit to drawdown ratios at or below 1, which is the somewhat expected results if you compare them with institutional and formal trader profit to drawdown records from top performers on standard benchmarks like the Barclays currency trader index. However most of these traders at myFXbook use trading techniques that many would consider unsound, such as the increase of risk exposure upon loses (#1) or the holding of open losing positions for years (#3/#4). Noticeably Ulcer indexes are fairly similar for all accounts when you consider equity curves, as strategies with smooth balance curves are often simply holding losing trades for long periods of time (most likely some sort of grid-like trading system as showed by the LiteForex accounts).

Long story short, myFXbook seems to be telling the same story that audited indexes have been telling for years. The best results achieved by top performers in the Forex market are most commonly in the 0.5-1 yearly profit to maximum drawdown ratio and may occasionally go above this number within 3-5 year periods (although there is a high likelihood to reverse to this region if you observe traders with longer 10+ year records). Trading seems to become exponentially more difficult when going near or above 2. This means that a trader with a long term record showing a maximum drawdown below 10% and an average yearly profit of +20% would be considered extremely good, although it is likely that most successful traders will be at a lower range (5/10, 10/10). This means that if you’re a successful trader who wants to live from trading with a salary of 50,000 USD per year, you will most likely need at least 200,000 USD to avoid putting your capital above a 50% loss. This does not mean that larger profit to drawdown ratios are not possible in Forex trading but merely that they are expected to be extremely uncommon.

If you would like to learn more about trading and how you too can learn to design systems through an automatic and sound development methodology please consider joining Asirikuy.com, a website filled with educational videos, trading systems, development and a sound, honest and transparent approach towards automated trading in general . I hope you enjoyed this article ! :o)

Hi Daniel,

what’s your opinion about systems on networks like for example Currensee ? Among Trade Leaders there are some of them with Profit/DD ratio greater than 2 and sometimes even 3 and 4 (i.e. LW Trading, Annualized Return 141.9%

Max DD% 26.6%).

Best,

Rodolfo

Hi Rodolfo,

Thanks for posting. The people at currensee with these results are in large part fast scalpers. I know a few people who have tried following them with very different results (due to spreads, slippage, etc). This points out that their results are most likely constrained to some very specific execution conditions that do not allow scaling. However their results are certainly real although probably also related to some broker specific features (like the swap free case I showed). Nonetheless, some of these are in fact very good traders. As I have said larger ratios are not impossible but simply expected to be difficult to obtain. ÍI hope this answers your inquiry,

Best regards,

Daniel

Hello Daniel,

is this possible to know what are these accounts on Myfxbook or they are private and we can’t have access?

thanks