Profitable trading using automated trading strategies is the future. As computers become more advanced and the ability of retail traders to use advanced tools becomes more prominent it is predictable that discretionary users will lose their advantage with time. However the building of tools and strategies to trade the market in an algorithmic manner is not trivial and new users might be significantly confused with the problem and might have no idea of where to start. On today’s post I want to start a series of posts that should help new traders get into the world of automated trading. I will try to tackle several issues faced by traders starting on the field, attempting to place people interested in algorithmic Forex trading on a road that will hopefully give them a higher probability to achieve success.

–

–

The first thing I want you to think about is if you are really interested in automated trading or if you just want to achieve a good risk adjusted return. This is a non-trivial distinction because even though all traders are interested in achieving good risk adjusted returns, not all traders are interested in developing automated trading solutions. One thing is for you to be interested in creating automated trading strategies and another is for you to be interested in just using anything that will yield a good return. Is it important for you to create and manage a system and know it from the inside out or would you just trade any automated strategy given to use (even if it was a black box) if it gave you your target level of return? If your case is the latter then you are not interested in becoming what I consider an algorithmic trader (someone who designs, implements, evaluates and executes automated trading strategies) but your are simply interested in any means to achieve a return. If you want to become a real algorithmic trader, then these posts are for you.

Once you have decided that you want to learn how to design, implement, evaluate and execute automated trading strategies it is now time to decide how to make this happen. Your first steps in this journey are bound to be critical in determining your chances of success, start with the wrong foot and it might take you much longer than you first anticipated to get to the level that you initially desired. The first thing is to take a step back and see if you have the tools necessary to walk this journey and get them if you don’t have them. The tools are not nifty trading platform, frameworks or backtesting software, the tools comprise a fundamental knowledge base that every algorithmic trader needs (regardless of market or particular algo trading field). I am talking about what I view as the two fundamental pillars of algorithmic trading: programming and statistics.

–

–

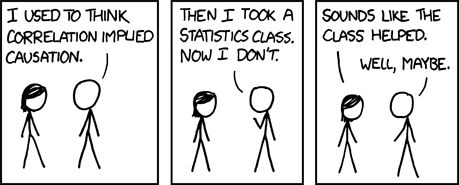

Listen carefully, without programming and statistics you will most likely get nowhere. Statistics is the science that will allow you to separate truth from illusion and programming will give you the technical ability to execute your ideas. Every successful algorithmic trader I know has at least strong basic notions on both of these fields. I am not saying that you should become an IT specialist and a statistician, what I am saying is that you should have a strong foundation on these two fields. If you want to take it a step further I would say that data-analysis (which is a place where both fields meet) gives incredible tools to become successful in algorithmic trading.

Luckily we now live in a world where getting high quality basic notions in statistics and programming can be done for free. If you want to get a head start that will increase your chances of success by a very large amount I would advice you to do the coursera specializations on data science and fundamentals of computing. After you complete the courses within these specializations you will have very clear notions of how to analyse and process data as well as strong basic programming notions in python that will help you tackle the problem of algorithmic trading without flinching. Getting a strong base is something you won’t regret, I cannot tell you how many people I have met who started to tackle automated trading without strong notions in statistics or programming and lost a ton of time (sometimes even many years) on problems that would have taken sometimes minutes to solve for someone who had the proper knowledge base.

So to get to your goal of becoming an algorithmic trader the first step you must carry out is get the tools that you will need for the journey. Imagine finishing your courses in statistics and programming as getting climbing gear to tackle a huge mountain, you want your gear to be of the highest possible quality or you might fail bluntly in the middle. Sure, you can climb Everest without equipment but what are your chances? What are your chances to climb it more efficiently if you have equipped yourself with all the proper tools? If you would like to learn more about my journey in algorithmic trading and how our community has tackled the problem through the years please consider joining Asirikuy.com, a website filled with educational videos, trading systems, development and a sound, honest and transparent approach towards automated trading.