When you trade in the forex market you have the option to choose from a large collection of different instruments. The instruments which have the most liquidity (formaly called the “forex majors”) are the ones most often bought and sold by traders since they present the best technical behavior and the highest ability to get in and out of the market easily. Although most people consider the “majors” only the USD/JPY, EUR/USD, GBP/USD and USD/CHF, the reality is that the majors (as defined by their liquidity) are a much larger group of currencies which include – besides the above – the USD/CAD, EUR/JPY, GBP/JPY, AUD/USD and NZD/USD. When we look at this group of “highly tradable” instruments we find that – after all – they are not that many. They are at most 9 different instruments (most of them including the USD) limiting our ability to diversify outside USD correlated trading. On today’s post I will give you my opinion on trading the minors (“low” liquidity pairs) why this is difficult to do, what precautions need to be taken to do this and what efforts I am doing to achieve this “higher degree” of forex diversification.

If you want to diversify your trading outside forex majors, then you will have to trade other much less liquid forex pairs which are mainly crosses of the majors. Pairs like the AUD/NZD and the GBP/CAD have a much smaller liquidity than the forex major pairs, although this liquidity is not – by any means – small. The liquidity of the most illiquid currency pairs is actually comparable to the liquidity of the average futures contracts but the problem is that the lack of a central exchange makes the prices very variable and the spreads sometimes absolutely unpredictable between different brokers.

–

Another problem we face when developing systems for forex minors is the fact that we lack reliable data down to the one minute time frame and the fact that historical spreads have changed significantly during the past 10 years. Some currency pairs may have had spreads at least 2 or three times bigger than their current values, making simulations difficult since it becomes very easy to create very profitable systems in the past assuming that the current spread levels were always constant. These problems greatly limit our ability to develop profitable systems for minors within reliable simulations something that makes their use much harder than that of forex majors. Additionally, spot FX data for many minors (even daily data) is only available from about 2002-2003, limiting our ability to carry out simulations to just the past 7 instead of the past almost 11 years, as it happens with majors.

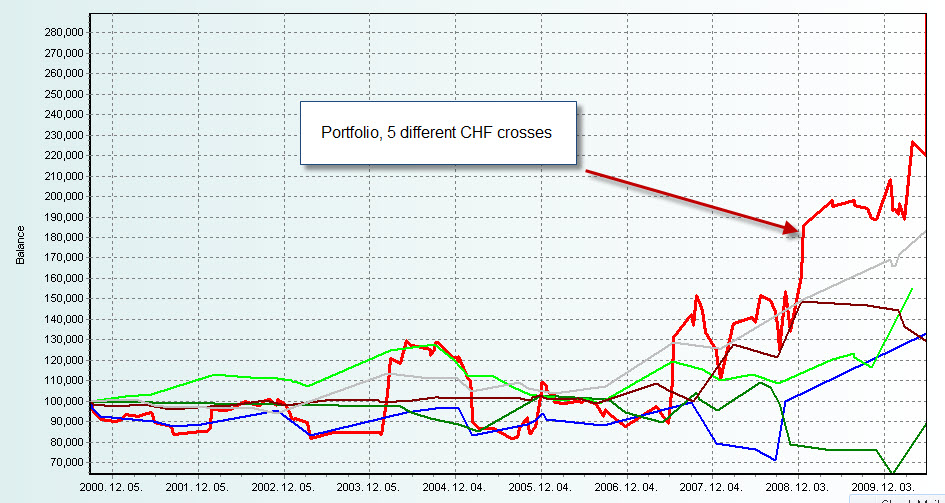

Should this mean that we should avoid developing systems for forex minors ? Definitely not, this merely means that we need to focus on developing systems which can tackle the above mentioned limitations without compromising their reliability. The easiest way to achieve this is to develop trading tactics that give reliable control point simulations so that we can use daily data to perform reliable simulations on minors without worrying about the integrity of data below this time frame. The use of the daily time frame and high profit/risk targets will also ensure that the contribution of the spread becomes minimal and historical variations of the spread can therefore be implemented as an assumption of a constant 2x spread for most minors. Below an example of a strategy evaluated on 5 CHF crosses using a strategy that gives ACCURATE control point simulations on the daily charts.

–

Of course, the above mentioned methods greatly limit our ability to simulate systems on forex minors to only systems on daily time frames that can be reliably simulated using the control points method but they allow us to at least develop a given type of system to trade forex minors. If we couple a system that trades minors with majors we potentially have a system to trade more than 20 different currency pairs, something that will provide us with a very important degree of diversification as the system would be “as universal as possible” on the forex market.

Definitely trading the forex minors with a given group of systems that give profit on individual pairs or on all of them is one of my goals for 2011, something I have already achieved with a certain degree of success on at least about 5 different minor currency pairs. In the following year starting to trade minors as well as JPY crosses much more will be one of Asirikuy’s main goals as it will allow us to diversify from systems that are heavily reliant on USD based currency pairs. Of course there are some very exciting developments going on which I will probably share with you within the next few weeks. That said I hope that one year from now we will have systems to trade at least each one of the currency pairs available within Alpari UK, potentially even CFDs and metals.

If you would like to learn more about my work in automated trading and how you too can develop your own mechanical trading strategies based on sound risk and profit targets please consider joining Asirikuy.com, a website filled with educational videos, trading systems, development and a sound, honest and transparent approach to automated trading in general . I hope you enjoyed this article ! :o)