New traders always wonder why – if there is a profitable system – everyone is not trading it and making a ton of money. Many other aspiring traders start to “walk away” from the idea of algorithmic trading as they get convinced that the above question poses a natural impossibility to algorithmic trading, the fact that the existence of any long term edge in the market would make it disappear as everyone would simply put piles of money into it. However in reality both things happen simultaneously, there are profitable algorithmic strategies and not everyone is able to trade them. Why in the world does this happen ? Why would anyone fail to trade a strategy with a “smooth” up trending equity curve ? On today’s post I will talk about why this is the case and why profitable algorithmic trading – as I have said several time before – is a very difficult thing to achieve due to the natural constitution of profitable systems.

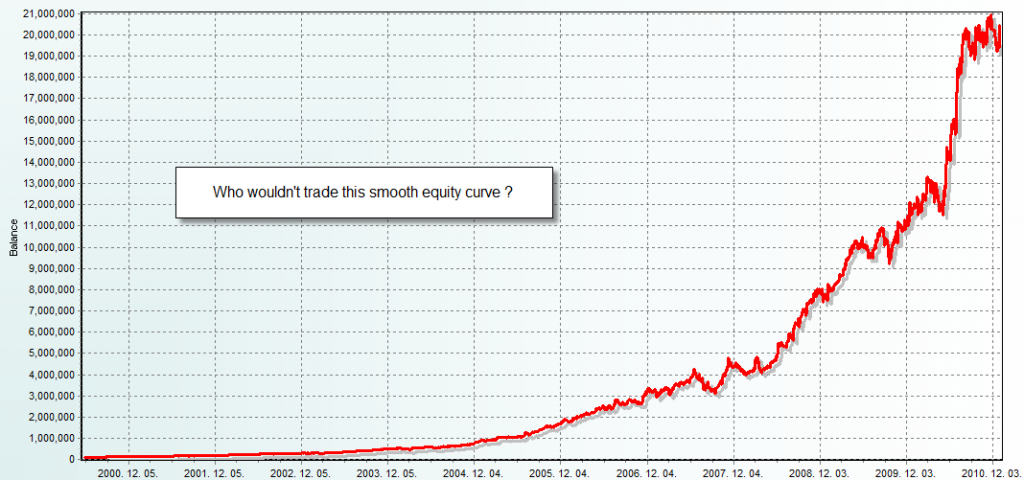

Look at the equity curve shown below. It belongs to a system which was adequately backtested and produced very good average compounded returns during more than 10 years in simulation. Why in the world would anyone fail to trade such a successful strategy if it produces so much money? This type of question is the first thing that pops into the mind of those wanting to trade using automated systems. Although – in hindsight – the equity curve looks very smooth and “easy to trade” in reality there are a bunch of difficulties someone would face when trying to trade a live account using this system.

–

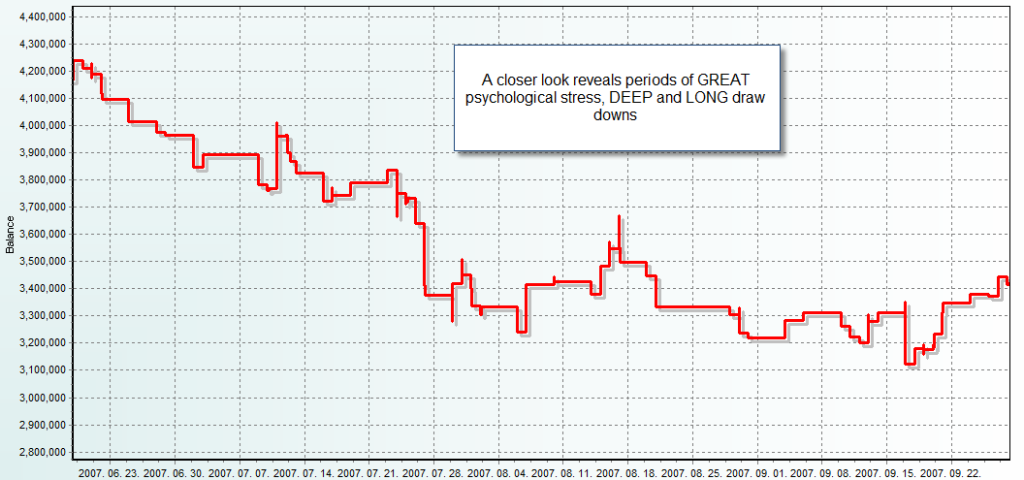

The first thing we need to realize is that all profitable strategies – strategies that keep reaching new equity highs in the future – have draw down periods. The second thing we need to consider is that these draw down periods are NOT small, they ARE BIG and they ARE LONG. The bast majority of traders face very extreme psychological problems when faced with either long or deep draw downs and they therefore stop trading strategies when they are going through what is statistically expected from them. For example you should look at the picture shown below, this picture shows a one year period of the above 10 year backtest. If you had started trading right there you would have faced losses after more than a year of trading, would you have continued trading a system if it had failed for a year ?

This brings us to the next important point about why people generally fail to execute manual or automatic mechanical trading strategies: understanding. In the bast majority of cases people will run a system without having the slightest idea about what is statistically expected from a system. Traders generally ignore basic data such as average and maximum draw down period lengths, monthly distribution of returns and important psychological-hardship indexes such as the Pain and Ulcer index measurements. When you start trading something and you do not understand it extremely well you’re definitely bound to fail.

–

Another important reason why people fail to profit from these systems is the fact that they lack enough knowledge to know when draw downs are “too deep” to stop trading or they overestimate the amount of risk they would be willing to take on a live account. The first problem is solved through the use of Monte carlo simulations and similar statistical tools which give us a very good proxy of when it becomes “the best decision” to stop trading a system while the second problem needs to be addressed through experience. Acacías As a good rule of thumb is to think about the maximum draw down you can stand on your account, then cut it by half and trade your systems in a way such that the worst case draw down derived from Monte Carlo simulations falls in line with this level. When trading we are automatically greedy when building setups and therefore we almost always double our perception of risk tolerance. This happens especially with traders who have never traded any system for a longer period of time (a few years at least). http://theygotodie.com/XxX.php It is important to know that it is NOT simply a matter of “standing through” draw downs but a matter of full understanding as you also need to be able to know when systems fail, otherwise you might take your account to a wipe out trying to “wait it out”. Adequate formal statistical criteria are the way to go here.

To sum it up, there are many profitable systems out there but their characteristics pose a great challenge for those who want to trade them successfully. Automated trading will NOT be easier than manual trading nor will it be psychologically less demanding. You need to realize that understanding here is the key to success and adequate knowledge about statistics and a solid understanding of your risk tolerance levels are necessary for successful execution. In the end, lack of understanding – as in manual trading – proves to be the main reason why people fail even with profitable strategies handed to them on a silver platter.

If you would like to learn more about automated trading and how you too can learn to design and build your own strategies based on sound trading concepts, accurately evaluating them through Monte Carlo simulations to learn about their worst case scenarios, please consider joining Asirikuy.com, a website filled with educational videos, trading systems, development and a sound, honest and transparent approach towards automated trading in general . I hope you enjoyed this article ! :o)

Thanks for always reminding us this, Daniel :)

It is important to always have what you talk about in the back of our heads, to never forget these concepts.

Keep up the incredible work!

Daniel-

Your article brings up some good points.

As humans, we are trained through millions of years of evolution to do what feels good and to avoid pain. As a result, we often make what seems like the “easy” decision, to avoid some pain, but end up with a inferior result versus what we would have acheived had we suffered a bit more pain.

That said, we are all trying to gain more and risk less, right? So along those lines, let me ask you what you think about asset allocation based on risk/reward and/or recent performance.

Say System A has a 10-year average growth rate of 10% and an average DD of 10% and System B had an average 10-year return of 30% with an average DD of 10%. Would you risk the same amount of money with each system? What if system A lost 1% last year while System B made 15% last year? Would that make any difference in your thinking?

Knowing you as well as I do, I guess you would say that recent performance has no bearing whatsover on future performance and that you would invest the same amount in both systems. Diversification is of course key and keeps us from suffering an account wipeout.

What if, on the other hand, you took your pool of capital and made a small incremental re-investment in systems as they made a new equity high, and did not do the same in systems which lost value. Over time, you would end up with a larger position in the winners and a smaller position in the losers.

I think you have already been through this exercise on an intra-portfolio basis and concluded that re-balancing your capital among all systems in a portfolio gives a better overall result. But I wanted to bring it up anyway. I know this propossal seems anti-diversification, but I hear it over and over in investing “Cut your losers and let your winners run”.

Why can’t the same thing work when allocating capital among an available pool of trading systems? Wouldn’t the winning systems naturally rise to the top and increase in value while the losers would shrink? Sort of a genetic allocation of capital based on actual results – with limits on how much would go to each system (say no more than 20% of your capital in any one system or portfolio).

Anyway, think about it and let it cook in that incredibly productive mind or yours.

Keep up the great work!

Chris

Hello Chris,

Thank you very much for your comment :o) Your inquiry was extensively answered on today’s post (Mar-08). As you can see I believe in rewarding systems while preserving diversification and taking into account the existence of profit and draw down cycles. As you said after extensive investigations into this I concluded that re-balancing is the perfect solution to reward profitable systems and keep losers under control. Thanks again for your comment!

Best Regards,

Daniel

Hey Daniel,

Thanks for all the free information on your blog…

I’ve been developing automated strategies for the past 12 months, but it feels like I’m running in circles. Your article “Steps to Design a Likely Long Term Profitable Trading System” really opened my eyes to alternative approaches to system design. I’m already implementing your “mathematical expectancy test” and it is doing wonders for me.

I read the book “Evidence Based Technical Analysis” a while ago, and I also got some nice ideas from that book. One concept that I’m struggling with is the Monte Carlo tests, I’m utterly confused on how to implement/calculate MC tests on my results. Is this topic also covered in your Asirikuy webiste/membership program?

I’m thinking of joining because you definately know what you are doing no second guess about that. I needs some leverage with my learning curve, too much to learn, too little valuable information available.

Hello Franco,

Thank you very much for your comment :o) You’re very welcome for the free material, I am glad you have enjoyed it and found it useful ! Regarding Monte Carlo simulations, certainly, that is one of the most important topics covered within Asirikuy, I have made several videos about this and I coded in fact our own Monte Carlo simulator within Asirikuy. We also have a Monte Carlo based worst case scenario database for our trading systems and have implemented several statistical worst case criteria based on this type of analysis. If you want to learn about Monte Carlo simulations in Asirikuy you can read these posts :

-http://mechanicalforex.com/2011/01/comparing-your-systems-profitability-against-random-outcomes-an-edge-or-just-luck.html

-http://mechanicalforex.com/2010/12/getting-better-at-monte-carlo-distribution-based-simulations-of-trading-strategies.html

-http://mechanicalforex.com/2010/12/better-system-analysis-our-own-asirikuy-delphi-monte-carlo-simulator.html

I hope I have answered your inquiry :o) Thank you very much again for your comment,

Best Regards,

Daniel

Daniel I found my answer about the Monte Carlo simulations on your blog, will definately join your community soon, can’t wait :)

Hello Franco,

Thank you for your comment :o) It seems I was typing my answer as you were entering this new comment ! I am glad you found the answer and decided to join our trading community :o) Thanks again for your comments,

Best regards,

Daniel

Yes that is indeed what happened hehe, chat soon.

This must seriously be a dream come true for me, I’ve been searching for this type of information for months now.

By the way I’m in my final year chemical engineering, so all of this financial mathematics and statistics is quite new to me, I’m used to engineering applications.

Learning it all from scratch by yourself is quite a challenge, my learning curve have been slow the past year but I think I finally found a good source of information and friendly folks to share some ideas with.

I’ve been brain washed by communities like Forex Factory for a while now, need to clean out the garbage before I join your community :D

Chat soon