I have written several posts in the past about the trade frequency of algorithmic trading systems which have showed my points of view regarding how a person should approach this subject. Through these posts I discussed aspects such as statistical relevance and increased problems due to broker dependency on trade frequency increases but lately – especially through August 2011 – I made several observations which have revealed a more intriguing aspect dealing with the trading frequency of a system that has nothing to do with simulation accuracy or statistical significance but with the inherent market exposure of systems which trade more frequently. Through this post I want to share with you some of my findings and why trading systems or portfolios with inherently higher trading frequencies are basically more vulnerable to sharper and more dangerous increases in their maximum draw downs.

Let us first begin by talking a little bit about what actually makes a system work. An algorithmic strategy delivers profit because it exploits a given market inefficiency which is fairly consistent through time. Draw down periods appear when such an inefficiency does not manifest itself but the fact that this efficiency shows more frequently than not – or if when it shows it is very significant – allows the strategy to accumulate profit with a positive statistical expectancy (the system has an edge). This simply means that a strategy works because the market is predictable beyond random chance by the system’s entry and exit mechanisms (the market is inefficient to some degree).

–

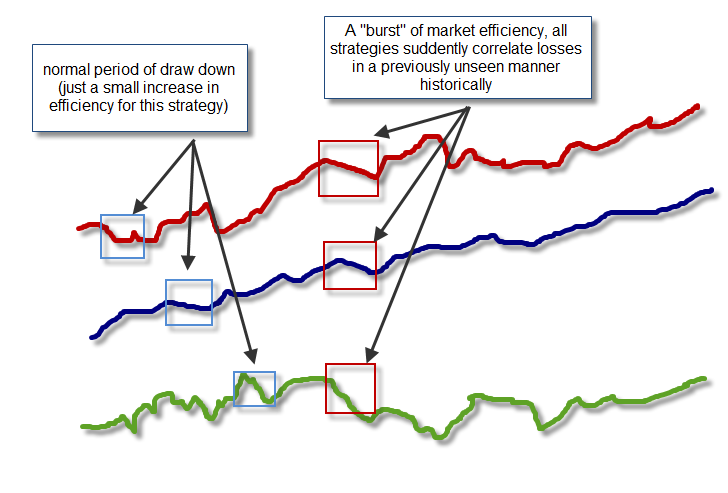

Now that we know what makes a strategy “tick” we must now think about what happens when the market suddenly becomes “more efficient”. Let us say – for example – that a strategy works because the market is inefficient about 40% of the time towards a given outcome but under a small time period, the market becomes much more efficient and the inefficiency now only presents itself on 5% of cases. This means that there is a very high chance that a trade taken within this period will yield a negative result. If you have a strategy that trades 15 times a week and another which trades 5 times a week and both have the same expectancy under these circumstances then the first strategy would lose 14 trades while the second one would lose only 4. If both strategies are risking the same per trade then the first strategy takes a hit which is three times larger. This doesn’t have anything to do with long term statistics but purely with the fact that periods which exhibit “bursts” of market efficiency affect strategies which trade more much more significantly.

When you trade portfolios you have a very similar effect. Since all systems depend on the market being inefficient in order to produce profit, periods in which market efficiency is increased are bound to affect a large amount of strategies as the market being “more random” has a net negative effect because overall predictability is bound to be reduced. What we get is that a portfolio that trades 50 times pair week will be hit by such a period in a potentially much bigger way than a portfolio that trades with a similar expectancy but only 5 times per week. In essence what we have is a reproduction of what we see with single systems as bursts of market efficiency are bound to cause system correlations that go beyond the historically predicted results.

In essence what we’re talking about here is market exposure. A strategy or portfolio which trades more frequently is bound get much worse draw down results as a consequence of periods which produce losses for “all” systems. When market efficiency becomes much more prominent we’re bound to see losses which are far greater for frequently trading portfolios than for less frequently trading portfolios with the same risk levels. Does this mean that we should quit using large portfolios or that we should consider not using systems that trade too frequently ? No this simply means that we should take into account exposure as a part of our risk analysis when deciding to trade a given system or portfolio, this analysis would then allow us to decrease our risk in order to control the exposure scenario as well as the draw down scenarios derived from historical analysis.

What the above means is that you should consider the trading frequency of a system and what might happen if a burst of market efficiency causes your system to give you the worst possible result for a short period of time equal to the largest historical “efficiency” burst. From the historical analysis I have carried out, bursts of market efficiency – which I considered as periods were a large amount of Asirikuy systems have showed correlated losses in the past – have lasted for 5 weeks at the very most so you should consider what would happen if after 4 weeks of trading 80% of your trades gave the worst possible results. For example if a system takes an average of 5 trades per week and the average loss per trade is 2% – on your chosen risk level – you would then have a theoretical exposure of 2%*4*4 or 32% of draw down from a “burst” of market efficiency. If this value is too high for your risk aversion you could then consider reducing either trading frequency or risk in order to have a result more in line with your risk tolerance.

You can see how this approach does not imply that you will not trade large portfolios or strategies that trade frequently but it merely implies that you will trade at a risk which will procure a market exposure in line with your risk aversion level. The above also explains quite well why portfolios that have very large compositions and very high historical average compounded yearly profit to maximum draw down ratios tend to fail – reach their Monte Carlo worst case scenario – with such a high probability. The problem seems to be that such large portfolios have an inherently extremely high exposure to bursts in market efficiency and therefore they eventually become prey of large bursts in correlation that end up causing enough draw down to hit their worst case historical statistical scenarios.

–

–

Of course the above analysis is certainly not written in stone and we can probably improve it in order to have better estimates of market exposure. However the above calculation does provide traders with a simple way in which to evaluate the potential exposure to “bursts” in market efficiency in order to reduce risk in a way which deems the possibility of a catastrophic scenario due to such an event much smaller. Certainly after analysing systems and portfolios in this way it becomes evident that trading frequency should not only be analysed from a “statistical significance” perspective as a higher trading frequency inherently carries a higher market exposure which can – in itself – cause systems to become inherently unsafe as the market tends to show “bursts” of efficiency towards any strategy at some eventual point in the future. Considering exposure is therefore not a matter of historical analysis but an exercise that assumes the market will eventually show us some period of “high efficiency” towards the inefficiency we’re trying to exploit. Assuming that the market will never show a “burst” of efficiency towards your trading system or portfolio is a very dangerous assumption that could lead to important risk underestimations. apoplectically The important thing here is to realize that such bursts of correlation are ALWAYS possible even though they might have never showed up in historical testing.

Considering this analysis we will be able to improve our system and portfolio analysis skills at Asirikuy, making portfolio building much more robust to bursts in market efficiencies that may appear in the future. If you would like to learn more about automated trading through knowledge and understanding please consider joining Asirikuy.com, a website filled with educational videos, trading systems, development and a sound, honest and transparent approach towards automated trading in general . I hope you enjoyed this article ! :o)

Hi Daniel,

You are a brave man my friend. I know how it can be difficult to move from even one city to another. But, you are moving intercontinental, even then you are answering all forum posts and on top of it, today I saw this blog post. Thanks for all this effort. I know you will be very successful in your PhD, too. Wellcome to Europe.

Regards,

Caner

Hi Daniel,

very interesting article, thanks to you for it! I hope all is going well for you :)

The conclusion to this article is that “we will be able to improve our system and portfolio analysis skills at Asirikuy, making portfolio building much more robust to bursts in market efficiencies that may appear in the future”

Would you have some examples as how we will be able to apply the knowledge in this article concretely within our Asirikuy tools for analysing different portfolio strategies?

Thanks again and wish you all the best!

Hi again,

I think, in addition to trading frequency, reward to risk ratio of systems is also very important to overcome this efficient market periods. Portfolios consist of systems that have higher reward to risk ratios can deal with this type of periods in a much better way.

Caner

Hi Bruno,

Thank you for your post :o) I think the best way is to implement this directly in the profit & draw down analysis tool as well as ADA so that users can analyse the results right away and take a look at what the market exposure is for their intended single system or portfolio. This way Asirikuy members will be able to compare the potential danger their portfolio faces on highly efficient short market periods. Thanks again for your post Bruno!

Best Regards,

Daniel

Hi Daniel,

another approach addressing this problem would be to limit the number of trades per time to a certain value. With a symmetrical TP/SL the punishment because of losses is higher than the reward if you look at the compounded returns. Although this approach will cost you some profits, the overall balance should profit from it. It would also make calculations and portfolio design much more reliable.

Best regards,

Fd

Hi Caner,

Thank you for your posts :o) Definitely I try to do as much work as I can, Asirikuy is definitely a top priority for me even with this whole “move to Europe” thing so close! If everything goes well I will be all settled and ready-to-go by the end of September so I will be able to resume my previous level of activity. Also thanks a lot for your good wishes, I will certainly try to do my best on both my PhD and Asirikuy :o)

About the risk to reward issue, you’re right in that risk to reward helped in August but this is not always the case as this does not intrinsically remove exposure. For example a system like Sunqu can get very bad results under an efficient market even if its reward to risk ratio is through the roof. You cannot simply draw conclusions from the systems that had a bad August as this group just happened to be the one that “got it” this time. There will certainly be a period of highly correlated efficiency for all systems which haven’t suffered it yet (just a matter of “when”). What happened this time is that high reward to risk ratio systems tended to trade less under these market conditions (this is what protected them this time). Thanks again for posting,

Best Regards,

Daniel

Hello Daniel,

I think that a very useful parameter in this sense in the ulcer index. When we compose a portfolio, we have to take it in big consideration, not only other parameters as the DD and the risk/reward ratio. Portfolios with low ulcer index behaved much better in july-august when the market was more efficient and random probably because of the low liquidity in the market.

Regards.

Hi Maurizio,

I don’t agree with you. Ulcer index takes into account the whole period of backtest, not these type of market conditions. For ex. sumaq portfolio have a very high ulcer index, but strategy of sumaq can behave very well in efficient market periods. My portfolio (atinalla 4 sm + coatl) have a lower ulcer index than atinalla 3 sm, but my drawdown is 30% since middle of july.

Caner

Hi Maurizio,

Thank you for posting :o) I agree with Caner in that the Ulcer Index has nothing to do with this. Please remember that this measurement (exposure) is NOT related with historical results. A system can have an efficiency spike which causes very large losses even if its historical Ulcer Index is very low. This is why this calculation is so valuable because it provides a measure of risk which is not intrinsically related to historical results but only with the risk per trade and the trading frequency. I hope this helps!

Best Regards,

Daniel

Thanks for the excellent article as always :) We also also remember that the opposite (profitable spikes) are also possible, but yes that does not mean anything if the negative ones wipe out our entire account.

Hi, I understand your comments. So it will be very useful fo find a kind of “correlation index” of a portfolio to complete the already available pain and ulcer indeces in the profit/DD tool. Do you think it would possible to find anything in this sense? Meanwhile it would be judicious to trade portfolios with low max risk/trade as account%. I think this could help to avoid big correlated losses, toghether with few and clever combined systems instances in our portfolios.

Kind regards.

Maurizio

Hi Maurizio,

Thank you for your post :o) I believe a “correlation index” makes little sense because it also relies on historical correlation results (if you mean to calculate historical correlations). The idea of measuring market exposure is to estimate the potential effect of a period of max market efficiency which causes a very high correlation which may have never happened within the backtests. You can follow the calculation mentioned within the article to get an estimate of your exposure measure for any system or portfolio. Note here that we cannot avoid correlated losses – as they are bound to happen eventually – but we can simply diminish the risk per trade and/or the trading frequency so that the effect of such periods is considered. I hope this clears it up :o)

Best Regards,

Daniel

Glad you reached to same conclusion ;-).

I proposed a month ago in the forum to use the number of trades per week as a proxy of portfolio risk, in particular max DD for portfolios = NumberWeeks_DD*Number_trades_per_week (for 1% of average loss). According to the discussion with another member in the forum looks like the average loss in lousy periods is larger than the historic percentage of average lose. Now, according to your analysis we can put NumberWeeks_DD=5, then a back of the envelope conservative equation for the maximum DD expected in a portfolio is:

1.5*percentage_average_loss_per_trade*5*Number_trades_per_week

the factor 1.5 is a bit arbitrary, but in any case should be > 1.

Best