If you have been exposed to Forex trading for a while you might already know websites like Zulutrade and eToro that allow you to leave trading in the hands of hopefully more professional traders so that you can make money without having to learn how to trade. From an initial perspective it looks like a potential win-win for everyone and a pure gold mine for retail traders looking for scarce but existent talent within the trader pool. Definitely someone out there should be able to carry out the rags to riches dream and then a ton of retail traders can pile on as this person benefits from commissions, turning his or her road to riches into an even shorter one. However we’ll wee today why this dream will probably never come true and why social trading – especially in the Forex market – might simply never work as most retail traders expect it to.

–

–

If you haven’t read my previous articles on social trading I invite you to read this and this article where I explain some of the basics behind social trading, including the many dangers that it poses to retail traders. Today however I want to take a general look at why this model is inherently flawed and why it will never be the treasure cove that many traders do hope it to be. But what could be wrong with such an easy-to-understand and brilliant idea? What could be wrong about giving traders the opportunity to trade and the opportunity to manage other trader’s money? What is wrong with letting retail traders simply choose whoever they deem better fit to manage their money?

The problems are several and deeply entrenched within the soul of the social trading model and human nature. Let us consider how a retail trader in the Forex world behaves. Normally a person goes into Forex trading with the hopes of becoming rich quickly, then after hitting wall after wall in live trading and emptying potentially a few live accounts they then run into the promise of social trading websites with the hope to simply let someone else – who has achieved what they want – manage their capital. They then search for the top performers in terms of returns and give them their money, which is lost time after time after time. From Zulutrade statistics you can already see how traders older than 2 years who are profitable are merely a handful (less than 20) from the thousands of accounts that Zulutrade has had during this time. Top performers don’t last more than a few months – often less than a few weeks – and traders are often faced with worse results than what they see on the platform and extremely high risk that often goes unchecked.

–

–

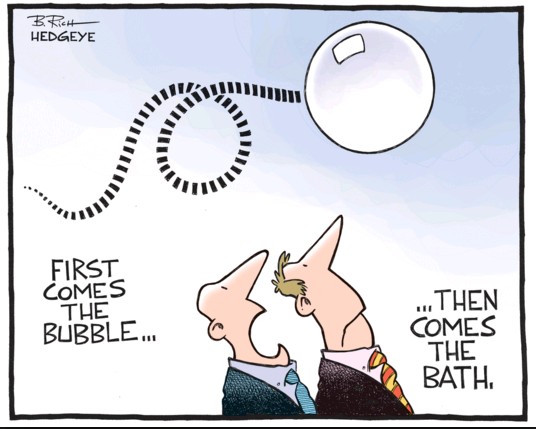

This is a consequence of customer expectations. People are not looking for someone who is a reputable money manager with long term experience and can exercise adequate risk controls, people are always looking for the extraordinary trader who can turn a nickel into a million in the blink of an eye. When you couple this with high risk and luck in the short term you can have some traders who do look like the holy grail. You can have traders with returns in the thousands of percents every month and you will see retail traders flooding them with money so that they can help them achieve the same return. This is because of a general lack of knowledge about the market and the inherent relationship between risk, return and probability. Any experienced trader who sees a ten thousand percent return in a few months will tell you that the risk of total loss must be extremely high, it is just what it is, great returns are tied to great risks. It is also true that such extreme returns under extreme risk are possible, this is simply because there is a possibility for this to happen within the available probabilities. However it is not reproducible and it is not long lasting. There is no “guru” that can escape from these relationships.

After this you then see a complete wiping out of accounts, retail traders disenchanted with the dream of social trading and a return to the drawing board to pick hopefully a better trader who “this time” can indeed produce what they showed within their early live performance. For most retail traders who go into social trading it then becomes a very frustrating journey due to the amount of work and the constant disappointment from different signal providers. It is further complicated by the real moments of glory and achievement when a provider does show abnormally high returns during a short period of time, it is here when I get messages telling me that I am wrong and that this or that other guy can indeed produce the dream. But all of them eventually fail with dramatic wipe-outs and the wheel of top performers continues its natural spin.

Social trading could potentially work if there was a time filter tied to a risk adjusted return filter. If only traders with more than a 2 year track record with an equity Sharpe above 1 and an equity R² above 0.9 could offer accounts then things would be much safer. They would also be much more boring. Tactics like risking a lot during the first several months to gain a foothold by chance and then lowering risk won’t work if you’re subjected to Sharpe and R² filter. After two years high risk takers would find it almost impossible to get to the list since they would have an extremely low probability to survive for this long maintaining those risk adjusted return statistics and those traders who were able to survive would indeed have to have adequate risk controls with adequate risk management that would make their returns quite boring. A retail trader who is looking to turn a 1K USD account into a million would yawn at the 20-40% yearly average long term returns that you are likely to see if such a service really existed.

–

–

There is a good reason why there are no mandatory time filters nor risk adjusted return measurements on these websites. There are also good reasons why traders are ranked from the start according to their performance and not in terms of risk adjusted returns. These reasons are all related to what people expect to see – the guru trader who can bring home the jackpot – and what generates the most money for the social trading business (which works on volume based commissions, a direct conflict of interest with traders). A “boring” website with professional money managers that have 5-10 years of experience in management who can consistently bring bread home at a controlled risk is much less exiting that the crazy uncle who drops by with a giant cake once every year (only to trash your home and leave you much worse than you were before). It is also extremely probable that all managers with these track record will find it highly unappealing to work under these conditions instead of the high net worth clients that they are normally going to get managing to achieve an average “boring” 20% a year with controlled risk.

Since the expectations of retail traders will not change and the most profitable and probably easiest way to conduct business for these websites is the current one I don’t see how social trading will evolve to anything beyond what it currently is. As I have said it before, social trading in its present form is a death trap for new traders. If you would like to learn more about how you too can become a retail algorithmic Forex trader building your own trading strategies with sound principles and adequate risk control please consider joining Asirikuy.com, a website filled with educational videos, trading systems, development and a sound, honest and transparent approach towards automated trading.