On one of my recent posts I mentioned the recent trends in google searches for Forex trading and the important rise that “social trading” has had during the past few years. As retail traders realize that profitable Forex trading is much harder than they initially thought, the market moves towards solutions in which the trading responsibility is delegated to what is perceived as “more efficient” parties. Since the high liquidity in the FX market allows for a large degree of decentralization (especially at the retail level), the crusade to learn how to trade profitably becomes mute in the presence of already profitable traders who can be copied. However a selection problem then arises for the retail trader in which top traders need to be selected and traded to achieve a significant level of success. On today’s post I want to share with you what I have learned from studying top performers and why social trading can be such an unsuccessful endeavor for the average retail trader.

–

–

You are average Joe Forex, a new retail Forex trader. You know how to open and fund an account – you wiped a few mini accounts trading manually yourself – but you know that a lot of money can be made in FX trading (one of your now wiped accounts was at some point above a 500% profit!) so you have now decided that you don’t want to trade the money yourself but you want to let someone who already “knows how” to trade it for you. You then go into social trading website (from which eToro and Zulutrade are probably the most popular) and try to find the “best trader” out there.

Traders like Joe Forex make trader selections in a very naive manner. Sound investment managers, especially on forex trading platforms uk, generally pick up investments over an assessment of risk adjusted returns over a significant period of time with the objective to minimize investment volatility and increase average returns at the same time. Analyzing an investment also requires a risk assessment that is above historical performance measurements, a trading methodology – like a martingale for example – can guarantee total loss of capital in the long term while having very “decent” performance statistics. Things like grids and strategies with absurd reward to risk ratios (like having a TP of 5 pips with an SL of 500) can have a very similar long term effect.

However Forex retail traders generally have precarious knowledge about proper risk assessment tactics and more often than not make selections based exclusively on annualized ROI statistics. Since these investments are generally of low quantity (smaller than 10 thousand dollars in most cases) traders treat this money in a very liberal manner and allow the prospect of total loss of capital to seem meager in comparison to the potential returns on this capital. Indeed an unsustainable method to manage capital that is fueled by grid and almost always ends up in a very large or total loss of investment capital.

–

–

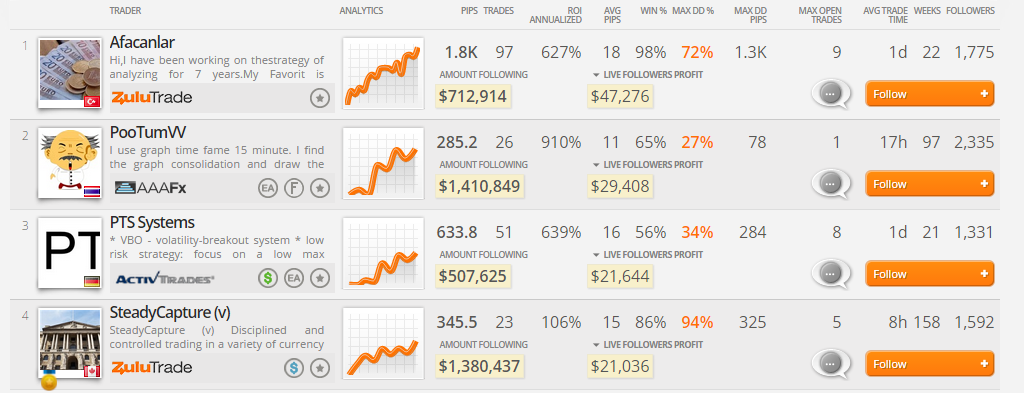

We can get a much clearer picture by looking at Zulutrade top traders. If you analyse the first graph within this post you will see that the overall ROI based ranking provided by the website does not make any account for risk adjusted returns. The top 4 investment has a ROI of 106% with a maximum drawdown ratio of 94%. Who in their right mind would trade with the expectation of a 100% yearly return if the risk is close to 100% ? However if you look closer at traders with top funding at Zulutrade, something immediately pops into the picture. There is a very strong driver to selection besides the ROI.

If you want to get anyone to follow you at Zulutrade it immediately becomes evident that what you need – above almost anything else – is a very high winning percentage. All traders who have any significant following have a winning percentage above 50% while almost all of the ones that have substantial followings have a winning percentage above 80%. Why is this the case? Well, Joe Forex hates to see losing trades in his account and the psychological advantage of having strategies with very large winning trade percentages gives Joe Forex the confidence that this trader really “knows what he is doing”. How can a person who wins 95% of the time be a bad investment?

Sadly almost all commonly used unsound investment tactics have very high winning percentages because it is precisely this fact what makes them so appealing to inexperienced investors. The reason why this happens is related mainly with delaying the closing of losing positions until they can be closed profitably. A loss is not a loss until you close it, so you can hang onto losers as long as necessary to preserve a large winning ratio such that your users can rest assured that almost all of their positions will have a happy ending. The problem is that for these strategies when happy endings don’t come, very bad things happen, which often leads to a blowup of the account. If sites like Zulutrade did any decent job of selecting traders and helping retail traders follow truly reliable traders with sound risk evaluations you would have top traders with years of investment experience under their belt, while what you most commonly find is top traders with weeks/months of trading record.

–

–

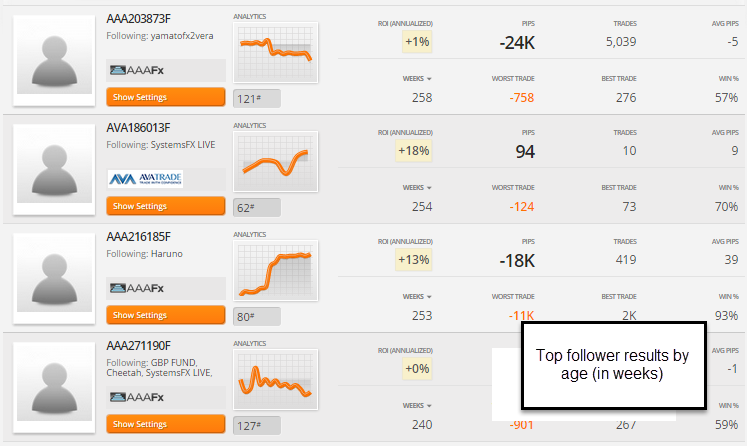

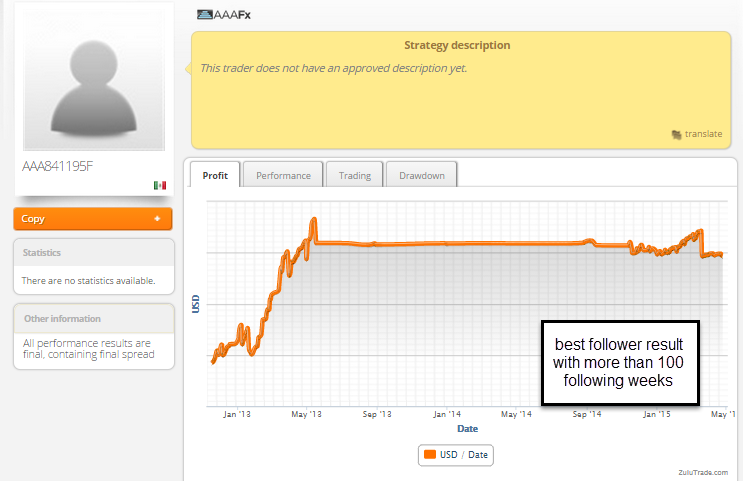

How retail trader selection fails is also evident within the website’s “Follower” statistics. If you look at how followers actually do (second picture) you will find that almost all followers with more than 100 weeks of following experience who are positive have less than a 20% return. The best follower you find with a more than 100 week trackrecord – with an 88% gain (third picture) – made this gain during an initial short period (first 20 weeks) and then stayed dormant for several years before restarting trading (potentially following another trader). It is evident that follower success is very small, much smaller than what you would expect from the seemingly stupendous statistics that the top traders show on the initial pages. infinitesimally From the huge user base and the very small and shy follower statistics one is tempted to conclude that most followers end up with losses.

My hopes for social trading in FX are not too great. Generally retail traders in FX are most commonly looking for very large returns that can only be obtained with the use of very high risk strategies (that inevitably end up in account wipeouts) this combination provides a self-reinforcing cycle where traders select strategies that seem to be “holy grails” which then collapse and lead the way to the next round of “great systems”. Overall this is a very good way to make money from trading volume commissions (the Zulutrader model) but a very poor model for stable capital returns in the medium/long term (what a true investor is looking for).

When looking at wider models like those of eToro (which includes stocks and commodities) the panorama is better but still very poor. You can see the meager returns of top selections as evaluated by a recent MIT study. http://artedgeek.com/blog/wp-admin/includes/ In the end it does not pay to be social (at least yet), at least not more than the SPY buy-and-hold from a risk adjusted perspective. If you want to learn more about my trading philosophy and how we create and evaluate trading strategies please consider joining Asirikuy.com, a website filled with educational videos, trading systems, development and a sound, honest and transparent approach towards automated trading.