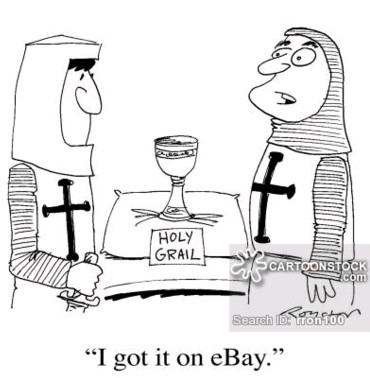

When talking to retail traders interested in automated trading you usually find out that they are all following a similar quest: the quest for a proven trading strategy. Some people try to pursue this venture by coding it themselves while others spend days, months or even years searching to buy or rent a strategy that has enough proof to be considered proven and worthy of being traded. However they fail to see a very important fact, there really is no proven trading strategy and no way in which a proven trading strategy can ever be realized. On today’s blog post I want to explain why this is the case and why the quest for a holy grail in algorithmic trading is fundamentally flawed. I will go through the steps that retail traders generally pursue and why their journey tends to end in more disappointment than success.

–

–

Well, it certainly makes sense to want to trade something that “works”. People who search for automated trading strategies want to find or code a strategy that makes money and there is nothing wrong in wanting to see live trading results before you commit money to one algorithm. However once an algorithm that “looks good” is found the journey tends to end in tears as these traders discover that the algorithm they so much believed in was not really “proven” and that in reality the algorithm destroyed their accounts or performed much worse than they expected. The problem comes from a fundamental misunderstanding of what past trading evidence can say and what it definitely cannot, a problem that generates a vicious cycle in which algorithms are sought, traded and discarded without achieving a positive result. What is so wrong here?

The problem is fundamentally associated with the notion of what constitutes an algorithm that “works”. For most people who are not professional traders an algorithm that works is a system that has made money in the past and will continue to make money into the future without ever stopping. Yes, the algorithm might go into a drawdown or two but in the medium term the expectation is to always be on the profitable side and anything less than that means complete failure and a need to start the search from square one in order to find an algorithm that can fulfill the role. This is why many people start believing that algorithmic trading does not work, because such an algorithm does not exist. As time passes the quest becomes more frustrating and everything that is found seems to fail after some time, regardless of the efforts made to avoid this.

–

–

The reason why you cannot find such a strategy is that future market conditions are potentially infinite while any algorithm you can come up with that has been historically profitable cannot survive all possible market variations. No matter how hard you search for there will never be an algorithm for which the probability of failure is zero, there is always a possible set of market conditions that will cause an algorithm to fail. An algorithm may have traded profitably for 2, 3, 5 or 10 years and it may still fail next month. Granted there are things that can be done to reduce this probability but the fact that an algorithm has a profitable track record is no proof that the algorithm will keep that track record going forward, the probability of failure is never going to be zero. There is very good reason why the NFA uses the phrase “past performance does not guarantee future results” because as hard as it sounds that is the reality of the matter.

If you think about it all the above makes perfect sense as it’s the way in which the market is expected to naturally evolve if there is a systematic and massive attempt to exploit the inefficiencies within it. If there was a “set and forget” strategy that would always make money it would in no time become extremely famous and massive volumes would be poured into exploiting such an inefficiency however once volume within an inefficiency is exhausted or its exploitation becomes evident to others the market becomes efficient to it and the inefficiency ceases to exist, the strategy fails. The reason why there is no strategy that can work indefinitely as an ATM is precisely because of the mere consequences of its use. The market is generated by the people who trade it and trading to exploit inefficiencies removes them from the market.

–

–

Jatiroto However the fact that you can never find a “proven” strategy does not mean that you cannot try to trade profitably, it only makes it much more difficult to do so. This is after all expected and answers the question of why if automated trading works everyone is not a billionaire. If all systems are expected to eventually fail and the market eventually becomes impervious to all inefficiencies within it then the biggest weapons against this are constant strategy generation and portfolio trading. What you would want to do is to ensure you don’t exploit one but a massive amount of inefficiencies at the same time and make sure that you have a capacity to constantly find new inefficiencies as the market evolves and some of the strategies you had designed stop working. Long term profitable trading is conceivably much more likely in this manner as strategy failure is not fatal to the trader who is able to constantly come up with new systems. This of course makes things much harder as only a handful of traders will be able to carry this out and keep this up.

The way in which we have approached this problem up until now has been with very large system portfolios (using thousands of systems) and GPU based system mining to search for and find large amounts of inefficiencies within the market. If you would like to learn more about our technology and how you too can mine for trading strategies to have constantly renewed portfolios please consider joining Asirikuy.com, a website filled with educational videos, trading systems, development and a sound, honest and transparent approach towards automated trading.strategies

Hi,

I didn’t find your email address on this site, so please excuse that my comment is not fully related to this very article. However, I’m a frequent visitor of your blog, since machine learning is a main part of my daily research as well. Unfortunately, as you’ve written several times, stock market prediction is not an easy topic at all.

Long story short, here’s my question :)

I’ve been working on a system for time series prediction for a few months now and it has finally come to a point where everything is running nicely. Here maybe a short overview what it does: for a given window size after normalization, it computes wavelet coefficients, applies pca whitening, constructs a code book of basis-shapes within this window and re-expresses chart patterns by means of those basis-shapes. This re-expression (in form of a histogram) is then used for classification. All of this is done over different scales of the input sequence to achieve some kind of scaling-invariance.

However, it’s really hard to actually evaluate how this system performs, as I have no cross-validation benchmarking results of other methods using stock market data. Since your methods show impressive results I was hoping you could point me to a dataset and some numbers I can compare with. All papers I’ve read are very vague regarding test conditions.

I appreciate any hint or advice.

Thanks and best regards!

Thomas