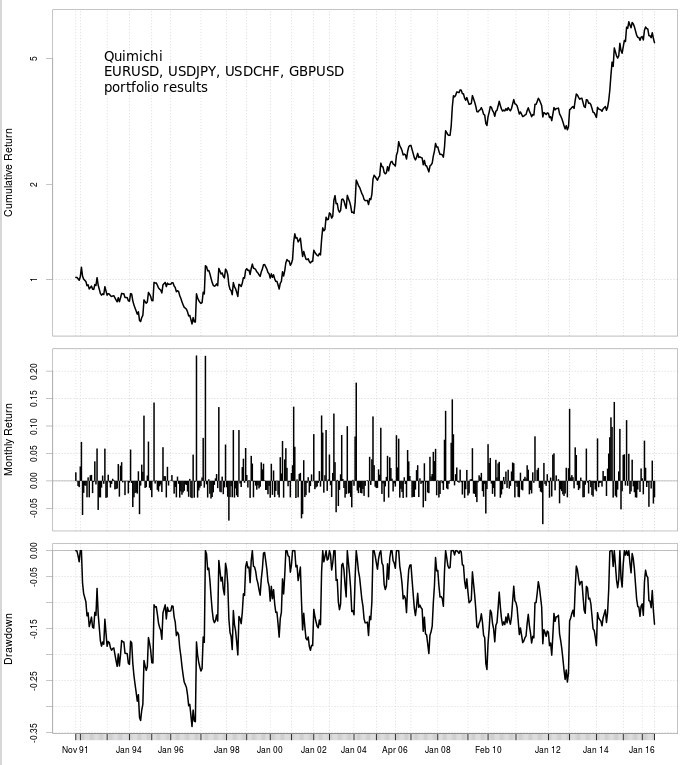

When we started coding systems at Asirikuy nearly 7 years ago we wanted to include strategies within our repository that were able to exploit long term trends in the daily timeframe, just as the turtle trading system did in the 70s and 80s. One of the systems that I liked the most back then – which is called Quimichi – was designed to do exactly this in Forex symbols. The strategy was developed and optimized across the 4 majors using the exact same parameters to trade all of them and was traded live by us from 2010 to 2013. In today’s post I want to talk about this trading strategy and the trading results it has had since we last changed the implementation in early 2012. I will talk about how the system has performed and why it still remains a long term profitable yet tremendously difficult strategy to trade.

–

–

When I studied the turtle trading strategy back in 2010 I believed that such strategies had a lot of trading potential in Forex trading although it was clear to me back then that the main drawback of this type of strategies was their huge drawdown period length, which you had to endure if you wanted to reap the benefits of long term trend following. I believed I could improve on the results of the turtle trading system through the 2000-2010 period in FX and I therefore came up with the Quimichi trading strategy which is also a highest high, lowest low breakout type system that implements some very simple criteria for entering and exit trades on the daily timeframe.

From the start in 2010 we only saw losses when trading this strategy. We traded the strategy in live accounts from early 2011 to 2013 and through this time we saw nothing but a drawdown that didn’t seem to stop. As you can see in the balance curve above for the Quimichi portfolio trading the EUR/USD, USD/JPY, GBP/USD and USD/CHF – at a 3% risk per trade – this period was marked by a sustained string of losses that actually didn’t stop till 2014-2015. We honestly did not have the patience to trade the strategy long enough to exit this drawdown period, which proves how hard it can be to trade this sort of trend following system. I can tell you what it can feel like to look at an account and only see losses after 3 years and you honestly want to stop trading because it seems that you’re trading something that will never profit.

–

–

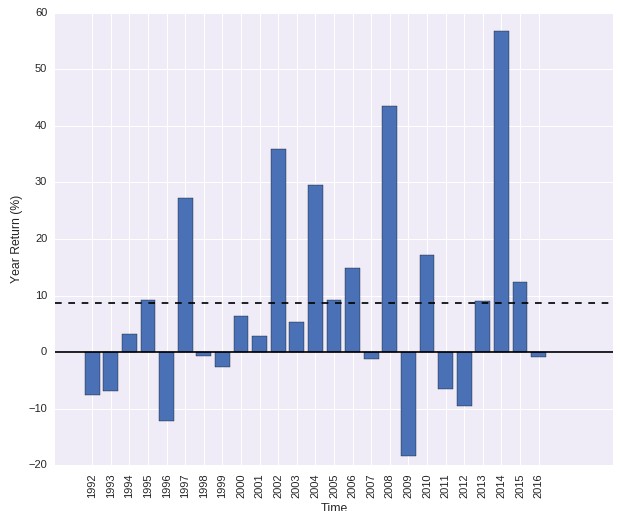

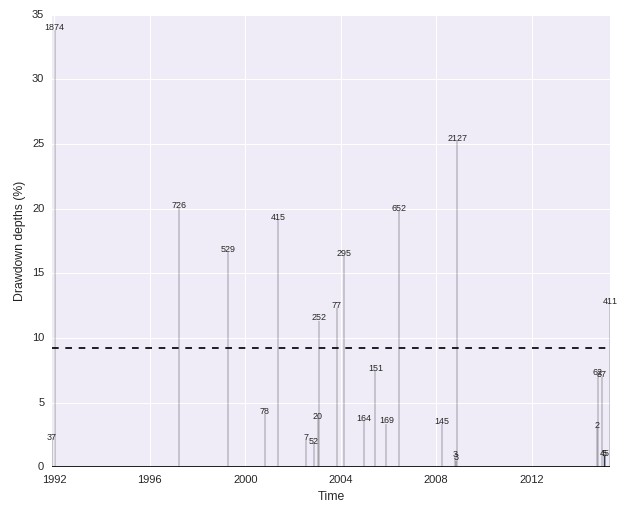

The above yearly return plot shows how agonizing this can be. In 2009 the strategy took a loss that did not fully recover in 2010 and then losses continued through 2011, 2012 and most of 2013, only to recover the drawdown partially during the end of this year. Then in 2014 you had amazing returns in the order of 60% that continued through most of 2015. As with most trend following strategies there are really amazing profit opportunities that happen around once or twice every decade when the strategy really shines through. The longest drawdown length of this sort of strategy is no joke with the biggest drawdown period length at 2127 days which went from 2009 to 2014.

Trend followers in futures and Forex are the sort of sure-thing that no one seems to be willing to get into. Long term trend followers like this rely on the existence of long term momentum in the markets which – although it almost never happens – when it happens it does generate very substantial returns. It is a space that almost never gets crowded because these huge returns are spaced in such a way that trading them constitutes a marathon that almost no trader is willing to get into. Almost no trader has the stamina to stay in a trading strategy for 4 years of losses waiting for something to happen. Most traders, especially retail Forex traders which are commonly very impatient, would through the towel long before that.

–

–

Many people try to trade this sort of strategy and most fail to do so. You might be lucky – as I certainly was – getting into trend followers right before a very strong market move that pays off dramatically (as I did in 2008) but the most probable scenario is that you will get into them within a drawdown period that may last anywhere from 1000 to 2500 days. Do you have the patience to take losses for 2500 days? I certainly did not have it. These results prove that there was nothing wrong with the ideas and logic behind Quimichi, we were just not patient enough to trade it. In any case if you would like to learn more about this type of strategy and how we have improved our strategy design procedures since then please consider joining Asirikuy.com, a website filled with educational videos, trading systems, development and a sound, honest and transparent approach towards automated trading.strategies.

Hi Daniel,

To what degree would you expect portfolio diversification will improve on those draw down statistics? The trading strategy appears to be universal in that it may potentially work across many instruments and time frames. Perhaps by expanding the universe of instruments (e.g. more FX pairs, stocks/bonds/commodities) it may be possible to capture one of those “mega-trends” more frequently and hence shorten draw down periods?

IMHO it seems like unless there is a fundamental reason why trends tend to happen at the same time in different markets, diversification can only lead to improved risk adjusted returns.

Andrew

Hi Andrew,

Thanks for writing. Per my experience the point is precisely that trending periods do correlate across markets to a good extent. Of course I have never done a very significant effort to back-test across a very wide range of instruments but the few intra-market tests I have done have showed this to be the case. Of course if you test the strategy and find otherwise it would be great to know. Thanks again for writing,

Best Regards,

Daniel