There has always been a question in Forex trading system development which pertains to whether strategies should be symmetric or asymmetric. Is there any harm in developing long-only or short-only strategies? Should strategies always use the same logic for longs and shorts? Five years ago I wrote a post about asymmetric trading strategy building, today I want to revisit this topic with the experience I have gained through these five years to show you how my understanding about symmetry in trading has changed. I will talk about the advantages and disadvantages of using different types of symmetry within Forex trading strategies so that you can make an informed decision about whether you should use one or another type of trading strategy within your own trading.

–

–

The Forex market is quite particular because it is one of the only markets where longs and shorts can be taken within the same rules and with virtually the same costs (ignoring swaps for the moment). Since – unlike in stocks – there are no special rules or requirements for shorting a pair vs going long it makes sense to assume that a trading system developed to trade them should use the same set of rules to address both directions. If the EUR/USD goes up after a given chain of events then an opposite chain of events would be expected to cause the exact opposite behavior. As a matter of fact we an find large varieties of trading rules that can work under these conditions, where systems stop-and-reverse on opposite signals and always obey the same patterns in both directions. Furthermore system exits are treated in the exact same manner and both longs and shorts use the same stops, take profits and trailing stop parameters.

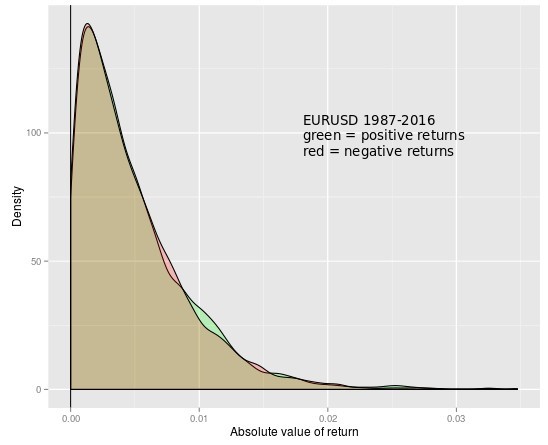

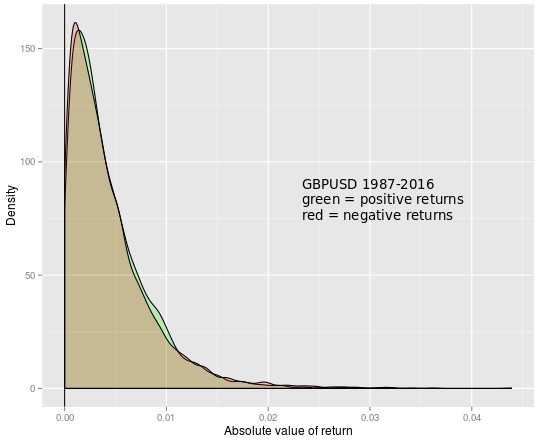

However an important point is that movements in either direction are not the same in all currency pairs. Although pairs like the EUR/USD show a high degree of symmetry (first image) others like the GBP/USD show some asymmetry in their distributions of returns (second image). The two distribution peaks, means and standard deviations show bigger differences in the GBPUSD compared with the EUR/USD. This asymmetry in the distribution of returns makes us think that the pair may not behave in the same way when it goes up than when it goes down. For those who trade it is no secret that USD favorable movements tend to happen much quicker than USD bearish movements, especially when this corresponds to risk-on behavior as sell-offs in stocks tend to happen rapidly. Even on symmetric pairs like the EUR/USD the tails of the return distributions tend to be skewed in favor of one side over the other.

–

–

So we should use asymmetric strategies right? Well not so quickly. The main problem with asymmetry is in essence that it carries with it a great increase in the mining bias of the process. The reason is that the potential for spurious profit increases exponentially since the strategy can just be benefiting from a long term bias in a pair and not due to an inefficiency. If you have a pair that has been up-trending for 10 years then it is very probable that almost any randomly chosen long strategy will perform positively, but this strategy has been profitable only due to the symbol’s bias and not because it’s logic really forecasts a bullish movement. Data-mining bias assessments by repeating strategy search processes over data created using boot-strapping with replacement will expose these cases and will inevitably make the requirements for asymmetric strategies very astringent, especially when on symbols whose behavior has been markedly trending for a substantial portion of the back-testing data.

The above is the main reason why it is so hard to mine for long-only strategies that are profitable on ETF instruments like the SPY where there is a market up-trending bias as a function of time. Of course the opposite effect also becomes true, it is much easier to find relevant short sided edges since the instrument generally goes against all positions that enter shorts and therefore something that is able to forecast bearish movements with any accuracy will become much clearer. In the end asymmetric trading makes an edge data-mining bias assessment easier on one side and potentially much harder on another and also more dependent on fundamental factors that mark these differences.

–

–

However asymmetric strategies are not fundamentally wrong, they can be just as successfully as normal symmetric trading strategies if proper measures are taken to avoid falling prey to the much larger and unevenly distributed data-mining bias effects. If care is taken it may even be possible to find processes with low data-mining bias that generate strategies that are one-sided on symbols where the generation of symmetric strategies might be extremely hard. I will devote some future posts to some cases in the Forex market where the above holds true. If you would like to learn more about trading and how you too can automatically generate your own trading strategies please consider joining Asirikuy.com, a website filled with educational videos, trading systems, development and a sound, honest and transparent approach towards automated trading.strategies