Last week I wrote an article about islands and peaks in trading system optimizations which prompted me to think about parameters, parameter definitions and parameter-less strategies. Most people argue that there is no such thing as a parameter-less strategy because there is always something you can change within a trading system but this comes from a wrong definition of what a parameter actually is and what distinguishes a parameter change from a whole system change. Today we will talk about trading system parameters, what they are, how to distinguish them and why there are in fact parameter-less systems if we define parameters adequately.

–

–

A trading system is simply a set of logical comparisons that are used to trigger trading actions. These logical comparisons can be varied and these potential variations are often called parameters. However we must be very careful in how we define what a parameter is since – most broadly speaking – any element of a trading system could be parameterized to end up with an infinite set of potential variations. Consider the case where a system takes a long trade whenever A > B. If you think that A and B are parameters then A could be a moving average, or a relative strength index indicator, or a commodity channel index indicator or the open price 5 days ago, etc. Charlottenlund Clearly not every variation in logical comparisons can be considered a parameter, because otherwise all systems would have infinite parameters.

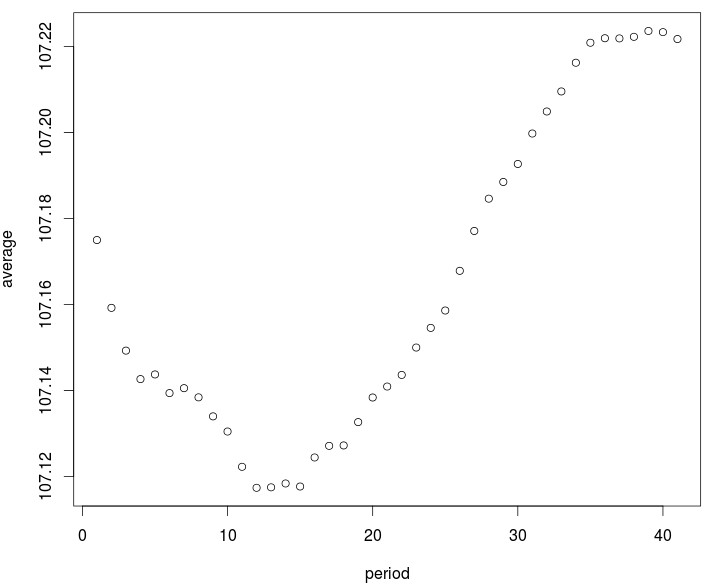

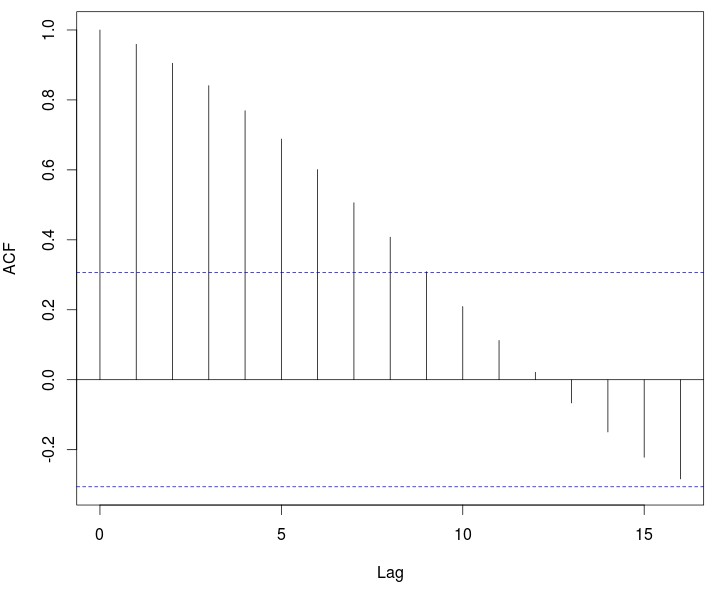

What is a parameter then? If you have the above example where A and B are moving average values then for most traders it is clear that the moving average period is a parameter while the indicator type is not. Changing A from a moving average to a different indicator would undoubtedly constitute a system change and not simply a parameter variation. Why is it then that changing an indicator is a system change but changing its period is just a parameter change if they both cause a change in input values? The reason is that there is an auto-correlation in the inputs when the period value of a moving average is changed – like in the sample images above – while changing the indicator provides a non-auto-correlated result. Frederikshavn Parameters variations always lead to auto-correlated inputs, if no auto-correlation is generated then you’re talking about a change that completely changes the system, not a parameter.

–

–

Think about the things you usually consider as parameters. The stop-loss, the take-profit, the highest high during the past X periods, the moving average period, etc. They all follow this rule. For example if we calculate the highest high for the past 10, 20, 30 and 40 periods we will see that there is an auto-correlation in the series, this is because they are all variations of the same thing. The same happens with things like the stops or take profit limits as well as things like indicator periods. In essence all these value lead to results that are in some way contained within each other, which is the root of the auto-correlation in inputs. They are all variations of the same system because of this fact, anything that does not show this behavior is not a parameter but a completely new system.

This is precisely what happens when you consider something like trading using returns. There is no fundamental autocorrelation when using returns and therefore a strategy that compares returns between two candles can be said to be parameter-less because changing the shift of the return value leads to a series of inputs that are not auto-correlated in any way. It’s not like changing the moving average period for another but more like changing the moving average for the relative strength index. The variations do not look like you’re trading a variation of the last thing but they look like you’re trading something that is completely different. This is one of the reasons why price patterns can sometimes be considered to be parameter-less strategies.

–

–

If not all things that can be parameterized are parameters in the traditional sense then you can have parameter-less strategies if you define parameters only as those variables that when changed lead to auto-correlated inputs. If all possible variations lead to inputs that are not autocorrelated then those inputs would all constitute system changes and would therefore not be parameters. Yes, you could parameterize and change things but then you would be changing systems, exploring a different logic space as I mentioned above.

What do you think? Does this way to define parameters make sense to you? Let me know in the comments! If you would like to learn more about trading systems and how you too can build, examine and trade your own trading strategies please consider joining Asirikuy.com, a website filled with educational videos, trading systems, development and a sound, honest and transparent approach towards automated trading.strategies.