When we start reading about trading and what makes trading instruments potentially inefficient a quick-and-dirty conclusion is usually that trading volumes should be directly proportional to market efficiency. However empirical evidence demonstrates time and time again that this is not true – highly traded symbols are sometimes the most inefficient – but this seems extremely contradictory given what we know about trading. So is there something wrong with our back-tests, is all our live profit due to random chance? Or is there something else? Is there some way for a highly traded symbol to be inefficient and is there even a reason to believe that symbols that are traded most could in fact be the most inefficient? On today’s post we are going to talk about this problem and how market efficiency relates with volume.

–

–

There is really no practical and adequate way to measure market efficiency. A symbol is inefficient if there is a discernible relationship between the past and the future – there are inefficiencies present – but there are many problems with evaluating this in hindsight due to bias problems. You could certainly simply say that a symbol is inefficient if its behavior is not random but this does not in itself constitute real inefficient behavior given that this non-random behavior must be constant enough through time to be exploitable. A symbol can perfectly behave non-randomly but the changes between regimes of non-random behavior can be such that the behavior can be rendered inexploitable by market participants. Therefore non-random behavior must be consistent through time. The more consistent non-random behavior is, the more you expect a symbol to be inefficient.

I have showed in the past how to approach this using chaos theory variables (see here). Variability in chaos series and deviations from random chance – an article I am still to publish in a magazine – show that symbols like the EURUSD have deviations from randomness that are far more consistent than those of other pairs. This is strongly in line with the fact that using data-mining software implementations you can always find historically profitable systems much more easily for the EURUSD than for other pairs. When plotting deviations against average number of systems found per million searched it is evident that there is a strong relationship between low deviations of non-random behavior as a function of time and trading instruments. See here for more on symbol differences in mining.

–

–

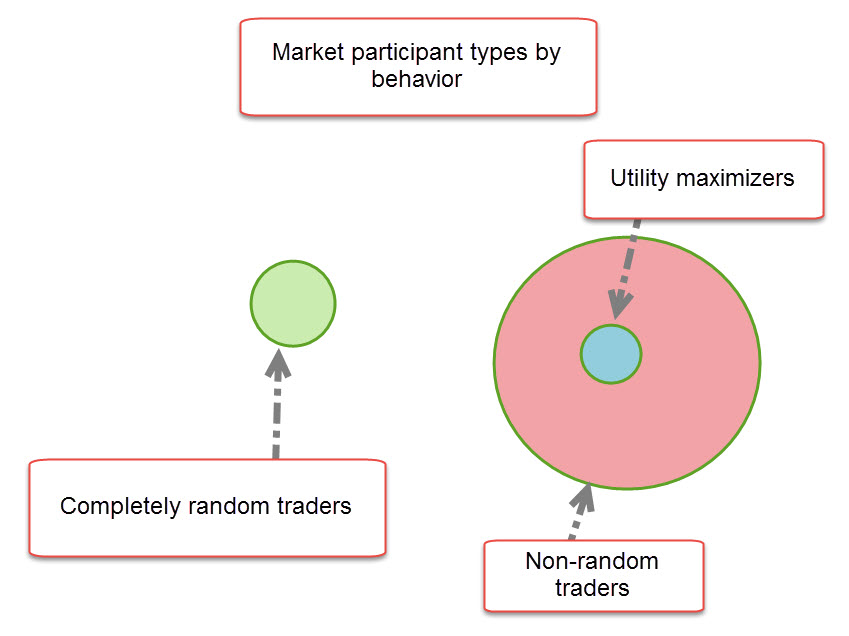

But the EURUSD has the highest volume, how can it still be so inefficient? Doesn’t that contradict the efficient market hypothesis? The answer is related to the volume that causes inefficiencies to shrink and the volume that causes inefficiencies to expand. In the efficient market hypothesis time series are expected to become more efficient as a function of volume because all people who participate in the market are expected to be utility maximizers. If you have a trading symbol where any new volume is volume seeking to exploit inefficiencies then it is evident that the more people who try, the more who will find, and the more who will find the more efficient a symbol will become. If we all search and find the same inefficiencies then we will certainly make them disappear and the time series will converge towards a random walk as the number of participants approaches infinity (although profitable trading will become impossible well before that due to trading costs).

However what happens if all participants are not utility maximizers? Then the question becomes much more interesting because volume increases will not necessarily cause a shrinkage in the amount of inefficiencies. As a matter of fact if most new participants make decisions that are not designed to maximize their statistical edge then they will amplify rather than diminish the number of inefficiencies present within the market. This however will not happen if they trade entirely randomly but this is bound to be a very small number of traders since almost all trading is bound to some intent even if that intent is not the maximization of trading profits (for example a currency exchange deadline, need to purchase products with regularity, working schedules, etc). If there is any sort of herd behavior attributable to these participants then they will create very significant new trading opportunities, despite the fact that they will incredibly increase volume.

–

–

As you can see there is no need for volume to be strictly related with more efficient markets. Whether the market becomes more efficient or not does not depend on how much volume there is but in how that volume is distributed among random trading participants, utility maximizers will tend to make the market more efficient while non-random traders will tend to make it more inefficient. The fact that volume seems to be directly rather than inversely proportional to the number of inefficiencies within pairs implies that most volume present in the FX market – at least – does not come from utility maximizing agents. If you would like to learn more about system creation and how you to can create and trade system portfolios please consider joining Asirikuy.com, a website filled with educational videos, trading systems, development and a sound, honest and transparent approach towards automated trading in general.

Thank you, another great article.

Daniel, could you please write a post about sites-urls that you read about algotrading? Something like your great site )

I read http://quantocracy.com (look at the list in the right side, many good sites)

But I guess not all interesting sites present there.

For example, your site not in the list.