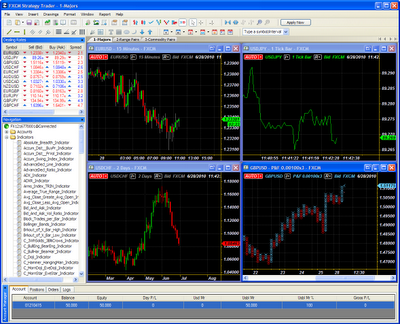

So what’s the name of this software ? The company who dared to fight the rule of Metaquotes in the retail forex industry is actually a broker in itself- FXCM – and the product they are using to compete with MT4 is actually a very young and still under development platform called Strategy Trader. The reasons why they developed this software seem to be both economical and technical since having a monopoly on a better-than-metatrader product would make them a must-use broker for many people and the fact that they have absolute control over the implementation means that they can better handle the straight through processing (STP) with their server implementation.

Is it really that good ? I have to say that I am surprised at many of the things that the people at FXCM seem to be getting “right” from the beginning with their software. It seems that they have really paid attention to what people want, not taking the position of metaquotes which simply turns a blind eye on anyone who wants to give some suggestions about the features and implementations within their platform. FXCM has actually already implemented many features that are obvious and that metatrader simply refuses to use. For example, FXCM has the ability to select ANY custom time frame and to create range bars and tick bars with ANY values. This is an obvious addition 99% of traders want and something Metaquotes has simply been “too lazy” to do.

– –

–

Another great advantage of the FXCM Strategy trader is the fact that the feeds are updated and the charts are created as a function of actual ticks taken from a server and not through one second updates as it is done in MT4 and 5. This allows you to have more precise charts and to have a more accurate picture of what is going on. Instead of just sending one package every second with whatever happened, the Strategy trader gets a package for every tick that happens. A feature which although harder to implement is far more robust for the end trader.

Regarding simulations – which I bet is what many of you want to know about – I have to say that FXCM has done a good job. Although the data is still reduced to one minute bars instead of ticks due to the practical size problems involving direct tick data for backtesting the fact is that there are several advantages. First of all, the data from the Strategy Trader is data from FXCM so the actual sources and reliability of the data are known from the beginning. Metaquotes does not disclose the source of their data and this makes it shady and more difficult to trust by traders all over the world. Another great advantage is the Bid/Ask data sources which means that actual spread values from real trading can be known with much better precision than with actual Metatrader data which simulates the spread.

Sure, the Strategy Trader is only in its infancy and it is still a much less stable, robust and of course used platform than Metatrader 4. However I think that FXCM has done a great job so far probably due to the fact that they have listened to what people want and they have created a platform to reflect this. In the future I would say that if FXCM continues with their efforts and decides to sell this platform to other brokers this might come to be the preferred industry standard over the currently more popular Metatrader series. I’ll continue to follow up on its development and I’ll share some future posts about my experiments with it in the future.

If you would like to learn more about automated trading and how you can gain a true education in the use and development of algorithmic trading systems please consider joining Asirikuy.com, a website filled with educational videos, trading systems, development and a sound, honest and transparent approach to trading systems. I hope you enjoyed this article ! :o)

This is so good to hear.