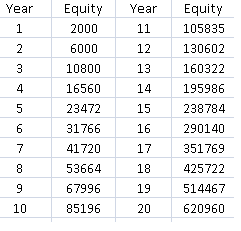

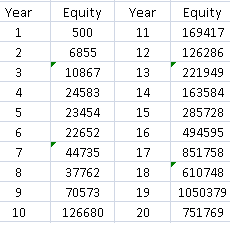

In forex trading the power of compounding can be used to reach a future in which a person lives from trading. However there are several aspects we must take into account to make the calculations as realistic as possible. First of all, lets assume that our system makes 20% each year in average, that equity compounds only once each year and that at least a new equity high is reached every year. Let us also assume that a given quantity of money is saved each month and all the accumulation is added once the system reaches a new equity high. If a person invests 2000 USD in such a system and the amount saved each month is 300 USD, this is the growth perspective that the person will get :

– –

–

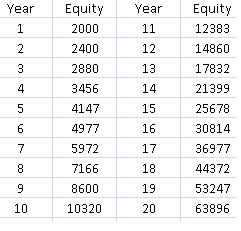

Now bear in mind that if no additions are made from monthly savings, the person will make a LOT less capital in 20 years.

– –

–

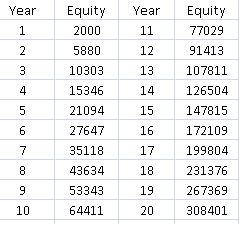

In fact, profit is reduced from 620K USD to a mere 63K, effectively the power of regular additions of capital on yearly equity highs proves to be VERY important. Now, we also need to take into account taxes which range from 20-30% in most countries so let us assume the worst case scenario of a 30% tax on each year’s profits. This will reduce the yearly profit from 20% to 14%. The profit scenario we get is effectively cut to one half, reaching only 308K in 20 years. In this worst case scenario the person has reached a point were he or she gets a 61K yearly profit in 20 years.

–

–

In fact, the initial capital is not as important as the monthly additions, if a person starts with only a 300 USD investment, the person will reach 287K in 20 years (tax included) making the profit targets mostly the same. The monthly savings are what counts in the ends since they amount to the majority of the invested capital. If a person saved 500 USD instead of 300 USD each month, this person would get 479K.

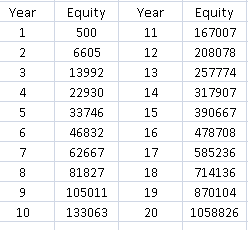

However the most important point is still the actual average yearly profit of the trading system which when increased to only 30% (21% after taxes) increases the profit of the above 500 USD investment example to 1 million USD in 20 years. In 10 years reaching already a yearly income of 23K, as shown on the table below.

– –

–

I still feel however that all the above results are too unrealistic for my taste. Let us introduce the fact that profits in forex trading are not always constant, so lets introduce a standard deviation of the yearly profit of +/- 50% (note that the average yearly profit is still 21% in 20 years, the maximum draw down of the strategy below is around 50-60%) . As you see, profits become a lot more variable but an equity high of 1 million dollars is still reached and a new equity high will be reached if the system continues to function appropriately.

– –

–

As you see, the power of compounding is great and anyone can live from forex automated trading after a certain amount of time simply if they use systems with limited levels of risk and save enough money to invest on equity highs. Living from any financial instrument demands time and simply turning those 500 USD into 1 million in 5 years won’t happen. Long term success in trading demands continuous investment and a true commitment to financial freedom. It demands a lot of knowledge and a lot of confidence. Certainly this shows that people can trade to live from the market and not just “for fun” due to the under capitalized character of most forex traders. Proving that even though Reason 10 of yesterday’s post is the hardest to overcome it can be vanquished with adequate saving and investing.

If you are interested in learning more about my trading systems and their risk and profit targets please consider buying my ebook on automated trading or joining Asirikuy to receive all ebook purchase benefits, weekly updates, check the live accounts I am running with several expert advisors and get in the road towards long term success in the forex market using automated trading systems. I hope you enjoyed the article !

Daniel-

Interesting post and I have a few comments of course :-).

Adding the issue of adding extra money to the account each month dilutes some of the effectiveness of your argument, because I can't be sure how much of the final gain is due to the monthly additions versus the capital gains.

I see you have a separate table without the monthly additions, but that one didn't include the 30% tax burden.

Also, the monthly additions make it more complicated to calculate the tax burden since you only pay tax on the capital gains and not on the new additions which are presumably money that you have already paid taxes on.

One more thing, I wonder if its wise to suggest that people invest years of long-term monthly savings into a forex account which could easily drawdown 50% – 60% or more. This could wipe out years worth of patient savings which could be devasting both financially and psychologically.

I would rather see you suggest starting with an initial amount (less than 5% of your total net worth) and let that accumulate over time. This way, at least if you wipe out, you are playing with the "house money" at that point versus your long terms savings.

Also, in my comparison, I chose to compound weekly rather than annually since the Megadroid seems to gain a slow steady fashion with occasional drawdown versus some of the systems you follow which more "lumpy." In other words, they go for months with breakeven or small losses, then make their money for year in one or 2 large lumps. Your results will suffer from a single year compounding versus weekly compounding. Its pretty clear that a shorter compounding timeframe will lead to larger gains. And this is a reality with Megadroid since it increases lot sizes as the account grows so the effect is very real.

One last question, let me know which of your systems you are basing the 20% a year figure on so I can backtest the system and see what are my results. Understood if I need to subscribe to your newsletter to get that info.

For the record, my analysis on the same topic is found here->

http://fx-mon.blogspot.com/2010/01/megadroid-backtesting-and-1-week.html

Thanks and cheers.

Hi Daniel,

Congratulations. You got to the point. Excelent. From now on even investors with small capital and a litle bit monthly savings can (if they follow the nine reasons for not failing, from your previous post)look at automated trading as a real investment. And of course all type of investments have their own risk. Even life is a constant risk. But if you know what you are doing and follow the rules the risk is minimized and the rewards are great.

Of course compoundind weekly will give more returns than yearly. But compounding early was just an example, because the rule is to add capital as far as the account reaches higher equity and the EA will calculate, the new lot amount to trade, based on that new equity, meanning that compounding will depend on how many times new equity are reached annualy. And I do not think its fair Txcmon coming always to this blog trying to "sell" Megadroid. You Daniel already made your point about that robot. So in my opinion discussion about the merit or not of that robot should take place in another forum. Sorry Txcmon, I do not mean to offend you, but thats my opinion. You could have made your point without mention that robot.

Best regards

Cador

Hello Txcmon,

Thank you for your comments :o) Always nice to have them for discussion.

The monthly additions are easily calculated. During 20 years of 500 USD additions you will have 120K added as savings. They are a significant amount of capital but the amount they represent of the total changes depending on the actual profit gained.

I also would not entice people to invest any amount of money in forex trading they are not prepared to lose, however trading systems available at asirikuy with a 20% average yearly profit certainly have historical draw downs of less than 50-60%, I just used this figure to point out that an account could face such draw down and yet recover if the average yearly profit stands at 21%. People should also evaluate the systems continually and stop trading them if they go over the worst-case draw down targets which for a 20% average yearly profit are only at 30-40% for several systems on Asirikuy.

The concept of facing "wipe outs" is simply not acceptable. I use automated trading systems for the long term and the way in which I continuously evaluate them allows me to stop trading them if they face a worst case scenario which will in NO CASE be even close to a wipeout. In the worst case I would face a 30-40% capital loss as I already mentioned. In addition, NOT adding money to an account will doom you to low profitability since your ability to compound will be awfully limited.

For me, the way you are approaching long term trading is very unsound. You are using a system you do not understand (you don't know the exact logic behind it) with backtesting results that are not reliable (therefore you have no knowledge about long term profitability) and with a terrible broker dependency problem due to spread widening and other such things (your backtests are probably GREATLY under estimating draw down due to these issues as I mentioned on an earlier post). Please don't take this the bad way :o) I am genuinely concerned about your capital safety and I would encourage you to find a reliable trading system based on sound trading tactics, either mine or someone another person's systems.

There are SEVERAL systems in asirikuy which are able to reach a 20% average yearly profit with a risk of less than 30%. For example Watukushay FE or Watukushay No.2 with adequate risk settings (you can backtest them with several risk settings and see for yourself) are both able to go above this capital mark with draw downs of less than 30%. It would be great if you could join asirikuy and watch all the videos there. I honestly feel that you would like them :o)

Anyway, thanks again a lot for your comment :o) They always help me better explain myself and they should also provide more insight for the people who read the posts.

Best Regards,

Daniel Fernandez

Hi Cador,

Thanks a lot for your comment Cador :o). I am glad you have liked the post ! Of course, there is a lot more to reaching this long term profitable goals than just running the systems.

Using automated trading systems is far more than setting up a robot and forgetting about it and this is what will mainly protect people who are aware of the 9 other reasons mentioned on yesterday's post. You need to constantly understand, expect from and evaluate your trading systems. Something which you simply cannot do with a system you do not fully understand.

I chose yearly compounding over monthly or weekly compounding mainly because I wanted to portray a worst-case scenario regarding compounding rate(with the system maintaining average yearly profitability) because otherwise compounding calculations may reach unrealistic results which may get people excited and encourage the use of unsound trading tactics, systems or excessive risk. Backtesting and live trading has shown that several of the systems available at Asirikuy may actually compound at a much faster rate.

Regarding the mentioning of Megadroid, I am actually not bothered by that but I am truly concerned about the fact that Txcmon is trading a system as long term profitable when there is no evidence of this being the case (with the evidence NOT being reliable as I pointed out). Even more, as I mentioned on the previous comments, trading a system one does not understand is a road to failure in the long haul.

However as you say, in the future it would be best to keep references to the robot away from the discussion and within the posts pertaining to that system. Thank you very much again for your comment Cador :o)

Best Regards,

Daniel Fernandez

I am learning about Forex and have 5 books on it and any other books I can find.

Now I thought about investing just $1000 and adding $100 every week for a year.

Since you are the mathematical people could you do a bit of calculating for me

And how would that work with your compounding system.

Very interested and still learning forex.

Suppose also I can learn with a demo account.

Also I was just wondering when I sell my pips does it go straight into my account

so I compound it straight away or do I have too wait for it to go back into my account?

Cheers Gazza