Yesterday we talked about our current monetary system and some of the problems that are behind it. The main issues we discussed pertained to the ability of banks to control the money supply and to restrict the possibility to generate interest for all debt participants by simply failing to spend interest once it was repaid. We discussed how all money is generated as debt and how this creates a “market carnage” for the repayment of the interest owed, an eternal shortage of money which can be exacerbated by the banks by failing to re-spend paid interest. Today it is all about the solution. Within the next few paragraphs I will expose some of my views and what I believe is the “perfect” monetary system.

WARNING: This is just a blog post not a tome on how to change our money supply for a new one! I certainly haven’t thought about every possible loop hole and there are possibly an extremely large array of things which can be improved. Take this as what it is at the moment, a set of ideas which I believe could replace the current monetary system by a much more efficient machinery. Of course, they can certainly be improved!

–

Let us start by looking at some of the possible solutions and why they are not realistic solutions to the problem. The first idea that most people have is to replace the current monetary system by an intrinsic storage of value (gold, silver, zinc, copper, etc). The idea here is that we would exchange something that has value on its own and therefore we would avoid all problems related to inflation and money creation since any “money” must be mined and minted. The problems we have here are mainly two fold. The first problem relates with the availability of the physical quantities of these metals. The world carries out huge amounts of exchange across the world in which we would need to transfer bast quantities of gold between countries and people for everyday operations. Gold would then become more and more valuable as it became less and less available relative to the amount of exchanges being carried out (as this increase exponentially while gold increases only linearly and at a very slow rate).

The second problem of this is the issue of supply control. All new gold is controlled by miners and minters and already available gold can be accumulated and stored by wealthy market participants. What happened if China decides to purchase all the world’s gold production? What happens if a country starts to accumulate gold reserves causing a shortage on other ones? Gold inevitably puts the control of the monetary system in the hands of a few which can choose to accumulate metals and cause world shortages. Hard commodities are a BAD idea as currencies under the current world situation because they can be potentially controlled by a few, world supply of the commodity would become a primordial issue while this should not be the case.

To find the solution we need to remember that money in itself should not be dependent on anyone for its creation. Money should only be a means of exchange and therefore – by definition – it should exist as exchanges demand its existence. The amount of money available should be proportional to what we produce and exchange, it should be created organically by the market in itself without the intervention of ANYONE -government, miner, minter or banker- on its creation. We need a monetary system that is regulated organically without any intervention, money which comes into existence only to warrant exchanges and then disappears.

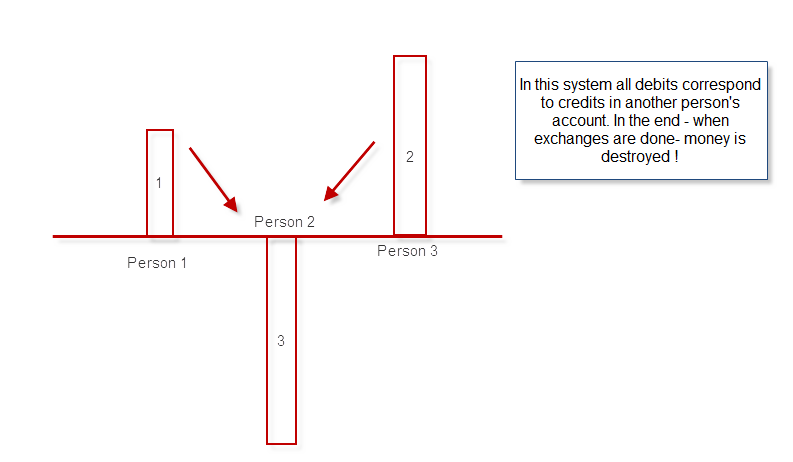

How do we achieve this? After long hours of thinking I have found the best solution to be the creation of a credit/debit system in which money is dynamically created purely as a mean of exchange. Let us suppose you have 3 people Peter, Jane and Roger who all have things each other want. The three of them have an electronic entry controlling their credit/debit status and all of them start off at 0. When Peter wants to buy a flower from Jane he credits 1 unit to Jane’s account and 1 unit is debited from his. After this Peter builds a fence for Roger who pays him 1 credit (and gets 1 debit) and then Jane buys a pound of salt from Roger for 1 credit (and gets 1 debit). In the end the balance is zero, money was created purely as a means of exchange and – after all exchanges are finished – money is destroyed!

Of course, the beauty of this system is the ability to go into temporary debits in which you “owe” the community and you get credit which means the community “owes” you something. Debit in this scenario means that you need to provide something to the community while credit means you are entitled to take something. Now many of you may be thinking about what happens when someone just “screws up”, can someone “default on their debit” ? We could limit the ability to get debit to your capacity to get credit. For example everyone would start at a minimum debit allowance which can be increased in the measure that you show capacity to produce more credit. If you “default on debit” then you are forced by law to do something for the community which gives you credit (like forced road building, social work, etc).

Another great thing is our ability to work as a community. If the government wants to build a bridge it debits all of our accounts and then credits the contractors who build the bridge and the money is effectively recirculated back into the community when the contractors spend this credit. The beauty of the system is that there is no debt-tied money and money is generated organically as we need to exchange things, debits and credits show your status against your community and after all exchanges are carried out the net outcome is ALWAYS zero as every credit corresponds to a debit in someone else’s “account”. Money here acts ONLY as a means of exchange.

Now a possible problem we have here is the accumulation of credit. What happens if someone decides to start taking credit and “not spend it” would they be able to make the community “owe” them in great measure? Could they cause an economic crisis? In principle credit accumulation is detrimental to the system and therefore we must prevent it because money is a means of exchange and should NOT be a means of accumulation. The way to do this is to automatically reverse transitions if the credit is not spent after a given amount of time. This means that you should cash the community’s debit to you under a certain time frame or this debit will be nullified. Does this mean that you cannot save ? No, it simply means that you need to exchange money (a means of exchange) to a store of value so you can buy a commodity, a property or something else.

What if you want to get credit beyond your means? The good thing is that you can’t as your capacity to go into debit is controlled by your ability to produce credit and your inability to pay debit forces you to carry out duties for your community which give you credit to pay this debit. Of course in cases where this cannot happen the community can agree to bail-out people (such as might be the case for very sick people, drug addicts, etc) by taking credit from everyone to repay their debit. Notice that I have NEVER used the word DEBT as DEBT is tied to interest and under this system all debits are INTEREST FREE. The beautiful symmetry of the system allows for money creation and destruction with money’s purpose being solely to carry out exchanges (which is what money IS for).

–

Of course, probably a book will be needed to run into all the necessary details of how this system would be tied in the beginning to a regular currency system and how this migration would be carried out across economies but in principle it is a very sound choice which puts money in “its place” as a means of exchange which is created by people to exchange things, whose creation is ONLY limited by the means of production and which is NEVER limited by any group of people. Money supply is potentially infinite but TIED to exchange, all credits and debits are in the end cancelled and the net outcome is always ZERO. Money is only a means of exchange and in the end – when there are no exchanges to take place – it is destroyed.

If you would like to learn more about my work in automated trading and how you too can learn to build systems to trade under the current currency system please consider joining Asirikuy.com, a website filled with educational videos, trading systems, development and a sound, honest and transparent approach towards automated trading in general . I hope you enjoyed this article ! :o)

Daniel,

A very interesting idea!

I think that if you further develop it, you can apply for Nobel prize on economy. On the other hand, those who control large amounts of capital wouldn’t want to allow your proposition come to life since this would destroy their way of life.

Maxim

Hi Maxim,

Thanks a lot for your comment and kind words :o) Wow, Nobel prize ? You certainly flatter me, I believe the idea is good but certainly it would be decades before I would make any progress with it in such a huge way. As you say implementation will be a completely different thing and probably the integration with the current monetary system would be a critical first step. Obviously those who have their business around debt will attempt to crush this with all their might but in the end it is up to the people, isn’t it? Thanks again for your comment!

Best Regards,

Daniel

It would solve many problems if it was posible to change the current one in to your proposed system. Everything is posible, right? On the other hand, we may even be pressed to change the system one day, as the current one has many bugs.

Btw, how would we know how much diferent things cost? Everithing can`t have the same price…

Hi Rimas,

Thank you for your post :o) Well the price of things would be defined by supply and demand as it usually is. If there is a lot of demand for bricks then their price in credit will go up and therefore people who get this would incur in more debit. Price is determined by how much people are willing to pay for a given item according to supply and demand. The important thing is that all credits correspond to debits and when all exchanges are done money is destroyed. If you want to pay 50 credits for a shovel then you will get that debit and the owner of the shovel will get more credit, if demand for shovels increase then the owner will demand more credit and this will create a proportional debit. However there won’t be inflationary pressures as the money supply is always of the exact quantity needed and it is controlled organically (destroyed when it is not needed and created when we need to carry out exchanges) . Prices will shift relative to one another according to how much different goods are demanded and supplied. I hope this answers your question :o)

Best Regards,

Daniel

Interesting idea. I like the idea of separating the “exchange” function, which can be assigned to a paper/digital currency, from the “store of value” which should be assigned to a hard commodity like gold (I hope that you at least agree that gold or a similar “hard” commodity should be used as a store of value, not a fiat currency that can be created for the purpose of carrying exchanges!). You should look at the work of FOFOA (see his blog), who has given a lot of thought to these ideas.

One major point of disagreement, though (this is also the continuation of our discussion on your previous post): if gold would be used as a currency (it is already used as a store of value de facto, given that central banks hold thousands of tonnes of gold in their vaults), it would be extremely difficult for a country like China to “purchase” all the gold. Think about it: nobody would give their gold away so easily because they would (as you rightly pointed out) lose their economic power in such as system, so this would lead to a reorganization of the economy of entire nations in such a way so that their balance of payments (in gold) would be close to zero. This is not a mere hypothesis: this is more or less what happened during the gold standard era (but please note that I am NOT advocating for a return of the traditional gold standard, as I think that it does not make sense to back a paper/digital fiat currency which can be created at will with a hard commodity like gold, sooner or later the “backing” will be shown to be a fraud). To take your example, China would not be able to purchase all the world’s gold production unless their productivity was an order of magnitude higher than all other nations combined. You are making the mistake of extrapolating the current situation (where the USA basically exports freshly printed dollars in exchange for Chinese cheap imports) to what would happen under a “gold as money” system. But if you think about it for a minute, you would see that this cannot happen. The USA could not rely on their gold to obtain cheap imports for a long period, the way they do with their fiat money which can be created at will, and they would, of necessity, start to produce more of these products on their soil after a few years.

Hi Xyz,

Thank you for your comment :o) Well I do recognize that hard commodities are stores of value (no doubt about that) but I disagree on their use as a means of exchange as you cannot rule out the possibility of accumulation that restricts money supply. Certainly – as you point out – my example about countries might have been wrong under current economic conditions but it doesn’t mean that such an accumulation couldn’t eventually happen. For example if a country produces a large amount of goods which it sells to other countries and then only spends that money internally (with a large trade surplus) then a country will star to accumulate gold. Of course, such accumulation would be limited as the other countries would soon be without enough gold and therefore unable to import goods but the country with the most gold would have the upper hand. Countries which are gold producers also have a big advantage in the long term as they are able to increase their reserves of currency while those that don’t cannot (through production).

Now, besides this discussion – which is quite interesting – you also point to a very interesting fact which is that the gold standard eventually generates fraud and definitely this could only be eliminated with the exchange of only-physical gold which is impossible due to the large amounts of money that changes hands each day. My proposition is to separate the notion of exchange from storage of value. The purpose of money – as I described – is not to serve as a way to accumulate value but to provide a means to exchange, you can use this means to move to a storage of value (like gold or other commodities) but exchanges will be carried out on a system which is debt-free and generates money organically according to exchange needs. In this system you could think of gold as a way to “save” (store value) but not as the general means of exchange. This – in my view – is the best monetary system as you do not restrict money supply, this supply is always exactly what the market needs, it cannot be controlled by any group and there is no debt (no interest to be paid). Long story short I say YES to gold as a store of value but NOT as a means of exchange :o) As – according to what I said before – the money supply needs to be proportional to our needs of exchange and not to the availability of any commodity. I’ll also checkout the blog you mention ! Thank you very much again for commenting,

Best Regards,

Daniel

Daniel-

Interesting idea and it definitely fits with the idea that money is simply a medium for exchange of value between 2 parties.

But it doesn’t address the idea of money as a store of value. I take personal pride in the fact that I work hard and i’m responsible with my money such that if I need something – like a new car – I can just go out and buy it. I don’t need to borrow money or work off a debt – because i’ve already worked for the money and its there for me if and when I need it.

The idea of my money going away if I don’t spend it is a very scary concept from my own perspective. That system is a disincentive to hard work and saving. What’s the point of working hard and saving if my money is just going to redistributed to those who have not worked hard and saved?

Somewhere inherent (but not stated) in your model is that wealth should not be stored, rather everyone should have only enough money to meet their needs – and that’s all.

So I think your model needs some further work to develop the role of wealth creation – who is allowed to develop wealth and for what reason. That will help to address the underlying issue that I think you are trying to address which is the unfairness of the current system. In other words, why some people have so much more wealth than they need while others don’t have enough.

Thanks and keep up the great work,

Chris

Hi Chris,

Thanks a lot for your comment :o) Although the system simply looks at money as a means of exchange it does allow you to store value (although not in money). As I explained on the post you can use the money earned when you work to buy some store of value (property, gold, silver, etc) and then when you want to get money you can exchange your store of value. However the idea is that the existence of money should not lead to wealth accumulation through money but wealth needs to be accumulated in tangible goods (not in money). What I am trying to do is separate both things, leave money as a way to exchange things and accumulated wealth as another type of thing which needs to be related to something which tangible. Wealth accumulation in money is destructive as it restricts the money supply. If you base wealth accumulation on tangibles and exchanges on a debit/credit system you have a system where money supply is exact and wealth accumulation is REAL (people accumulate things with true value). However the exchange of these things is NOT restricted to any of them but ALL of them are potentially exchanged for any other through the credit/debit money system. The system therefore takes care of all the issues you have mentioned :o) I hope this clears it up!

Best Regards,

Daniel

Interesting idea :)

You should keep in mind that the system needs to be robust against criminal activity. If the system can be easily bypassed then it obviously won’t work.

Hi Franco,

Thank you for your comment :o) Certainly criminal activity is an issue to consider but this system is robust against this in the sense that it allows track of every transaction (as the means of exchange is electronic in nature). Of course the robustness of the system in itself against things like hacking would need to be evaluated but such is just a practical (technical) aspect of the implementation. Thanks again for giving your opinion :o)

Best regards,

Daniel

If only Daniel was president…

But we live in a non ideal world with power hungry corrupt idiots who will always have the “last say” and control everything. Don’t think we will ever be rid of them :(

Hi Franco,

Thank you for your comment :o) President ?! Lol, I think I would never be able to deal in politics (I believe I am too rational for that job!). The truth – I’m afraid – is just like Jefferson put it, that the tree of liberty needs to be refreshed with the blood of patriots and tyrants if liberty is to be maintained. There is no government free of corruption and revolutions need to happen every other generation to make sure that those in power understand that the power they have is not truly theirs. Thanks again for commenting!

Best Regards,

Daniel

That’s true Daniel, from my limited historical knowledge of the world it is obvious like you said no goverment in ever free of coruption.

In my country it is so open they display in the streets, they don’t even try to hide it!

I think instead of trying to overthrow goverments and causing bloodshed we should rather be smart and plan our future around corupt goverments, rather than trying to change the unchangeable nature of human beings.

Hi Franco,

Thank you for your comment :o) Well we could say that we need no government (absolute democracy) but the problem about this is that the majority can make some very bad decisions. The american fathers were against the idea of an absolute democracy (where decision are made by everybody) because this can bring some potentially huge problems. However we need to weight if this is in fact better than a representative democracy (which eventually becomes filled with corruption). The price of liberty – as they said – is eternal vigilance, a government is not corrupt when they are afraid of their people. When a government becomes the lobby of corporations and the people do not hold their representatives accountable, then all hell breaks lose. You know, as Adams said (if I remember correctly), no taxation without representation. Thanks again for posting!

Best Regards,

Daniel

As another example, i currently live in a country which is not a democracy, and which in this case is probably kind of a not so bad thing, well as long as the central government is taking decisions for the benefit of the whole. In practice, i would guess 50% are indeed good for the country, 30% for the people, and 20% for personal benefit along the chain of power. As it is not a democracy, civil servants do not get feedback from the people, but they get tasks, orders, rewards or punishment from their direct superior. Once there is a worm in the apple, it affects all the chain of power below.

Most are worms, and contrary to our western systems, this is a public fact, and as such, networking and corruption/gifts has simply became a standard part of any procedure or request. It does not shock anyone, this is the standard way of living or doing business.

Why don’t the people let things as it ? Because the police, army and civil servants do not work for them, and are not accountable to them. Because people are mostly uneducated, have no access to exterior information, nor have examples of other systems. Because once the 30% for the people is done, and they are not starving and hungry anymore, then the people feel fine the way it is. It has already saw a huge step forwards in easying its life, and is not about risking his life of emprisonment to do a revolution. Which they do not know yet but would bring another 50 years of starving and another system no better that the current one.

Daniel:

Great post and a really interesting idea. One thing that might need further analysis is how to expand this system to the simply things you buy every day. May be in the future everything will be electronic but, right now, if you are in a small town and need, let’s say, an apple or a newspaper, you will need some coins or bills. Your idea, which is excellent, requires certain access to a central system using some sort of electronic communication. If this system is not available or if it is to complex for the ordinary people, we will end having a physical replacement, which, in time, will be similar to the current monetary system.

Hi Cava,

Thank you for your comment :o) This is an excellent argument! The system I propose is mainly electronic in nature because the fact that money is physical imposes a limitation in itself (there is always a fixed quantity of anything physical). When you have money that needs to be exchanged physically the money must be made by someone and this enables someone to control the supply of money. Having physical money also allows money accumulation and therefore it becomes a potential store of wealth (which is something we try to avoid as we simply want money as a means of exchange). Sure, this requires everyone to be connected to a centralized system which uses some sort of card or tag to debit/credit someone (could be some sort of biological signature to avoid problems with crime). What you say is in fact a “roadblock” for this system but by no means an unbeatable one and certainly each day doing something like this becomes more realistic. Thank you very much again for posting!

Best Regards,

Daniel

PS: Seems like writing a book about this idea to explain all details doesn’t seem that far fetched :o)

Capitalism, communism, socialism, whatever, … All are good or functionning systems in theory and when described on books. Unfortunately, the implementation of these systems are the failure. I believe your proposal will have the same fate, as good as it looks like. We are all humans, and too many of them are greedy, and this will end up as usual as a race to find loopholes and shortcuts, corruption and whatever to gain credit fast.

The system might work if we were ants and thinking as the whole for benefit of community, but this not the case.

My belief is that if someone plans to build a system, he should begin by postulates about human and individual behaviors first and build on top of these considerations. Avoiding this aspect will lead any good system to fail. If ther needs to be laws to maintain a system working, that means the system is not self substainable and self regulating.

Hi Alex,

Thank you for your comment :o) Let me first be clear in that this is NOT a government system (like communism, socialism, feudalism, etc). This is simply a monetary system. The proposed monetary system does not change the nature of the economic system (still capitalism whose main objective is the accumulation of wealth by individuals). Again, this does not change the system of government or the fact that its capitalism, it merely changes the implementation of the monetary agreement.

Also bear in mind that all systems need laws to work as all systems assume that we have some sort of social agreement amongst humans in which we recognize that we need to restrain the natural excesses some may be prone to. There is a system that works without laws (natural selection) but we as rational beings have the capacity to recognize that our ability to accumulate wealth and survive should not depend on some sort of natural strength. We recognize that as humans we are entitled to some rights which others have not the right to take by force, we have some rights by birth which need be part of any functioning system. Laws are the basis of modern society, every system has them as there is a need to punish those who act against society.

Certainly I am not saying this system is the “best of the best” but in my mind it is the best and most robust solution to the current monetary system problem. The problem that money is created through debt and the fact that money supply is controlled by a few. The system has the advantage of organically controlling money supply and guaranteeing that the accumulation of wealth and the ability of exchange are adequately separated. It is a monetary system based on what I believe is a sound economic model (nothing more and nothing less). Thanks again for your comment,

Best Regards,

Daniel

I just took political examples because it talks to everybody and are good examples in my eye of how systems generally degrade, or more generally do not pass the test of time accross changes of minds and societies.

Coming back to your monetary system proposal, the first thing that came to my mind in your Peter, Jane, Roger and all working as a community is that in reality, albeit not necessarily knowing it (and this is an important fact), Peter, Jane and Roger will not behave for the benefit of the community and will search or benefit for “edges” or loopholes in the system. Eg, in the case of not knowing, just buying cheap stuff at a supermarket brings harm to the community on the other side of the planet, there is no sense of community there. Which is the point of having a whole regulatory system, which as time goes become overly complicated with rules dedicated to specific cases, while retaining too many obsolete rules.

Coming back to the example, so how would Peter know about the debt status of Jane and her thrustworthiness ? How to ensure that Roger will not fake his credit or default his debt ? How to ensure there will be no collusion between Roger and Jane to the detriment of Peter ? Who would compose the regulatory system that would need to keep track and regulate all accounts ? Would you trust the regulatory organ after 10 or 20 years once some people are in place and rules and procedures became nebulous ?

Should i also mention, as you did also some time in the past, that you and me and most of forex people are indeed searching money and try to take advantage of or in extreme cases parasiting the system. Otherwise we would not be doing what we currently do, meaning speculating on the money or whatever security, but instead producing goods, services (or living in autarcy :-) )

Your system based on credit/debt works as long as people are willing to contribute in order to get credit. And well, you got my point now

Please understand that my comment is not to “troll” the blog, i am just expressing what i see every day around me, or should i say, as a commoner, what i do not see and do not understand about our monetary system, which is how some people can abuse and regulate commoners like me, otherwise there would be a bloody revolution as you say.

I do aggree and like the points and benefits of your blog post idea, credit and debt, and there is no point for me to express these points again, but what i see is that even if the system is good and goes though the backtest, to take a forex metaphor, the system is i believe bound to failure because of the whole machinery managing it when live. In that case, i just wanted to be the devil’s advocate ;-)

How would the system scale, for example if company A needs money from B to invest or get something from C ? How does it work if at some point money is destroyed ? Would’nt there be a point at which money can not be destroyed because all the chain of transactions are not terminated ?

Hi Daniel,

You said in the article that money is destroyed after it is created purely for the purpose of being used for exchange, but then in a reply to Alex you said that the system remains capitalist with the objective of accumulating wealth for an individual. If money is only for exchange and is destroyed afterwards how could someone accumulate wealth? Forgive me if I have missed something but that is my understanding from what I’ve seen written above.

Also, how would somebody purchase a house for example if they can’t accumulate credit or get into too much debit and can’t get into debt at all. It seems then like purchasing anything substantial would be impossible.

A reply to disambiguate some of my concerns would be much appreciated.

Regards,

Mike

Hi Mike,

Thank you for your comment :o) As I have said before the system allows for wealth accumulation but this accumulation is NOT in the form of money. For example you can accumulate wealth by exchanging your credit for something of real value – like gold or silver- and you save real value in this way. The difference between this system and a gold based one is that any valuable commodity can act as a means of storage and only money – the credit/debit system- can act as a means of exchange. The idea is to SEPARATE the idea of exchanging from the idea of storing value. The money system is only used to exchange things and the credit can then be used to “store wealth” through something that has some real world value (like metals). I hope this answers your questions :o)

Best Regards,

Daniel

Hi Daniel,

Thanks for the quick reply and thank you for answering the bulk of my question. The only thing you left out was how somebody would make a substantial purchase such as a house. Would you be able to take out a mortgage and get into debt or would you need to accumulate enough assets in the form of physical commodities to exchange for credit to purchase a house at a later date.

Also, how would a start-up business work. Would they be allowed to get more debit with the hope of profiting in the long run, as most new businesses don’t start making a profit for a few years.

Also, how would people get paid by their employer? Would the employer give them credit which they would then have to exchange for something before it expires?

Would there still be a stock market in this monetary system? Would shares be another thing people could exchange for their credit?

Sorry I am kind of bombarding you with questions, it’s just this is a very interesting idea as it is such a radical overhaul of our current monetary system that I can’t help but ask.

Regard,

Mike

Hi Mike,

Thank you for your comment and questions :o) I have written today (apr-23-11) a post about how we could start replacing the current monetary system and tomorrow I will write a post answering your questions related with the replacement of the current “loan based” economy. On tomorrow’s post I will show how this system allows people to make large purchases and start businesses without the need for the interest based loan structure. I will be glad to hear your opinion on today or tomorrow’s post!

Best Regards,

Daniel