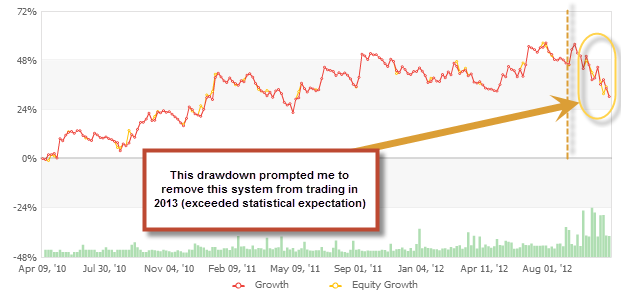

The year 2013 was very enriching for me from a professional perspective. I started the year with many goals and fresh ideas, with the intention to increase my profitability in Forex trading and hopefully get rid of some technical and practical problems that I had faced in 2012. However 2013 had many surprises hidden for me – both good and bad – with the appearance of difficult trading conditions that challenged some of our already well established trading strategies. Through the year 2013 only a handful of my trading systems were able to deliver profitable results and some caused significant draw-downs that led to their elimination from my trading repository. Through the year I was also able to study many ideas in more depth, especially those related to machine learning and money management, helping me learn a lot about the predictability of price series and the different implications of different position management schemes.

–

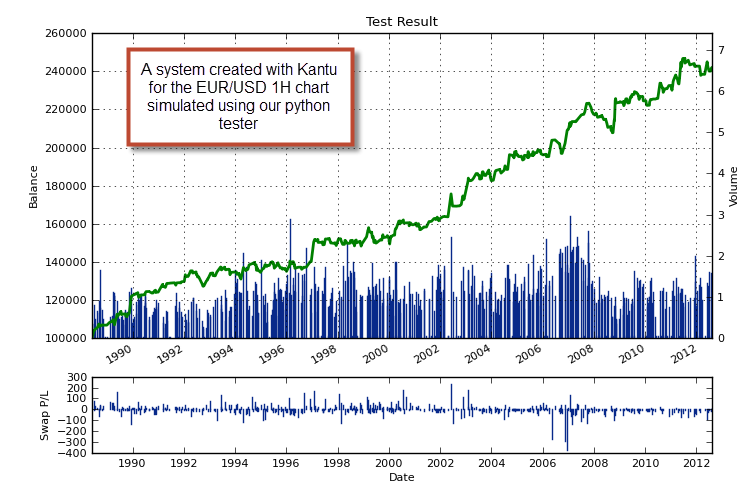

Perhaps the biggest achievements for 2013 were related with the development of our tools at Asirikuy. This year we finally achieved our objective to be able to fully back-test and trade strategies outside of MT4, added to the ability to also back-test and trade on Linux and MacOSX systems. We were also able to polish the F4 framework to a very professional degree and implement very useful libraries (such as Shark, Curl or Waffles) to serve a wide variety of purposes. The functionality of the framework was further expanded by our python tester, which allows us to control genetic optimizations and also allows us to perform OpenMP and MPI based tests (which allows for multi-core and multi-station simulations).

Another achievement I am proud of is the development of the Kantu parameterless system generator and the Kantu ETF rotator (the latter which I haven’t mentioned on this blog) both programs that allow us to explore the realm of automatic system creation. With these programs I was able to understand a lot about in-sample/out-of-sample profitability as well as things such as data-dredging, which are so important when generating trading strategies from an algorithmic perspective.

–

–

The losing side was also very important for me. Looking at the way in which some systems failed is allowing me to develop a new philosophy around trading system development, as it is evident that certain types of systems might be more dangerous due to their inherent statistical characteristics, despite any historical analysis (be that walk forward analysis, 25 year optimization, etc). I will come back to this in future posts ;o)

Another event that marked the year for me was the introduction of ETF rotation strategies to my trading. Thanks to some conversations with a couple of fellow money managers, I was introduced to this type of investment near August and promptly developed software to allow us to trade these strategies within Asirikuy. It was very refreshing to develop something to trade outside of the FX market. I will go into more detail about this in future blog posts.

What are my goals for 2014? My first goal – which I’m currently working on – is to perform a judicious analysis of all the systems I’m currently trading in order to stop from trading all those that are showing either excessive broker dependency or results below what is expected from their simulations (within Monte Carlo defined boundaries on a trade number basis). This means that I will completely overhaul my live accounts in order to remove all instances that I consider have been exceedingly unreliable and damaging to my live trading. This first goal is simply to eliminate everything that is not working and keep everything that is working. This obviously does not mean that I will trash anything within a drawdown but that I will look at drawdowns and eliminate all systems that are either in abnormal drawdown periods (too deep, too fast, too long etc, obviously judged by statistical criteria) or which have obtained drastically different results between different accounts where results should be fairly similar. This goal should be done by next week :o).

My second goal relates specifically to system development. I want to put the things I’ve learned about what makes systems easier to manage (how we can detect failure faster) into a system creation methodology and generate a new set of algorithmically created systems that we can trade live along our currently working systems. I want to move towards a trading regime where all systems are created primarily by data mining and later refined through a manual iteration process (if this is necessary). We already have some Kantu strategies trading on live accounts and I want to make this number larger. From now on, all strategies that fail within Asirikuy will be replaced by strategies generated through a data mining approach, incorporating all the things I’ve learned up until now. I intend to refine Kantu much more, adding new types of position management schemes (such as break-even and trailing stops) to enhance different aspects of Kantu generated strategies. I also definitely want to carry out a serious overhaul of all the Atinalla material within the Asirikuy website so that new members have some much clearer guidelines for their portfolio trading (the present Atinalla project videos and pages can be very confusing due to all the historical changes).

–

–

My third goal is to implement event based trading system generation within Kantu. As you know kantu currently works on price patterns based on OHLC time charts and this means that price patterns are derived entirely from a time horizon defined completely by the traded time frame. What I want to do is enable the formation of Renko and constant volume based charts within Kantu so that Kantu can create systems based on price patterns derived from Renko or constant volume charts. This will probably reveal some patterns that we haven’t been able to find up until now on regular OHLC charts or it will at least reveal if there are any substantial differences between both.

My fourth goal relates to moving outside of MT4. If the Oanda REST API is released before the year ends I have made it a personal goal to move all my trading accounts to Oanda in order to finally be able to trade outside of the MT4 platform with the additional benefit of an almost infinite fractional lot sizing (thanks to Oanda’s ability to allow trading down to 1 unit, which is 1/100,000 of a contract).

There are many other goals, but I’ll probably think them up as the year starts ;o) I also have some thoughts regarding blogging. In 2013 I was clearly very negligent with my readership (with only 30 posts for the year), so I would like to be able to post more frequently, which also helps me on my research as I am able to get some feedback from other traders as well as put my thoughts together into some – hopefully coherent – writing. I also want to open a new blog, dedicated to other investments outside of FX trading (mainly equities and bonds) where I can share developments on those markets as well. I clearly don’t want to promise you daily posts, but lets see if I am able to come close ;o)

–

–

Finally, I would like to wish all of you a very happy, healthy and profitable 2014 :o) Thank you very much for reading my blog and supporting my work!