Last week I wrote an article about the start of our search for systems with different reward to risk ratios as a way to diversify trading within our Forex trading system repository. Through this article I talked about why the reward to risk ratio was a potentially more valuable avenue for diversification than variations in other system qualities and I also discussed how we intended to start mining trading systems with this idea in mind at Asirikuy. Today I want to talk a bit more about the reward to risk ratio and our experience so far mining systems with a reward to risk ratio of 2:1, especially how different reward to risk ratios seem to affect the mining bias and the number of stable and profitable systems found along different Forex trading symbols and how this relates with previous research I have done in the past.

–

–

Whenever I studied the reward to risk ratio in different symbols it became clear that things were not the same for all symbols and that all reward to risk ratios were not the same. If trading with any R:R was the same we would see that random trading with any R:R ratio would have the same negative expectancy – due to the spread – but in reality what we find is that the distributions of returns of random trading outcomes change and do so differently for each different trading symbol. What we have is that changes in the R:R ratio are not always compensated proportionally by changes in the winning rate. I encourage you to read this month’s FXTraderMagazine article where I show you how this changes across several different Forex symbols.

The consequence is that both the abundance of systems expected to be profitable and the abundance of those expected to be profitable just by chance changes depending on the symbol where you’re trading and the R:R you choose. My previous research suggests that some symbols favor larger R:R ratios – we find more profitable systems in the real data and less profitable systems when mining on random data with the same distribution of returns – while in others lower R:R ratios are more favored because the mining bias for higher R:R ratios becomes too high (their probability to be found just by chance increases). This week we made some of the first practical experiments in this regard at Asirikuy and our results were coherent with this theory.

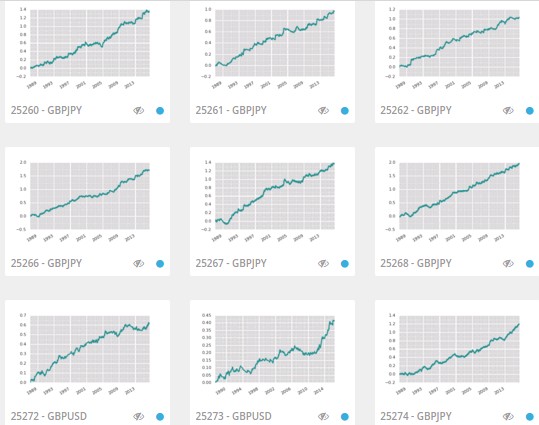

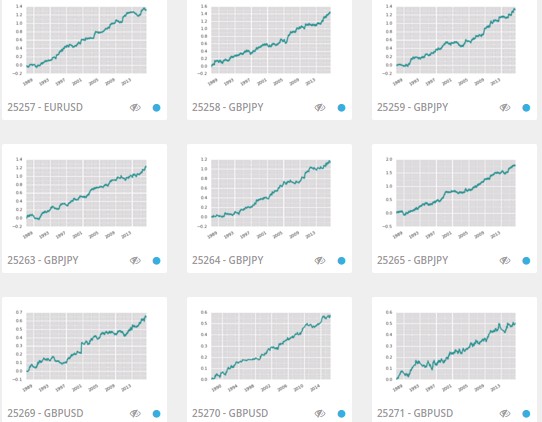

When attempting to mine for R:R ratios of 2:1 in the EUR/USD, USD/JPY, GBP/USD, EUR/JPY, USD/CHF and GBP/JPY coupled with functionally adjusted trailing stops we found that systems were generally harder to find overall – less profitable and stable systems found on the real data sets – and the mining bias was higher on symbols where larger R:R ratios are generally favored (EUR/USD, USD/JPY, USD/CHF) and lower on symbols where previous research suggested it should be lower (GBP/JPY, EUR/JPY, GBP/USD). So far we have been able to add 15 systems to our price action repository (showed in the first image in this post) where the R:R ratio is in all cases much lower than the R:R ratio we see in the average repository. In particular adding GBP/USD systems with high R:R was very hard due to the mining bias – we only had 23 systems trading on this symbol from more than 5 thousand – but by dropping the R:R we have been able to add several systems after only one week.

–

–

The above results are in very good agreement with both the FXTraderMagazine article and my previous research, suggesting that the choice of R:R ratio should be taken depending on the actual characteristics of the symbols that you want to explore. If you choose to search for systems with high R:R ratios on symbols that do not favor them you will have trouble both finding the systems and then showing that they do not come simply from randomness due to the mining process. Choosing the right R:R ratio and the right symbol is a clear path to be able to find a good range of high quality systems with both a very low probability to come from randomness and a significant abundance.

Another important point is how these strategies correlate with high R:R systems. Gladly what we have seen is that the correlations between the high R:R and the new low R:R systems are generally low, meaning that we have been able to add a large number of systems compared with the latest high R:R experiments we carried out where correlations with the overall repository for most systems were already high. The fact that the low R:R space is not saturated in terms of correlations with our current repository is also encouraging news. If you would like to learn more about mining and how you too can trade a repository containing thousands of different systems please consider joining Asirikuy.com, a website filled with educational videos, trading systems, development and a sound, honest and transparent approach towards automated trading.strategies.