Whenever we start trading the first thing we wonder – perhaps to know what we might expect in the future – is how other traders are doing. I have said many times that new traders here face a problem since the “media” and marketers usually portray trading as a very successful business and therefore there is a significant distortion of what in reality is achieved for most people that get into trading. When you truly look at some statistics that measure the performance of retail traders you soon realize that the panorama is quite bleak and a true reflection of the fact that most new traders fail and those who don’t usually trade in a way which makes their future failure a high probability. Within this post I will show you some evidence about this and why I believe this is the case.

Oh yes, the rich retail trader. Most people enter the world of trading with the idea of becoming this sort of “guru” who makes a living by trading a few hours each day, then drives his Ferrari down the beach and parks it on one of his many beach-front mansions. Although this view is quite exaggerated most people believe that they will be able to easily achieve something much more modest – like a comfortable yearly income between 50-200K – without a lot of effort or problems. The idea that this can be easily achievable derives from the fact that the media portray that the first case is achievable and therefore “realistic Joe” tends to believe that this might simply be a hyped version of what most people actually achieve. Certainly most people will believe that getting super rich from trading in a year is a fool’s errand but ask them about making a 50K USD income from 1K USD and they will believe that to be quite realistic.

–

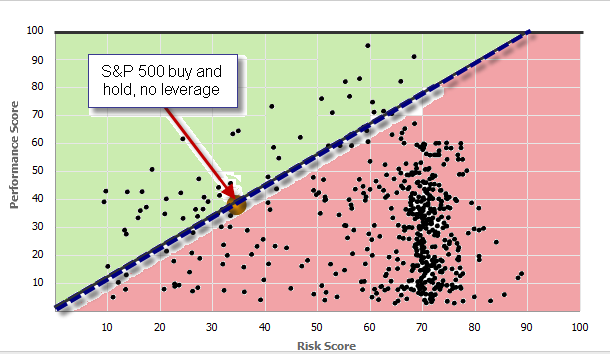

Now the reality of the world of retail Forex trading is actually much more bleak. Although we don’t have access to the data of thousands of traders to compare we do have access to the data of many signal providers which show how retail traders perform and how they compare with standard investments like the S&P 500 buy and hold strategy. Currensee has a particularly interesting way of grading their “managers” (which are simply retail traders renting signals) in which they have both a performance and risk index which is adjusted according to draw down depths, lengths and volatility compared to the S&P 500. The results of different traders are plotted across a graph which puts investments into perspective and how they relate to the stock market’s performance.

As you see on the above graph most traders fail to beat the market because they trade in a much riskier way without achieving a better performance than the S&P500. Although many of them have enormously profitable results they are simply getting them at the expense of market exposure without justifying the additional risk. The black line I drew represents the line which you need to cross in order to “beat the market”. The managers which are in the green zone are those who have a risk adjusted performance which is better than the market’s while the traders in the red zone are performing worse than the market.

The interesting thing we need to analyze here is where most traders are located. Yes, many of them have performance which – without considering risk – is higher than the S&P 500 but when you consider the risk they are taking to obtain that amount of return it becomes evident that they are not beating the market but merely leveraging their risk against a “worse than the market” strategy. If you had a strategy with a 10% profit and a 10% maximum draw down you could beat it – performance wise – with a strategy that has a 20% profit and a 40% draw down, however when considering the risk taking it becomes evident that you’re simply risking more as you are making less money for each dollar you risked.

Most Forex traders are doing exactly this, they are deceiving themselves into believing they are making more by leveraging strategies which are worse than the stock market’s buy and hold performance. They are getting the delusion of profits by over exposing themselves towards the market, they are taking a level of risk which is not justified by the level of profit they are achieving. This is sadly more the norm than a simple rare occurrence, if you analyze the performance of signal providers through a principle similar to currensee’s you’ll notice that the large majority of traders are really simply taking high risks that put their accounts at peril to make it look like they are beating the market when they are simply the trading analogue of a person getting a 1 million dollar loan to appear rich while working at a McDonald’s.

Long story short, is is extremely important to always look at trading results from a risk adjusted perspective and see things how they really are. If someone is making a 100% return every month but it is evident that they are putting their account on the line on every trade then they are trading below the market’s performance and they are bound to eventually lose everything. Looking at the returns of traders with a risk adjusted perspective against a market index like the S&P 500 is a very good way to see who is really beating the market and who is not. As I have said before if you would like to compare yourself to some good currency traders then compare yourself – after a few years – with the performance of the Barclay traders index, a serious index that encompasses the results of serious Forex traders which have track records that span from 5 to 20 years.

If you would like to learn more about my work in automated trading and how you too can evaluate your strategies to adequately address your level of inherent risk please consider joining Asirikuy.com, a website filled with educational videos, trading systems, development and a sound, honest and transparent approach towards automated trading in general . I hope you enjoyed this article ! :o)

Wisdom like yours is not easy to find…

Hi Franco,

Thanks a lot for your comment :o) I don’t consider myself especially wise but I do appreciate the fact that you consider me so! Thanks a lot for stopping by,

Best Regards,

Daniel

I`ve been learning about currency market for a year, I only traded demo account, so I never won or lost a penny, but I think I`m going the right way to beat the market:

Few thing I learned, tell me if I`m wrong Daniel:

Research until you find reliable source of information and education in the internet, then you avoid the scams.

Study until you fully understand about money management, also study statistics

If you have problems with gambling forget about this business it will most probably ruin your life.

Start to trade with a small account, risk the money you can afford to lose.

Look toward the future, make your expectation in long term, there is not miracle, be patience, be disciplined.

Hi Vitor,

Thank you very much for your comment :o) The small pieces of advice you have posted are actually quite good. Of course trading success can never be reduced to a small list of things but certainly those you have posted will put someone at least on the “right track”. In general staying away from Forex if you have a gambling problem is a good idea since you must treat this like a business I would also add to your list that evidence should always have a paramount position on your trading, you should always measure the edge of any system you trade and you should always know the worst case statistical targets of your trading business as per some formal statistical criteria. As the old saying in trading goes “plan your trade, trade your plan”, remember that if you fail to plan you will plan to fail! Thank you very much again for your post,

Best Regards,

Daniel