I have always wondered who exactly is interested in Forex trading at a retail level and how this compares with the people that are generally interested in things like investing and stock trading. During the past few days I have performed a quantification exercise using google trends, in order to see what the most commonly searched terms in Forex trading are, who are searching for this and how this relates to the most commonly searched terms in stocks. By reading today’s post you will be able to get a summary of what I have found and see the surprising reality behind today’s interests in Forex as well as how this interest has evolved since 2004. Let’s move onto the quantification exercise and see who searches for Forex terms and at what frequency.

The first graph I want to share with you (above) shows you the evolution of the terms “stock trading”, “forex trading”, “Futures trading” and “currency trading”. From the above graph it is evident that forex trading started ramping up in 2005 and reached a maximum sometime before the financial crisis in 2007. Interestingly the graph continues to evolve somewhat positively after the crisis and has a peak in 2011 as an important point was reached in the European sovereign debt crisis. Stocks were far more popular than Forex in 2005 but as time has passed the popularity of stock trading has decreased, reaching the same levels as the searches made by people looking for Forex trading. Futures trading and currency trading are far less popular search terms, which have become smaller and smaller as time has passed. However you can see some evident correlations, as the spike in 2011 that you also see in the Forex trading search term graph. The second graph also confirms the same overall trends on the more general terms “Forex” and “stocks” – which makes the 2011 peak disappear – and shows a maximum during the financial crisis.

–

–

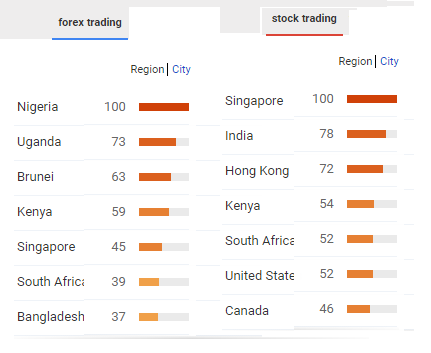

The thing that I find most interesting about the above search terms is actually where the searches are coming from. When you look at the global terms “Forex” and “stocks” it quickly becomes evident that the target audience for these terms is entirely different. The large majority of people currently searching for “Forex” are people from third world countries, mainly people from African and Asian countries (Uganda, Nigeria, Singapore, Malaysia, etc). This becomes even more evident when you look at the term “forex trading” where you can see that most people actually come from Nigeria and other African nations. Compare this to the terms “stocks” and “stock trading”, in “stocks” the majority of searches come from the United states and Singapore while in “stock trading” we see the United States a bit more behind.

We can attribute the above differences mainly to the way in which both markets work. Stock trading entry requirements are much larger and the market is much better regulated than the Forex trading market. A person in Nigeria would find it much harder to obtain at least 10,000+ USD and open a US stock trading account with a regulated broker while opening up a 100 USD account to trade Forex is probably very easy. It is therefore not surprising that a significant number of Forex brokers are now opening up subsidiaries to cater to Nigerian and other African country customers, it is clear that the next wave of available customers for quick “deposit burning” will come from African nations (even more as regulations become tighter for Forex trading within the developed world). As people’s standard of living starts to increase the first trading opportunity – due to capital requirements – will definitely be Forex trading.

I also wanted to look at different trading terms and see how they have evolved over time. I wanted to compare the terms “automated trading”, “social trading” and “algorithmic trading” to see how they have evolved. The terms “automated trading” and “algorithmic trading” have followed trends similar to that of the general term “forex” and the term “forex trading” which I think implies that searches for automated/algorithmic trading are mainly related with the forex trading market. This is not surprising given that the automation of stock strategies is much more complex – with very little currently available for the general retail investor – while automation in terms of Forex is widely available and even sold in a prepackaged manner in the form of expert advisors. The terms were declining steadily from 2011 to 2014 but they now seem to be gaining ground, probably due to a new interest in Forex trading stemming from social trading. Interestingly these terms are also heavily located in developed countries (from the top 5 search countries, 4 are developed countries) while the top 1 search result is India. This does not seem surprising as India is well known for harboring a large portion of the world’s software coders.

–

–

It is interesting to see how social trading was not noticed very strongly in the beginning (with a quite shy surging in 2005-2007) but has now been steadily climbing as the market has become more interested in solutions offered in this manner. Social trading is also heavily focused around forex trading, since there are actually few sources of social trading for things like stock trading. This is further confirmed by the top 10 trading results in google when searching for “social trading” which are mostly biased towards Forex trading . Most notably, “social trading” seems to have a a prevalence in developed countries as well (with Australia leading the way), showing that this sort of trading seems to be more appealing -at least for now – to people in developed nations.

All-in-all the current interest in retail forex trading, stock trading, algorithmic trading and social trading is distributed in some rather surprising manners and has evolved in a very unexpected way during the past several years. Although interest appeared to be going down during 2010-2014, it now seems that the market is again warming up to the ideas of forex trading, stock trading and automated trading. I will be revisiting these trends within some years to see how things have changed. If you would like to learn more about my work in automated trading please consider joining Asirikuy.com, a website filled with educational videos, trading systems, development and a sound, honest and transparent approach towards automated trading.