During the past few days I have seen a lot of visits to my blog going into a post I wrote a few years ago on the top long term retail performers trading in regulated brokers extracted from myfxbook. The post showed the results of these traders, warned about some of their trading tactics and went further to conclude that the long term CAGR to Maximum drawdown ratio of Forex retail traders is most likely not any better than that of traders that show up in the Barclay’s currency trader index. Today I want to expand a bit on this previous post and talk about the fate that these accounts followed, why long term performers in myfxbook extremely rarely go past the fifth year and why you should be extremely wary of accounts that show “perfect” looking results, even if these have been going on for a few years.

–

–

buy isotretinoin in uk I want to start by saying that all the accounts I showed in the post I wrote 2 years ago are now dead. Not even one of these accounts was able to make it into the 2016 period. As it could have been predicted accounts that I thought used martingales and grids finally reached their destination – wiping out all equity – and the other accounts faced very important drawdowns which I guess triggered their removal by their owners. This shows that even when attempting to evaluate performers based on traded time, you can make a poor risk assessment if the overall trading tactics used are not examined carefully. Bad trading strategies based on uncapped risk will always end catastrophically even if in 1 in 100,000 cases it takes them 5 years to do so. The fact that you see profitable trading for years is no guarantee that those results can be reproduced neither is that a guarantee that the underlying trading strategy used is sane.

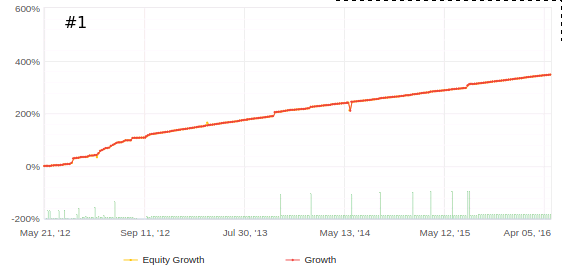

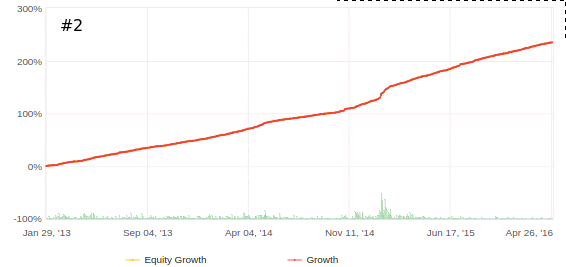

Right now there are some other accounts that have been trading for several years which appear to have “great” results but their trading tactics show to be variations of the same terrible trading tactics that we saw on some of the “top 5” a few years ago. For a large majority of retail traders the above graphs would look exceedingly tempting. Hardly a loss after 3-4 years of trading, it’s easy to think “these people must have a really good sense of trading”. In reality they don’t. In both cases the traders are making trades with a very unfavorable reward to risk ratio. The first scalps for 2-3 pips with 100+ pip stops while the second takes profits in the 10-11 pip range and losses in the 180+ pip (but there are no stops so losses could potentially be much larger). Most importantly both of these accounts are trading DAX30 long-only strategies hoping to benefit from the long term bias of the DAX30. However it is very easy to see how this can go very wrong, take for example what happens when the same user applied this logic to currencies as showed in the figure below.

–

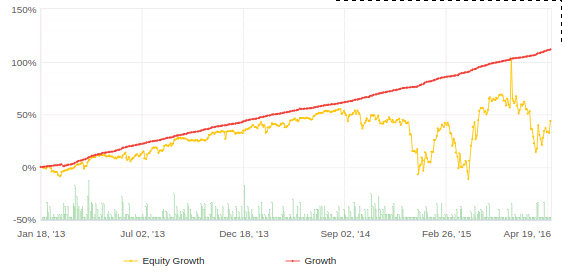

–

As you can see in the image above when a similar strategy (long only positions) is applied to currencies you start to accumulate extremely heavy equity drawdowns that are bound to end up in wipeouts at some point in time, which is what will eventually happen in the case of the DAX30 strategies showed above despite the long term positive bias of the DAX30. These traders are not considering the black swan events in equity indexes which can cause 10-20% losses in short periods of time, even during single trading days. Traders so heavily leveraged are bound to pay very hefty prices under these scenarios. In practice what these traders are doing is very leveraged equity proxy trading which – even if there is a long term positive bias – will be unsustainable in the long term, especially as the equity indexes experience sharp decline events (which is guaranteed to happen at some point in the future). Such trading strategies may be very rewarding in the short to medium term but with a guaranteed equity wipeout at some point in the future they do not constitute a sustainable trading strategy. This is not something we haven’t seen before, in 2009-2012 there were several long-only gold strategies with years of almost perfect live trading records. Guess what happened after?

It is rather easy to see why most myfxbook accounts that make it in the long term follow these type of trading, they do whatever type of trading can show very high winning rates and low levels of loss which is what most retail traders would be willing to buy and put their money into. Most aspiring traders will not bother to look deeper because what they see is someone who has made money for 3 years which for most people is proof enough that that person can continue making money for another three or more. However even after years of trading these accounts then collapse simply because their trading tactics are not sustainable. Whenever you encounter trading opportunities like this you must ask yourself whether what they are doing has a very high inherent risk. Trading strategies that show heavily skewed reward to risk ratios like the ones above are very good at delaying losses towards the future.

–

–

It is very important to understand that some strategies have very high potential for short term luck with a certainty of long term failure. Such strategies are simply gambles as the day of reckoning – which will always come – is unknown. Some traders believe they can outwit this by periodic withdrawing or similar strategies but in the long term the payoff of this type of behavior is the same – total wipeout – simply because risks of wipeout are taken whenever money is put into these strategies and the dates of huge loss are unknown. Like a gambler who believes he can outwit the roulette by taking money off the table when he wins and only betting again another day, such methods are pointless.

Of course long term sustainable trading is an extremely hard thing to do, hedge funds spend billions each year to try to achieve this. It requires a lot of effort, a ton of understanding and a constant push to seek new algorithms and discard old ones. It is very likely that we will never see such accounts at myfxbook, simply because retail traders are much more interested in the above really high risk (but apparently low risk) type of trading. If you would like to learn more about the markets and build an understanding that can help you create systems that are sustainable and have controlled risk please consider joining Asirikuy.com, a website filled with educational videos, trading systems, development and a sound, honest and transparent approach towards automated trading.