During the past 2 years we have been building a GPU mined trading repository at Asirikuy that currently contains more than 5 thousands Forex trading strategies. Our main way to diversify this portfolio up until now has been the use of several currency pairs – currently we trade 6 – plus the diversification of our entry times and the timeframes we use. However I have been recently thinking about what the current strategies in the portfolio have in common and what we could do to further diversify the results of our trading repository. Today I want to share with you some thoughts I have had on the risk to reward and winning ratio and why I now think that their diversification is fundamental to profitability under very varied market conditions.

–

–

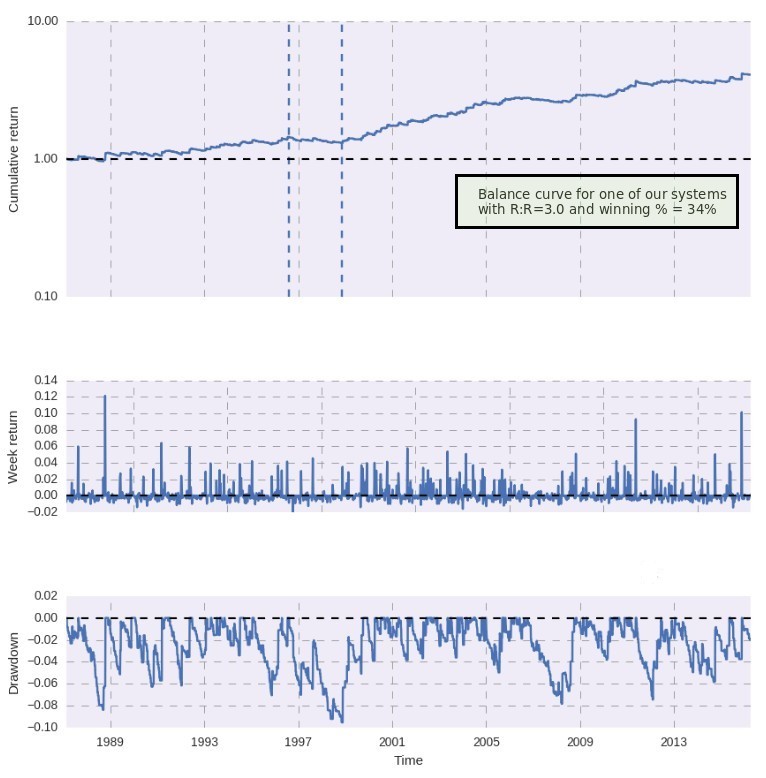

Through time I have learned that the most efficient long term strategies are those for which there is no cap to the amount of profit that can be made per trade but simply mechanisms that diminish potential losses with time (function adjusted trading stops). This is akin to building trading strategies that cut losses short and let winners run which by consequence generates strategies that have naturally low winning ratios and very large reward to risk ratios. A typical strategy in our trading repository – all which follow this philosophy – has a reward to risk ratio of 3 and winning ratio of 34%. This means that you’re trading something that when it wins, it wins big and when it losses it losses small with the caveat that you take losses most of the time.

Although all of our strategies have a low correlation with every other strategy in the repository (correlation of monthly returns is always below 0.5) it is true that the generation of profitability when the R:R is so high has to require conditions that are in someway similar. For example if the system in average makes so much more than it losses per winning trade then the systems can only be profitable under conditions where this is possible: when there are large enough movements to accommodate such profitable trades. Since all the systems usually have stop loss values between 0.5 and 4 times the daily ATR(20) the extent of these movements varies in size – which is what potentially allows for the lower correlation between strategies – but which still requires such an extensive favorable movement of price relative to the stop to happen.

–

–

Having systems with different R:R behaviors allows diversification over the above which means profit under different types of market conditions. Having a lower R:R with a higher winning ratio implies the construction of strategies that use some form of take profit and while this is something I don’t like I do recognize that this leads to an immediate diversification of the market conditions under which a set of systems can be profitable. A system mining process that properly tests for data-mining bias can still generate strategies that are statistically sound with different R:R ratios. The second image in this post shows a system with an R:R of 1.11 and winning ratio of 57% which has a similar Sharpe than the first systems showed. The system uses a TP to achieve the better winning ratio at the expense of the R:R.

Of course searching for a higher winning ratio with a lower R:R does not come without its costs. The naturally higher probability to hit the TP Vs the SL causes the data mining bias to become bigger while the existence of the function-based trailing stop – that still tightens the SL – makes the finding of systems harder. It is therefore a more costly search process – it takes much longer to find the same number of sound systems – but in the end what you have is a strategy that has a fundamentally different behavior from the other systems. However the trade expectancy, linearity and Sharpe ratios of such systems can still pass our filters, as showed in the system above, which means that they can greatly compliment our arsenal without meaning a lower expected profitability.

–

–

Right now we are exploring the lower R:R, higher winning ratio spaces to see if we can find systems that come from low-data-mining-bias processes and whether those systems are indeed far less correlated to the systems currently within our portfolio. Once I get some additional information I will share it with you within this blog. If you would like to learn more about our system construction and how you too can learn to trade and build large trading system portfolios please consider joining Asirikuy.com, a website filled with educational videos, trading systems, development and a sound, honest and transparent approach towards automated trading.strategies.

Hi, I like your blog. But you’re often mentioning your 5000 running forex trading strategies, so I’m curious. Do they win or do they lose? If they win, why has no one heard about them? Can one see the live results somewhere, like on a myfxbook account?

Hi Algoguy,

Thanks for writing. There are 5K strategies, some have won and some have lost, performance depends on how you choose strategies and how you balance them in a portfolio. We haven’t made any type of advertising effort right now as we’re not interested in attracting retail traders but in gathering a track record to attract large capital investments. It is also important to note that we want to become properly regulated as a CTA so we do not want to advertise performance in any way right now to avoid any potential legal issues. We’re in an initial development phase so there is still a lot to learn about large portfolio management and GPU based mining. Thanks again for your interest,

Best Regards,

Daniel