During the past year we have been working on the development of mining software for the automated creation of machine learning based trading systems. Along this time we have faced several challenges and have had to restart our mining attempts a few times – due to problems with the implementations – but after a lot of effort we have now started what seems like a solid foundation for our machine learning mining and portfolio building. On today’s post I am going to talk about these tools as well as the current state of our machine learning portfolio and where we hope it will be within the next couple of years. I will highlight some our current advances as well as discuss some of the improvements that will help us take these discoveries to an entire new level.

–

–

After automating the generation of traditional trading systems using our pKantu software we then wanted to take a further leap by automating the creation of continuously retraining machine learning based training systems. This means to create a framework that is capable of generating strategies that use predictive algorithms that train based on constantly moving windows – that are always retrained after every bar – while properly evaluating the data-mining bias of these implementations and henceforth avoiding problems due to data-mining bias, that can be so common and difficult to evaluate when dealing with this type of trading implementation.

The first answer to this problem was the creation of a software that was able to do mining using regular CPU technology. This was very inefficient since it required the full execution of all the machine learning code every time. Each back-test took minutes to complete and therefore the evaluation of anything but the smallest spaces – say 10-15 thousand systems – was prohibited by this technology. Add to this that the data-mining bias assessment requires the process to be repeated many times over bootstrapped series and the problem becomes even worse. We were adding systems at a pace of around 1-2 per month using this methodology so it was clear that we needed an advancement to move forward.

This is when we implemented the pKantuML software which uses the CPU for the creation of binaries for the machine learning process and then uses openCL technology to be able to perform much faster back-testing (around one thousand times faster) on GPU chips. This means that the machine learning predictions are stored once using the CPU – the slow part of the process – and then all back-testing variations are performed using a much faster back-testing implementation. This increased the speed of the entire process by a factor of about a hundred, which meant that we could generate trading systems much faster than we could before.

Furthermore we have advanced the pKantuML code to allow for the finding of systems that use ensembles of different machine learning methods. Presently we have linear regression, K-nearest neighbor, neural networks, random forests, support vector machines and linear mapping as the algorithms available to our machine learning process. This conjunction of both regressors and classifiers allows for a lot of flexibility and the search of gigantic spaces since an ensemble using 2 algorithms implies that we need to calculate just N algorithm predictions and we can then run N² system backtests. This has taken us to a whole new level in machine learning mining where we expect our system addition efficiency and diversification to increase substantially.

–

–

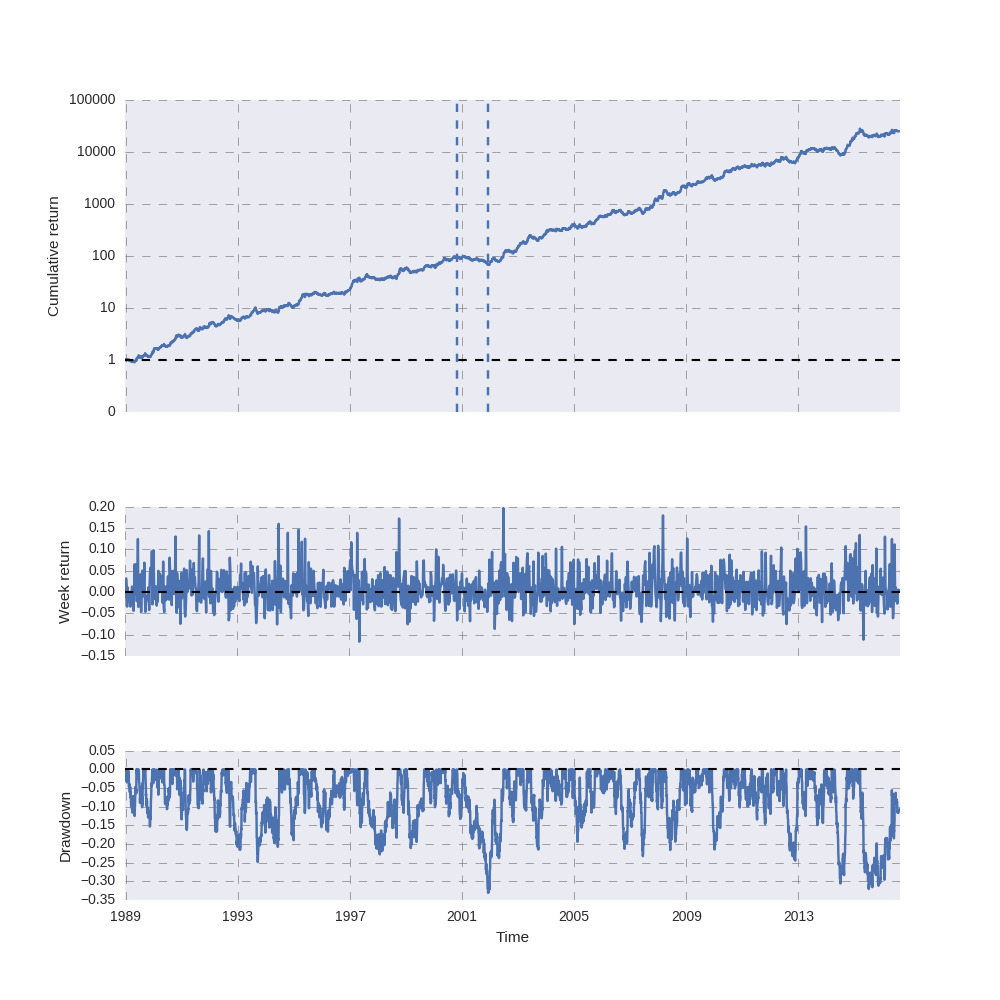

Of course our journey has just begun and we have just started the live trading of these systems around two months ago. We still have a lot to learn from these systems and their trading techniques. In the future we might implement many of the advancements we have made in price action mining to machine learning mining, such as the inclusion of shifted timeframes and the implementation of a server based execution platform to help our members trade these systems without the need to run their own software on their home computer. If you would like to learn more about our machine learning portfolio and how you too can trade this strategies please consider joining Asirikuy.com, a website filled with educational videos, trading systems, development and a sound, honest and transparent approach towards automated trading.strategies.